RWNJ

Gold Member

- Oct 22, 2015

- 4,287

- 641

- 275

- Banned

- #1

But then, they have always hated the truth. It gets in the way of their favorite hobby. Destroying America.

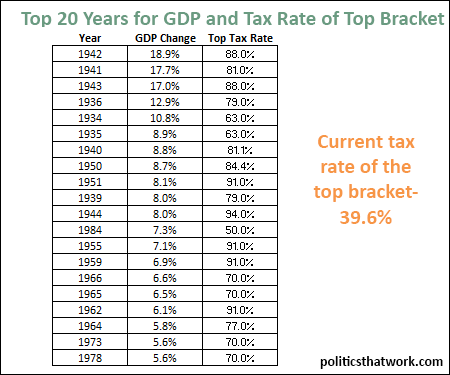

Why else would they be opposed to tax cuts? Here is the historical truth about the effects of tax cuts on the economy.

Read it and weep, liberal snowflakes.

The Historical Lessons of Lower Tax Rates

Why else would they be opposed to tax cuts? Here is the historical truth about the effects of tax cuts on the economy.

Read it and weep, liberal snowflakes.

The Historical Lessons of Lower Tax Rates