- Apr 12, 2011

- 3,814

- 758

- 130

Wow, this is neat! The thread just started out with Christmas time credit card debt and you brought up not only longer term broader financial progress but also the motivation behind our points of view.Yeah - we're doing great...:...Americans are definitely not spendthrift morons, we're hard working responsible good people. OK, most of us are --and for years now Americans have been paying off debts--

...

cuckoo: You must work for MSNBC. You must also work for...

SUPER!

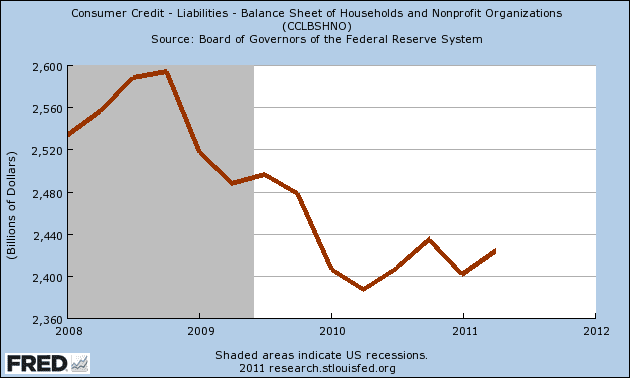

Let's go with the $2.5T credit card debt since 1952 like you mentioned and add in the rest of the the $13.8T debt. OK, it sounds big but it's the lowest it's been in four years, down $7T from the '08 peak. The latest numbers out today say the average household's paid off another $546 in the last 3 months alone!

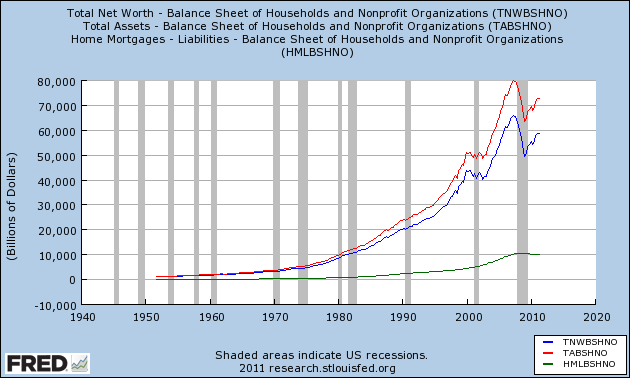

Anyway, let's go with your 60 year span at total household liabilities plus assets to see how the bottom line's going--

Anyway we slice it the entire picture is solid, and that's pretty much where I'm coming from; which brings us to where you're coming from. Like, what amazed me about your post is that you're obviously not another know-nothing doom'n'gloomer because you know hard numbers and how to use them.

However that means you had to have known that total household wealth was doing so well yet you made Americans out to look stupid. For a minute you seemed like some kind of paid shill from some America-hating Obama front, but before I got my tin-foil hat on I considered also the possibility you're just a fellow goof-off like me clowning around. Seriously, if you've a mind to please fill us in.