Winston

Platinum Member

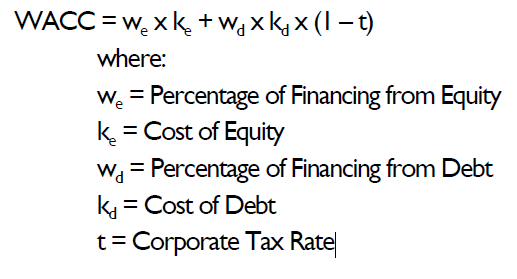

Look, anyone that has any exposure to capital budgeting, business planning, or a simple Monte Carlo stimulation of potential capital investments intuitively understands precisely what I am talking about. When the cost of capital is low, that is when the marginal tax rate is high, businesses can justify investments with higher potential risk and greater anticipated returns. But when the cost of capital is high, when the marginal tax rate is low, they can only justify the most conservative investments with lower potential returns. That is why companies are holding cash, conducting stock buybacks, or passing off their earnings to their stockholders in the form of dividends. There are no acceptable investment opportunities that meet the required IRR necessary to justify a capital investment. By lowering the corporate tax rate the Trump plan will only exacerbate that problem.

When the cost of capital is low, that is when the marginal tax rate is high, businesses can justify investments with higher potential risk and greater anticipated returns.

A lower tax rate gives a greater anticipated return.

Only if you don't understand tax planning, and the impact it has on corporate expenditures.

Only if you don't understand tax planning,

Enlighten me.

2 potential investments, each with an anticipated annual return of $1,000,000 pretax.

One has an anticipated after tax return of $800,000, the other anticipated after tax return of $650,000.

Which investment do you prefer? Why?

Look, anyone that has any exposure to capital budgeting, business planning, or a simple Monte Carlo stimulation of potential capital investments intuitively understands precisely what I am talking about. When the cost of capital is low, that is when the marginal tax rate is high, businesses can justify investments with higher potential risk and greater anticipated returns. But when the cost of capital is high, when the marginal tax rate is low, they can only justify the most conservative investments with lower potential returns. That is why companies are holding cash, conducting stock buybacks, or passing off their earnings to their stockholders in the form of dividends. There are no acceptable investment opportunities that meet the required IRR necessary to justify a capital investment. By lowering the corporate tax rate the Trump plan will only exacerbate that problem.

When the cost of capital is low, that is when the marginal tax rate is high, businesses can justify investments with higher potential risk and greater anticipated returns.

A lower tax rate gives a greater anticipated return.

Only if you don't understand tax planning, and the impact it has on corporate expenditures.

Only if you don't understand tax planning,

Enlighten me.

2 potential investments, each with an anticipated annual return of $1,000,000 pretax.

One has an anticipated after tax return of $800,000, the other anticipated after tax return of $650,000.

Which investment do you prefer? Why?

Let's assume the cost of each investment is also one million dollars. In case one, the marginal tax rate is 35%. In the second case the marginal tax rate is 20%. Case one--the million dollar investment costs $650,000 after calculating the $350,000 in tax savings. The POTENTIAL yield is $650,000 in aftertax revenue for a return of one hundred percent. Case two--the million dollar investment costs $800,000 after calculating the $200,000 in tax savings The potential yield is $800,000 in aftertax revenue for a return of one hundred percent.

So, would you rather risk $650,000 for a return of one hundred percent or risk $800,000 for a return of one hundred percent? In both cases the potential return is one hundred percent. The obvious choice here is Case one, where the potential return is the same but the money at risk is significantly lower.

So, would you rather risk $650,000 for a return of one hundred percent or risk $800,000 for a return of one hundred percent? In both cases the potential return is one hundred percent.

If both companies implode, the loss in each case is one million.

Case one--the million dollar investment costs $650,000 after calculating the $350,000 in tax savings. The POTENTIAL yield is $650,000 in aftertax revenue for a return of one hundred percent. Case two--the million dollar investment costs $800,000 after calculating the $200,000 in tax savings The potential yield is $800,000 in aftertax revenue for a return of one hundred percent.

Well, if we assume the first year profit is $1 million and the taxes paid the first year are zero, because we're deducting the total investment the first year, the results are equivalent.

Now in the second year, with no more write-offs, one company is going to yield an after tax profit of $800,000 while the other yields an after tax profit of $650,000.

I know which one I'm investing in!!!

What about you?

Your scenario would not even pass an Accounting 101 test. Look at it again and see if you can tell me the problem.