expat_panama

Gold Member

- Apr 12, 2011

- 3,899

- 814

- 130

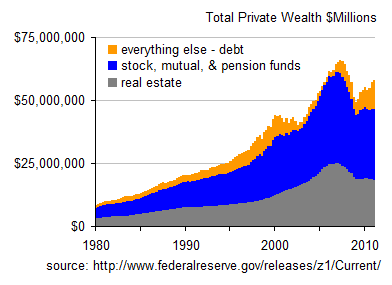

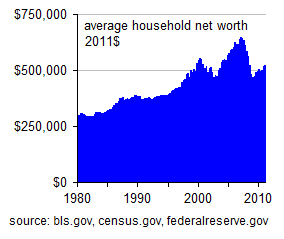

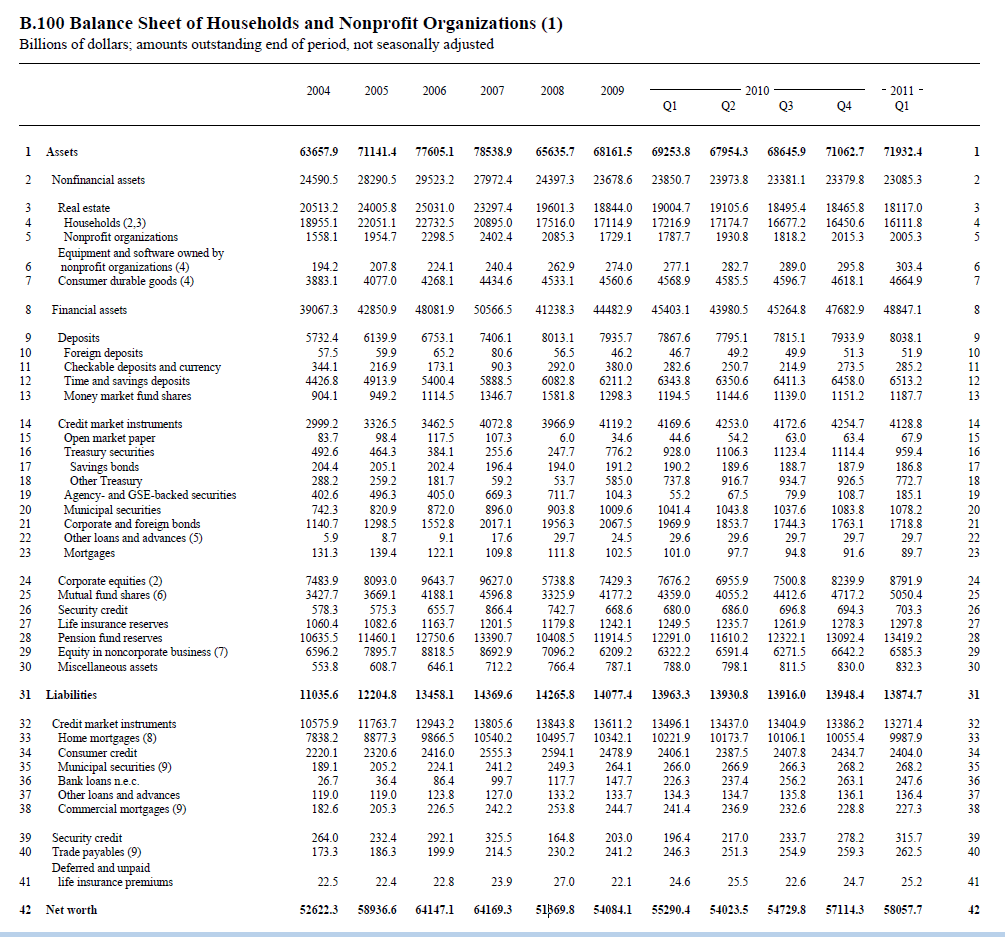

Since the recovery began 2-1/2 years ago private household wealth has increased by almost $9Trillion while private debt's been falling steadily. It's all in "Balance Sheet of Households" on page 104 of the Fed's latest flow of funds report. While some say we should thank Obama for handling the economy so well, others would complain that American households still haven't recouped $8Trillion in losses since the 2007 peak.

More info:

FRB: Z.1 Release--Flow of Funds Accounts of the United States--June 9, 2011

Household Wealth Gets Strong Bounce Even as Home Equity Falls

More info:

FRB: Z.1 Release--Flow of Funds Accounts of the United States--June 9, 2011

Household Wealth Gets Strong Bounce Even as Home Equity Falls