Dick Tuck

Board Troll

- Aug 29, 2009

- 8,511

- 505

- 48

- Thread starter

- #21

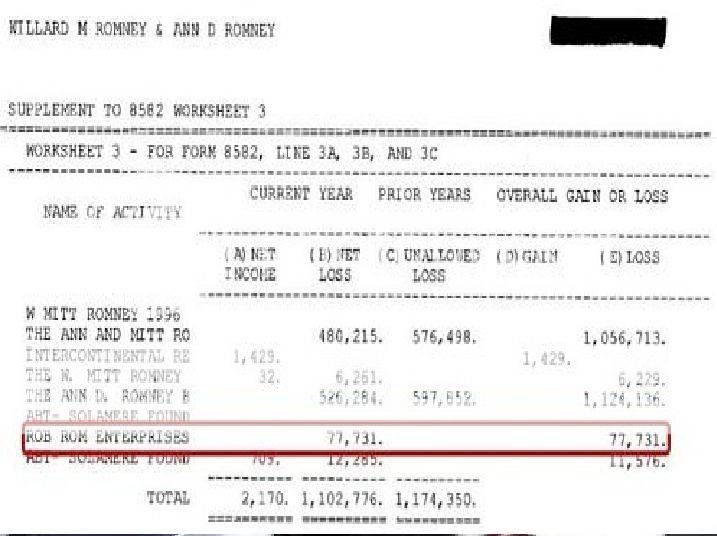

Mitt Romney says he's been audited by the IRS. Does that matter? - CSMonitor.com

Mitt Romney says he's been audited by the IRS ...

“From time to time, I’ve been audited as happens, I think, to other citizens as well. And the accounting firm which prepares my taxes has done a very thorough and complete job,” Romney said, adding: “I don’t pay more [taxes] than are legally due, and frankly, if I had paid more than are legally due, I don't think I'd be qualified to become president. I'd think people would want me to follow the law and pay only what the tax code requires.”

"I'd think people would want me to follow the law and pay only what the tax code requires.”

in most cases those are not the people who are audited - and being audited usually is a sign of those trying not to pay their fair share.

Romney may think the issue was settled by attacking Reid attempting to silence the critics but the trap he can not avoid is only reset for after Tampa all the way till Nov. 6th.

Bullshit... your audit risk depends on certain characteristics of your return, what types of filings, deductions, etc. It has nothing to do with being a sign of those trying not to pay their fair share. One's fair share is whatever you tax liability ends up being. The IRS does not determine your fair share.

You libs are so utterly clueless.

So what was the result of the audit?

Last edited: