What that means is HUD made them buy a certain percentage of crappier loans, but didn't give them credit for loans with "abusively high costs or that were granted without regard to the borrower's ability to repay"

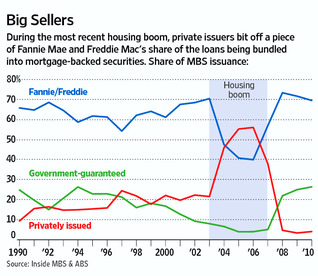

Right, which meant they wouldn't buy those loans if they're not getting credit for them. And they didn't buy those loans. Which is why GSE loan performance was 6 times better than that of private labels from 2005-7. Only 4% of GSE-backed loans defaulted from 2005-7, whereas 26% of private label-backed loans defaulted from 2005-7. It's inconvenient facts like that, which seem to unravel any argument you make.

In 2004, as regulators warned that subprime lenders were saddling borrowers with mortgages they could not afford, the U.S. Department of Housing and Urban Development helped fuel more of that risky lending.

So submitting an editorial absent of facts is not going to help you here. GSE loan performance was 6 times better than private label loan performance during the bubble. When you look at this chart, what is it you see? Because I see GSE delinquencies a fraction of that of the private labels. Do you have a problem reading charts? I know it can be complex because of all the colors. I don't want to overwhelm you. How can you come to the conclusion that GSE's bear any blame for the mortgage bubble when the chart below shows their delinquency rate is a fraction of those from private labels.

Wow! The government required them to buy over half their mortgages from the crappy end of the pool.

So, as usual, you ignore the facts. And the facts show that the GSE-backed loans (the ones you are talking about here) defaulted at rates that were a fraction of what private-label loans were defaulting. That's what the facts say. So you say GSE's were responsible for the housing bubble, yet GSE loans performed no better or worse than they did prior to the bubble. That's what the data says. So here is another example of reality clashing with Conservative fantasy. The fantasy is that GSE's were responsible for the delinquent loans that caused the bubble to pop, whereas the reality is that GSE loan performance was exponentially better than that of private labels, and saw delinquency rates no better or worse than prior to the bubble. Hence, GSE's were not responsible for the collapse. Also, GSE market share was cut from 70% of the market in 2003 to 40% of the market by 2005:

I expect an apology

I'm sorry, I thought you were smarter than a 5th grader.....I was wrong.

I'm smarter than you, that's for fucking sure. Also, not sloppy like you either.

Right, which meant they wouldn't buy those loans if they're not getting credit for them.

They had already made the loans. Per your source.

And they didn't buy those loans.

They did, at the end of the bubble, to the tune of 56% of their purchases.

So submitting an editorial absent of facts is not going to help you here

HUD didn't make them buy more weak mortgages? LOL!

P.S. it's from your own source. Moron.

How can you come to the conclusion that GSE's bear any blame for the mortgage bubble

Over half their purchases were weak mortgages. You think that leaves them blameless?

Do you understand supply and demand? LOL!

Also, GSE market share was cut from 70% of the market in 2003 to 40% of the market by 2005:

They were recovering from their accounting scandals. They ramped up their purchases just in time to catch more of the foamy top of the bubble.

"They had already made the loans"

Sorry Cupcake GSE's don't make loans

GSE Critics Ignore Loan Performance

There is no data anywhere to cast doubt on the vastly superior loan performance of the GSEs. Year after year, decade after decade, before, during and after the housing crash, GSE loan performance has consistently been two-to-six times better than that of any other segment of the market. The numbers are irrefutable, and they show that the entire case against GSE underwriting standards, and their role in the financial crisis, is based on social stereotyping, smoke and mirrors, and little else.

Or check out the FHFA study that compares, on an apples-to-apples basis, GSEs loan originations with those for private label securitizations. The study segments loans four ways, by ARMs-versus-fixed-rate, as well as by vintage, by FICO score and by loan-to-value ratio. In almost every one of 1800 different comparisons covering years 2001 through 2008, GSE loan performance was exponentially better. On average, GSE fixed-rate loans performed four times better, and GSE ARMs performed five times better.

GSE Critics Ignore Loan Performance

Sorry Cupcake GSE's don't make loans

You got me, they had already bought the mortgages.