There are always an abundance of job openings in the highly-skilled areas you mentioned, that is why people earn so much in those roles. These jobs are not adequate to address high unemployment across the nation because most people simply don't qualify. Where we are severely hurting is in manufacturing jobs. Those are never coming back unless there is an incentive to bring them back. As long as it remains cheaper to manufacture elsewhere, that's what most capitalists will do.

Now the left seems to believe the solution is to punish the capitalist for manufacturing abroad by making it more expensive to ship their products back to the US, through tariffs and fees or whatever means the government can manipulate to achieve this objective. The problem is, the capitalist is too smart to be manipulated. They simply find another customer for the intended US production and life (profits) continue on. Eventually, shortage of supply drives prices up and it becomes profitable once again, in spite of the tariffs and fees. This plan will never work to bring back lost manufacturing jobs, it simply drives prices higher for the consumer.

Fixing the problem is really not that hard if we simply apply common sense principles and standards we have already demonstrated will work. For instance, we need to standardize labor costs in the US. Rather than have organized labor constantly pushing for more and more unrealistic wages, we need to have a set base standard which everyone uses with an adjustable parameter for individual production. With computer technology we should be able to obtain information on production output for each individual laborer. So we establish a base rate, then a scaled increase/decrease based on actual individual production. I could write for hours about this, but the bottom line is, we have to change how we're approaching this problem to solve it.

As for capital available, yes... corporations are swimming in cheap money... that's not the problem. There is no demand because we are economically stagnant at the moment and nothing is going to change that until we take some action to affect a change. We can borrow another trillion from China and pump that into the economy to keep it churning along for another year... we haven't fixed the problem. Zero corporate tax combined with a tax moratorium on wealth held abroad would be the sort of thing that would change the dynamics. It's not that capitalists need the money, it's that they have the money available tax free if they want the money... and under that circumstance, many of them would.

It is an opportunity. Some would take it, others would pass, but it would certainly create new jobs and boost economic prosperity. As I said before, it represents a potential $20 trillion private-sector economic stimulus plan that wouldn't cost us a dime.

Our problem is the brainwashed Marxist masses who simply can't see the forest for the trees. I can't tell you how much I enjoyed this month's interview in Rolling Stone with Bob Dylan. He talked about politics as bit... Bob said, the people are sitting around with no jobs and nothing to do, hopeless and in despair, and we keep hearing this anger and rage directed at the billionaires, but the billionaires create the jobs and prosperity. How can anyone reject Dylan's philosophy?

"Zero corporate tax combined with a tax moratorium on wealth held abroad would be the sort of thing that would change the dynamics"

YOUR PREMISE IS IF WE DON'T TAX THEM, THEY'LL SPEND MONEY? LOL

The 'job creators' send their money to money managers, who promptly offshore it to the cheapest labor to make the largest return!

No, my premise is; if you don't tax them, they'll have more money available. They may or may not spend it. Despite what you'e been brainwashed to believe, no group of people always does the same predictable thing... not even screwball liberals. Some voted for Hillary and questioned Obama's birth certificate (before they blamed this on the right) and some voted for Obama.

The primary reason for offshoring US wealth is to avoid US taxation. Stands to logical reason if we remove that taxation there will be less offshoring of wealth.

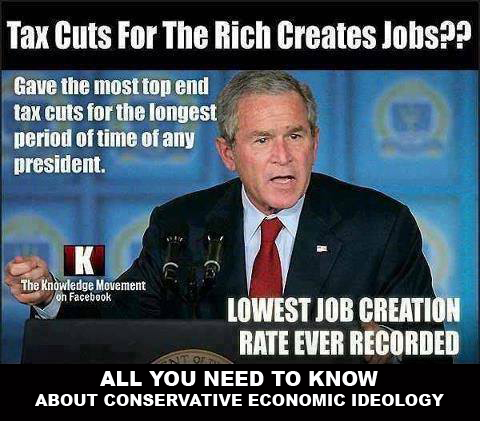

WHY DIDN'T DUBYA/GOP TAX HOLIDAY THAT BROUGHT BACK $800+ BILLION IN 2004 AT 5% DO THAT THEN? In fact orps that did that actually shed US jobs and cut back on R&D, lol

Mainly because Dubya didn't eliminate the corporate tax and his policies were not conservative. You have no valid data to show that all corporations did any one particular thing. Some cut jobs and R&D, some expanded and created jobs. But since you are a myopic socialist moron, you focus only on the bad and ignore any good.

WHAT DYLAN ACTUALLY SAID (YEAH, I;'M SHOCKED A LIAR LIKE YOU PUSHES A FALSE CATEGORIZATION OF HIS POSIT, LOL)

"The government's not going to create jobs," he said. "It doesn't have to. People have to create jobs, and these big billionaires are the ones who can do it."

But instead of doing that, he said he sees inner cities festering with crime and people "turning to alcohol and drugs." "They could all have work created for them by all these hotshot billionaires," Dylan said. "For sure, that would create lot of happiness. Now, I'm not saying they have to — I'm not talking about communism — but what do they do with their money?"

