JonKoch

VIP Member

- May 14, 2017

- 1,779

- 151

- 65

One thing at a time.

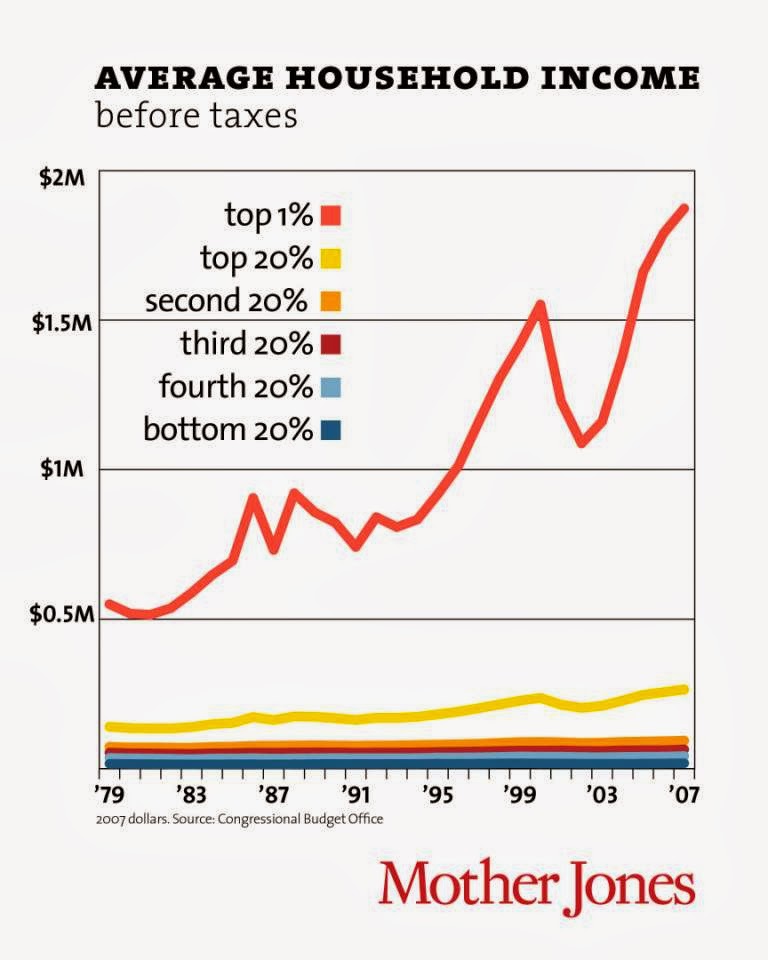

But they're intrinsically linked. A worker increasing their productivity should result in a wage increase, right? Well, worker productivity has increased, corporate profits have increased, yet worker wages have remained stagnant. So to where are all those profits going?

I am trying to make the point that a "tax on the rich is a tax on the poor."

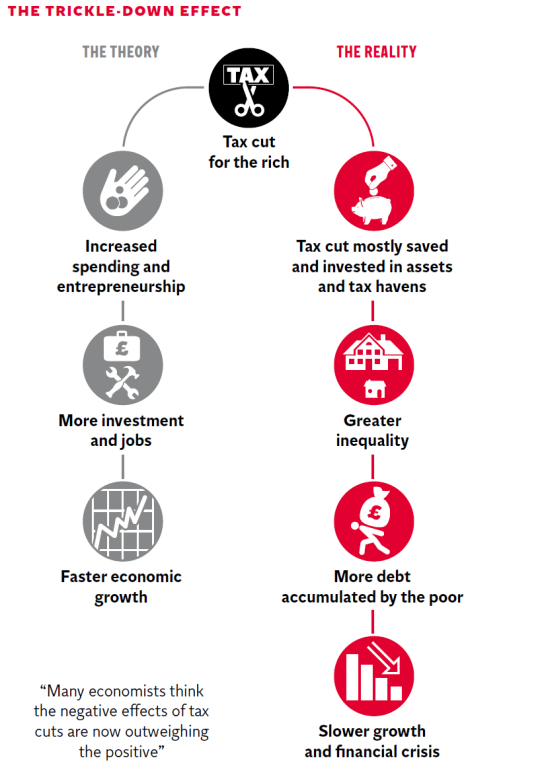

Actually, a tax cut for the rich is a tax increase for the poor. The reason is because tax cuts result in revenue drops, and those revenue drops result in deficits. To close deficits, spending is cut or excise taxes are raised. In the case of spending cuts for example, the first thing always on the chopping block is education. So a state misses revenue projections because of tax cuts, then the state has a BBA that requires them to balance the budget, so they do that by cutting finding to education and health care, and/or they raid the welfare block grant, or they raise excise and sales taxes. So that's how the poor end up paying for tax cuts for the rich, who are supposed to trickle-down, right???

You are claiming that the rich are STEALING off of their workers by not paying them enough for their labor.Correct?

That's exactly correct.

Well, worker productivity has increased, corporate profits have increased, yet worker wages have remained stagnant.

Liar!!

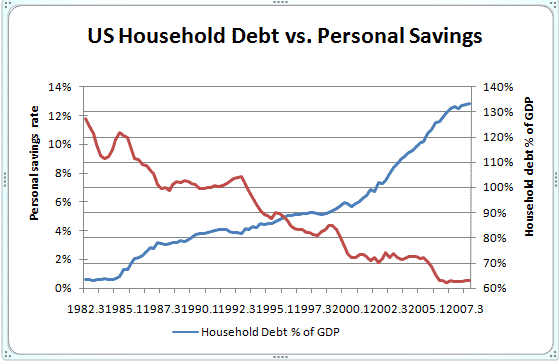

View attachment 127561

LET'S USE THE CORRECT GRAPH BUBS