william the wie

Gold Member

- Nov 18, 2009

- 16,667

- 2,402

- 280

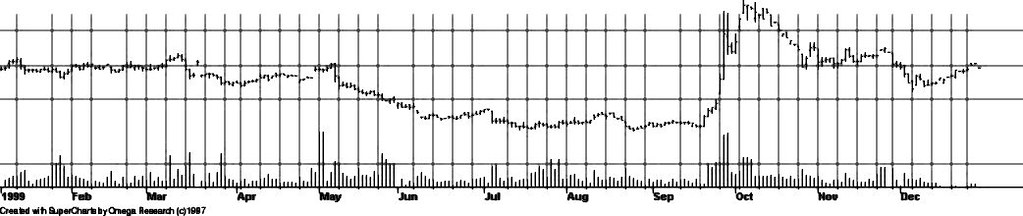

holy crap! you give kissmy a goldbug chart that certainly looked like the economy peaked before W was sworn in and he doesn't thank you and move on? has this thread moved into the Twilight Zone? Pinqy is defending a position that doesn't pass the smell test but at least has data backing it up and he isn't being pigheaded about it, he more or less admits that it doesn't pass the smell test but just the BLS definition test. WTF?