Again, Dylan is right and he is totally rejecting left-wing socialist nitwits like you. You're still stuck on the notion of the government creating jobs by building roads and bridges.

He later turned his attention back to the underprivileged. "There are good people there, but they've been oppressed by lack of work," Dylan said. "Those people can all be working at something. These multibillionaires can create industries right here in America. But no one can tell them what to do. God's got to lead them."

Bob Dylan The Government s Not Going to Create Jobs. Billionaires Can Rolling Stone

I'LL GET ON TO THE SPAGHETTI MONSTER IN THE SKY RIGHTAWAY, LOL

Wow, Bob's on a fucking roll! Now he's rejected your godless beliefs! Look out Bob, they don't like it when you talk about God!

The 'job creators' haven't had this much wealth or income since the first GOP great depression, why didn't they spend it then? Because like now, they don't NEED to. Of course IF we went back to a HIGHER TAX RATE ON THE 'JOB CREATORS', IT GIVES THEM INCENTIVES TO PUT MONEY INTO THE COMPANIES AND NOT GET TAXED, YOU KNOW CREATE MORE WEALTH THROUGH BUILDING UP, VERSUS STRIPPING OUT AND GAMBLING ON WALL STREET EAST?

What do you mean "if we went back to a higher tax rate?" We have the highest corporate tax rate in the world. What's their incentive to put money in a corporation so it can generate more tax revenue? You want to see them use their wealth to build up the corporation and create more jobs? Eliminate corporate taxation!

lol

"Mainly because Dubya didn't eliminate the corporate tax"

YEAH, I GUESS 5% WASN'T LOW ENOUGH, LOL

According to a study by the Internal Revenue Service, 842 of the 9,700 businesses with foreign subsidiaries transferred a total of $362 billion from their foreign subsidiaries to their U.S. parent companies

The evidence clearly shows that these repatriated earnings did not increase domestic investment, job creation, or research and development (R&D). As the authors of the leading paper on the subject concluded in 2010, “repatriations did not lead to an increase in domestic investment, domestic employment, or R&D.”The authors continued:

Instead, estimates indicate that a $1 increase in repatriations was associated with a $0.60–$0.92 increase in payouts to shareholders—despite regulations stating that such expenditures were not a permitted use of repatriations qualifying for the tax holiday. The results indicate the U.S. multinationals were not financially constrained and were reasonably well-governed. The fungibility of money appears to have undermined the effectiveness of the regulations.

LOL

RIGHT WING HERITAGE

Would Another Repatriation Tax Holiday Create Jobs

Oct 3, 2011

Giving U.S. companies a tax break for bringing home profits held overseas likely won’t create more jobs or spur domestic investment, an influential conservative think tank will argue in a report to be released Tuesday.

In a break from many Republican lawmakers and a host of major U.S. companies including Google Inc., Apple Inc., Pfizer Inc. and Microsoft Corp., the Heritage Foundation said in a new study that a repatriation tax holiday would not motivate companies to hire new workers.

Heritage Repatriation Tax Holiday Wouldn 8217 t Create Jobs - Real Time Economics - WSJ

The Institute for Policy Studies looked at fifty-eight corporations that accounted for 70 percent of overseas profits repatriated under the last tax repatriation holiday, in 2004 and 2005. It found that the companies cut 600,000 jobs.

Corporate Tax Holidays Might Not Create Jobs

"What do you mean "if we went back to a higher tax rate?" We have the highest corporate tax rate in the world."

ANOTHER RIGHT WING KLOWN ARGUING THE USUAL RIGHT WING MYTHS, FORGETTING THE AVG EFFECTIVE RATE IS ABOUT 1/3 OF THE 'RATE' LOL,

12% IS WHAT CORPS PAY, ONLY MEXICO AND CHILE IN THE DEVELOPED WORLD PAY LOWER RATES, LOL

The corporate tax myth

U.S. businesses might face the highest corporate tax rate in the world, but what they pay isn't nearly as bad in comparison to other countries.

In fact, the United States collects less corporate tax relative to the overall economy than almost any other country in the world.

And that's a more objective measure of tax burden. Different accounting rules around the world means what's counted as income in one country isn't counted in another -- that makes comparisons of tax rates misleading.

The corporate tax myth - Feb. 23 2012

Warren Buffett: ‘It Is A Myth’ That U.S. Corporate Taxes Are High

CARRY ON LIAR!

Instead, estimates indicate that a $1 increase in repatriations was associated with a $0.60–$0.92 increase in payouts to shareholders

So the government got 5% off the top, the shareholders got more dividends and then the government got the tax on those dividends as well.

Yeah, that sounds like a horrible idea. Let's never do that again. LOL!

Idiot.

Well according to Heritage Foundation, the right wing think tank, it didn't accomplish the STATED goal Dubya/GOP had, which was job creation and new investment that included R&D. Weird right? Gave a 5% tax rate to Corps and what they do is just give the owners a larger income, WHILE they cut 600,000+ jobs in the US?? lol

Well according to Heritage Foundation, the right wing think tank, it didn't accomplish the STATED goal Dubya/GOP had,

So all it did was give stock holders more dividends to spend and invest and give government more revenue to waste.

I can understand why you don't want that again. LOL!