JakeStarkey

Diamond Member

- Aug 10, 2009

- 168,037

- 16,522

- 2,165

- Banned

- #21

The home starts dropped by 1/3rd with the ending of the tax rebate for home sales.

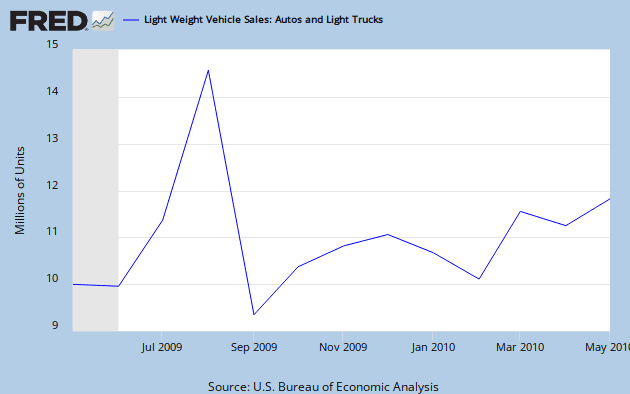

The auto sales dropped by 1/3rd with the ending of the clunkers deal.

Hmmm. Then auto sales have rebounded. Let's see if this happens with the home starts.

That's the common sense approach, and let's never forget the primary problem for both, of course, was the failed reactionary right policies underneath the Bush administrations.

The auto sales dropped by 1/3rd with the ending of the clunkers deal.

Hmmm. Then auto sales have rebounded. Let's see if this happens with the home starts.

That's the common sense approach, and let's never forget the primary problem for both, of course, was the failed reactionary right policies underneath the Bush administrations.