thereisnospoon

Gold Member

Printing currency to prop up the stock market is not the way to go.All that liquidity has to go somewhere.

Seems pretty clear its going into the market.

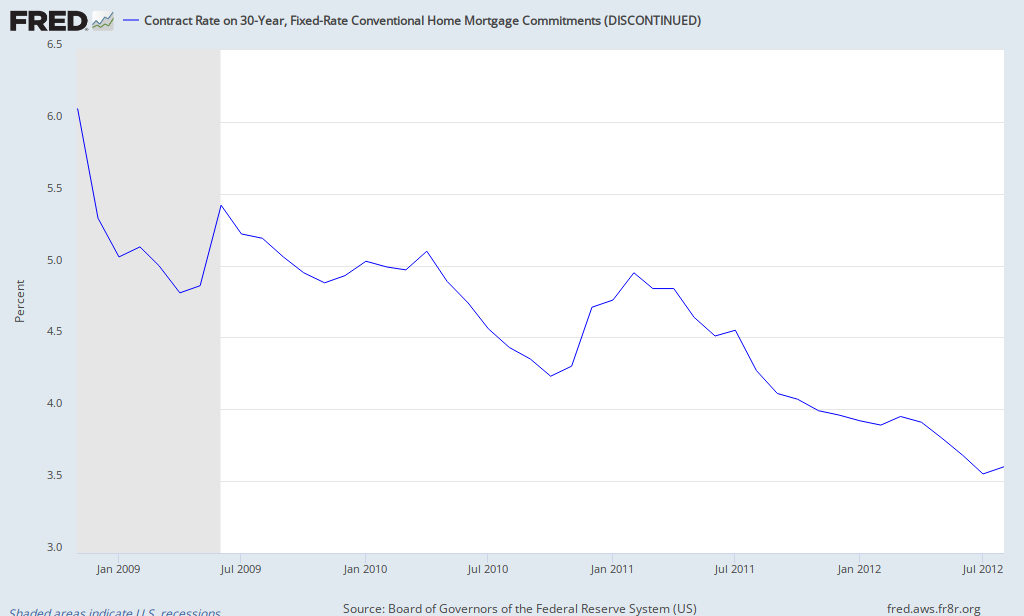

And as the real estate market seems to be slowly turning around, the whole point of easing seems to be doing the job it was intended to do.

Liquidity? Are you kidding? This is merely increasing the supply of currency without regard to the loss in value of said currency.

Actually they're increasing bank reserves, not currency. And they're going to take it out when they're content with a recovery, just like Sweden and Japan have done.

Ah, hey genius, the way the Fed holds interest rates low is by printing money. That's their whole job, administering the supply of base money. They happen to choose a quantity of money which results in a Fed Funds rate of whatever their target is for 6 weeks. They don't just order banks to use a certain interest rate.

Interest rates should be permitted to float with the market.

Okay, sure. But how? Let them float by freezing the quantity of money, by freezing the exchange rate, by freezing the path of the price level, by freezing the path of nominal GDP? And why is, say, fixing the quantity of money any better than fixing an interest rate?

After the marketplace calmed down, an immediate upturn in business activity and thus consumer spending would cause interest rates to fall.

That causes interest rates to rise, not fall. I'm sure you're aware of demand and supply? Apply it to this.

Increasing the money supply causes currency markets to sell off the US Dollar which weakens the currency and thus causes prices to rise. It's inflationary.

The marketplace should be the only decider of value. Not some government scheme.

None of this works. It's simply a temporary move and some say a political maneuver.

The federal reserve should stop screwing with the marketplace.

Through 3 phases of QE, two stimulus plans and out of control deficit spending, things have not gotten better, they have actually gotten worse. Just today an annual meeting of CEO's concluded there will be another 6 months of slow or even stalled economic activity

Let the economy fix itself.