ThunderKiss1965

Platinum Member

WRAPUP 1-U.S. job growth seen picking up, wage growth likely moderateIt should not surprise anyone. Wages are not growing...Only 13% of business' tax cuts are going to workers, survey says

Tax cut scoreboard: Workers $6 billion; Shareholders $171 billion

Wow, this is one of the most expensive tax cuts in history. And at a time when corporations are doing really, really well. Why not share with the workers?

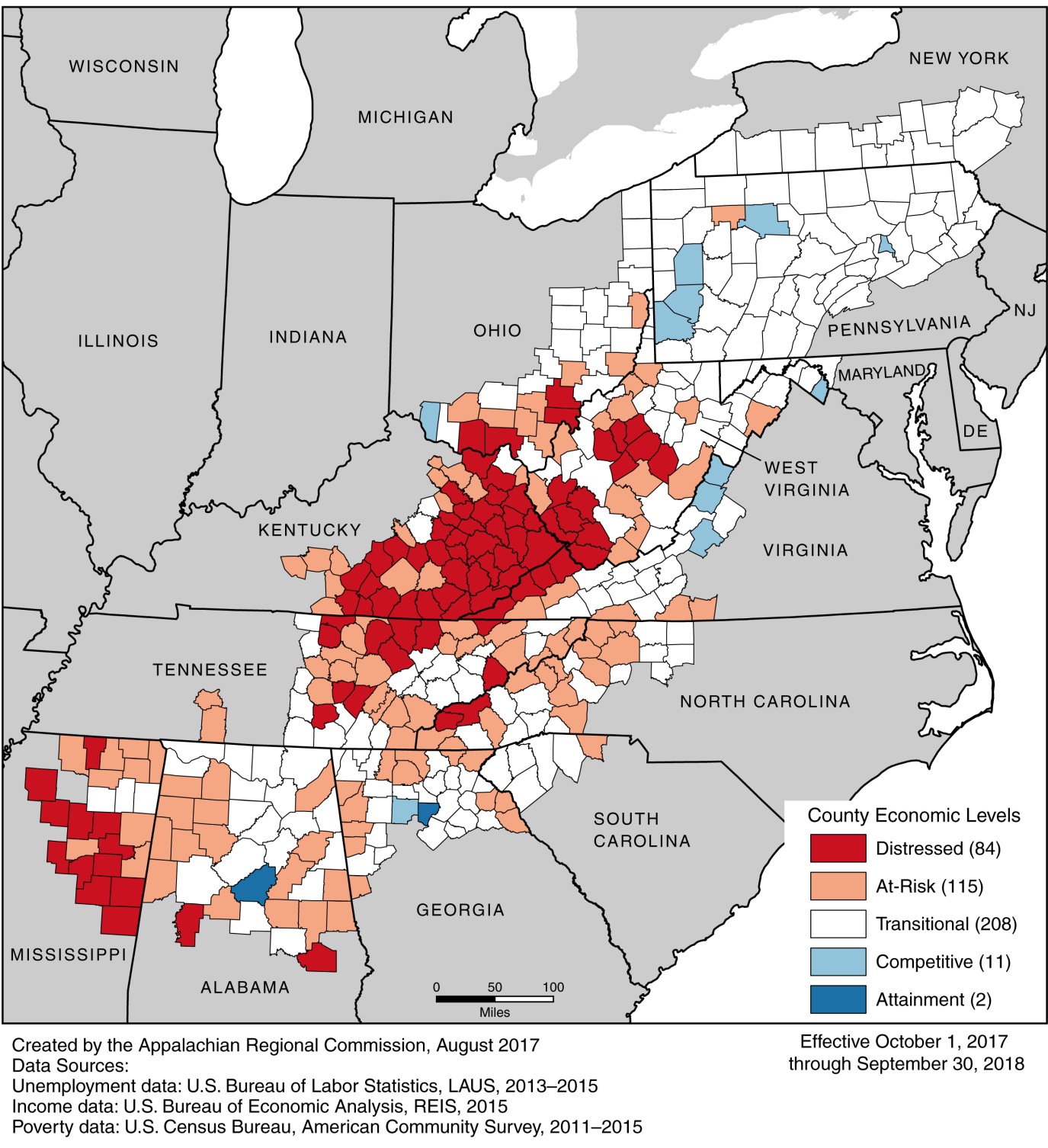

ARC: Athens County back to 'distressed' status

This is Appalachia, the center of the Republican Party. The area that has the 10 poorest counties in the United States. Those counties being more than 98% white.

Why not pass some of those tax cuts along as wage increases for whites living in the Appalachia area?

and

and