Wiseacre

Retired USAF Chief

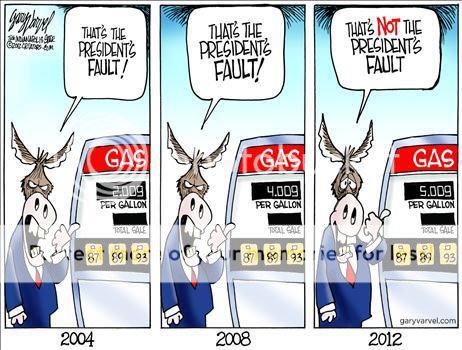

If you listen to Obama and the Dems, the rising gas prices are the fault of the godless and wicked oil speculators. Others might claim that it's more a case of rising demand in emerging markets coupled with falling supply, and also a weaker dollar. All that instability in the middle east makes the airlines and shipping industries nervous, and these folks are part of the evil speculators; they're trying to reduce the uncertainty of oil prices by buying large futures contracts. Hard to blame 'em for that, better a high price you can counton than a much higher price you can't afford.

So - calling the economists around here; are the evil speculators the sole problem, or are there other factors in play here?

snippet:

Now its certainly true that the price of a futures contract is established by the supply of, and demand for, those contracts--just like everything else. So as oil economist Philip Verleger points out, forward prices will rise relative to cash prices if a large number of buyers of forward contracts enter the market. And thats exactly what weve seen, as the advocates of futures market regulation so dearly love to point out. Verleger, in fact, agrees that the commodity index funds that invaded the oil futures markets with tens of billions of dollars have, since 2004, single-handedly turned the market from its normal state of backwardation (where futures prices are lower than present physical prices) to contango (where futures prices are higher than present physical prices).

If the flow of money into futures markets, however, were driving physical (that is, real) crude oil prices paid by consumers, one would at least expect to find some relationship between the dollars being parked in futures markets and retail prices. But Verleger has been tracking daily dollar flows in the principal futures markets for West Texas crude since January 2005 and finds that, while cash has been injected steadily into those markets, there has been no surge of dollars into those markets over the past few months.

In an earlier test Verleger examined the flow of money invested in the two principle commodity index funds (managed by Goldman Sachs ( GS - news - people ) and JPMorgan Chase ( JPM - news - people )) from January 2006 through June 2009 and found no correlation between the flow of money from these sources into the futures market and the price of West Texas crude. Its therefore hard to argue that trading volume alone has anything to do with the recent run-up of gasoline prices.

Oil Speculators Are Your Friends - Forbes.com

So - calling the economists around here; are the evil speculators the sole problem, or are there other factors in play here?

snippet:

Now its certainly true that the price of a futures contract is established by the supply of, and demand for, those contracts--just like everything else. So as oil economist Philip Verleger points out, forward prices will rise relative to cash prices if a large number of buyers of forward contracts enter the market. And thats exactly what weve seen, as the advocates of futures market regulation so dearly love to point out. Verleger, in fact, agrees that the commodity index funds that invaded the oil futures markets with tens of billions of dollars have, since 2004, single-handedly turned the market from its normal state of backwardation (where futures prices are lower than present physical prices) to contango (where futures prices are higher than present physical prices).

If the flow of money into futures markets, however, were driving physical (that is, real) crude oil prices paid by consumers, one would at least expect to find some relationship between the dollars being parked in futures markets and retail prices. But Verleger has been tracking daily dollar flows in the principal futures markets for West Texas crude since January 2005 and finds that, while cash has been injected steadily into those markets, there has been no surge of dollars into those markets over the past few months.

In an earlier test Verleger examined the flow of money invested in the two principle commodity index funds (managed by Goldman Sachs ( GS - news - people ) and JPMorgan Chase ( JPM - news - people )) from January 2006 through June 2009 and found no correlation between the flow of money from these sources into the futures market and the price of West Texas crude. Its therefore hard to argue that trading volume alone has anything to do with the recent run-up of gasoline prices.

Oil Speculators Are Your Friends - Forbes.com