presonorek

Gold Member

- Thread starter

- #61

First, many if not most states pay above $7.50 - many twice that. If you are in a poor, rural area where the minimum wage is $7.50, then a household income of $60,000 for four unskilled, uneducated people isn’t that bad. If you want more, you need to develop a career or trade.

Second, the AVERAGE household income is still close to $80,000 in the poorest states in the union - MS and WV. And in half the states, the average income is in the six figures!!

Third, take your example of two unskilled adults earning $35,000 combined. They are paying next to nothing for federal income taxes. With a standard deduction of $29,000, they owe on $6,000 - less than $1,000. (Just how little do you think they should pay?) And on top of that, they are eligible for Pell Grants to enroll in a career-building program, courtesy of the American taxpayer.

Sorry, but if there is a family of four adults living together - Mom, Dad, adult son, and adult daughter - who are all earning minimum wage or close to it, then they have made poor decisions in life.

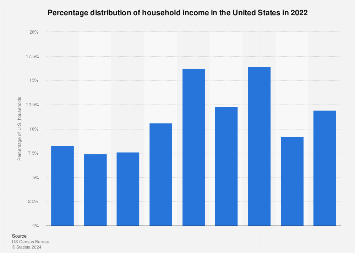

You are working with averages not medians. Ultra-high income earners inflate the average. There are millions of people in the United States earning less than $20,000 per year.