hvactec

VIP Member

More Americans are reaching their 60s with so much debt they can't afford to retire.

Most people used to pay off their debts before retiring. But as wages have barely kept up with rising prices over the past 35 years Americans have pushed debt higher, living beyond their means. Now, people are postponing retirement, cutting living standards or both.

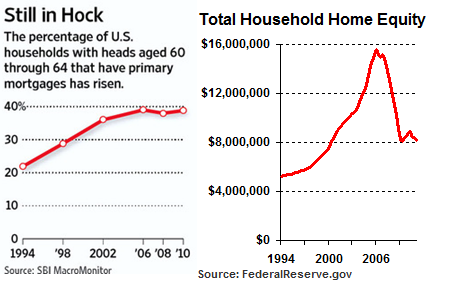

All kinds of debt held by this age group have risen, but the big problem is mortgages. Thirty-nine percent of households with heads aged 60 through 64 had primary mortgages in 2010 and 20% had secondary mortgages, including home-equity lines, according to research group Strategic Business Insights' MacroMonitor. That was up from just 22% and 12%, respectively, in 1994.

The housing crash has made things worse. A few years ago, homeowners in their 60s with big mortgages could sell their homes for a profit and buy smaller places or rent. But the drop in housing values means that many homeowners have little equity, and some now owe more than their houses are worth.

People have tried to reduce debt since the financial crisis, with limited success. Americans of all ages owed $11.4 trillion at the end of the second quarter, based on data from the Federal Reserve Bank of New York. That's down about 15% from 2007 but nearly double what they owed in 1999, adjusted for inflation and population.

Older Americans also have struggled to dig out in the past four years. "Relative to the value of their homes, the amount of indebtedness if anything has gone up because house prices have fallen faster than mortgages have been reduced," says Christopher Herbert, director of research at Harvard's Joint Center for Housing Studies.

Many have little choice but to keep working. "I imagine I'll be working until I'm 70," says Christine Shiber, a 59-year-old Methodist minister in California's Bay Area, struggling to pay off her mortgage, credit-card debt and a loan she took against her retirement account.

Debt isn't the only issue clouding retirement prospects. People aren't saving enough either. As calculated in a Wall Street Journal article earlier this year, the typical American household nearing retirement with a 401(k) retirement account has less than one-quarter of what it needs in that account to maintain its standard of living in retirement.

Four out of five households with heads in their early 60s and with mortgages had too little savings in 2008 to pay off debts without dipping into retirement accounts, according to Boston College economist Anthony Webb.

Read more debt-hobbles-older-americans-retirement-wsj: Personal Finance News from Yahoo! Finance

Most people used to pay off their debts before retiring. But as wages have barely kept up with rising prices over the past 35 years Americans have pushed debt higher, living beyond their means. Now, people are postponing retirement, cutting living standards or both.

All kinds of debt held by this age group have risen, but the big problem is mortgages. Thirty-nine percent of households with heads aged 60 through 64 had primary mortgages in 2010 and 20% had secondary mortgages, including home-equity lines, according to research group Strategic Business Insights' MacroMonitor. That was up from just 22% and 12%, respectively, in 1994.

The housing crash has made things worse. A few years ago, homeowners in their 60s with big mortgages could sell their homes for a profit and buy smaller places or rent. But the drop in housing values means that many homeowners have little equity, and some now owe more than their houses are worth.

People have tried to reduce debt since the financial crisis, with limited success. Americans of all ages owed $11.4 trillion at the end of the second quarter, based on data from the Federal Reserve Bank of New York. That's down about 15% from 2007 but nearly double what they owed in 1999, adjusted for inflation and population.

Older Americans also have struggled to dig out in the past four years. "Relative to the value of their homes, the amount of indebtedness if anything has gone up because house prices have fallen faster than mortgages have been reduced," says Christopher Herbert, director of research at Harvard's Joint Center for Housing Studies.

Many have little choice but to keep working. "I imagine I'll be working until I'm 70," says Christine Shiber, a 59-year-old Methodist minister in California's Bay Area, struggling to pay off her mortgage, credit-card debt and a loan she took against her retirement account.

Debt isn't the only issue clouding retirement prospects. People aren't saving enough either. As calculated in a Wall Street Journal article earlier this year, the typical American household nearing retirement with a 401(k) retirement account has less than one-quarter of what it needs in that account to maintain its standard of living in retirement.

Four out of five households with heads in their early 60s and with mortgages had too little savings in 2008 to pay off debts without dipping into retirement accounts, according to Boston College economist Anthony Webb.

Read more debt-hobbles-older-americans-retirement-wsj: Personal Finance News from Yahoo! Finance