Toro

Diamond Member

Your honesty goaded me into looking because for quite a while I've not wanted to see that stat.

Huh. Relieved to say I'm up one percent higher than I was on Jan. 1, 2011!

Good for you.

I was down over 8% last year and am up 5% this year. I've never had a two year stint as bad as this. My only condolence is that a lot of really smart money have struggled over the past two years.

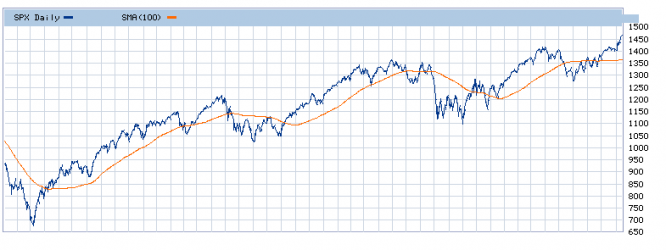

But I think we're going back to test the all-time highs. That's what will happen if past patterns of QE play out over the next few months.