emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #41

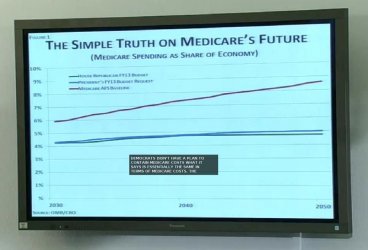

Now into the amendments section of the hearing. Swartz proposes the first amendment. In the closing statement Hollen goes to the graph Ryan put up for his time. What the green and the blue lines show are the PP versus the President's budget projection for Medicare. The lines fall pretty close to each other. The red line shows what happens if the President's plan fails to achieve the goals. However the red line also represents what happens if the Ryan budget fails. The difference is that under the President's plan the government is have to absorb the increase in costs. Under the Ryan plan the seniors are going to absorb the costs. Swartz mentioned that given the validity of the figures give so far the question of this portion of PP is also dubious.

The amendment was not adopted. Vote along party lines. Surprised? I hope not.

To better understand the PP Medicare mechanism I included this from the referenced pdf file.

http://www.google.com/url?sa=t&rct=...=PN83lC5jpHyPSI7bbMX1kg&bvm=bv.41642243,d.dmQ

The amendment was not adopted. Vote along party lines. Surprised? I hope not.

To better understand the PP Medicare mechanism I included this from the referenced pdf file.

http://www.google.com/url?sa=t&rct=...=PN83lC5jpHyPSI7bbMX1kg&bvm=bv.41642243,d.dmQ

Chairman Ryan and I drafted a skeletal version of Medicare Premium Support for consideration by the Simpson-Bowles Commission. The Ryan-Rivlin version would phase in much slower than Domenici-Rivlin, because it would affect only newly eligible Medicare beneficiaries beginning in 2021. This version would not offer premium support to those already in Medicare (although it would presumably retain Medicare Advantage) and would not retain FFS Medicare as an option for new enrollees . Hence, the transition would take much longer than the Domenici-Rivlin version.

While the proposed premium support model resembles the current structure of Medicare Advantage, there are important differences. Competition among plans would be enhanced by creating a federal Medicare Exchange, which would increase the competitiveness of the market, leading to lower premiums. While Medicare currently informs beneficiaries of available Medicare Advantage plan choices and plan performance through a web site and other means, one-on-one marketing by Medicares private plans is a dominant model for enrollment. A more formal exchange could make it easier for beneficiaries to compare and select among the plans available to them in head-to-head comparisons, reduce sales and marketing costs of the plans, and create better value for enrollees. Improvements will also emerge as states develop exchanges for individuals and small employers under the Affordable Care Act. The proposed Medicare Exchange would also provide incentives for plans to develop products that will save beneficiaries money. Today, if a Medicare Advantage plan has very low costs, it cannot pay a rebate to enrollees; instead, it must increase benefits. Under the proposed Medicare Exchange plans could offer beneficiaries relief from rising Medicare premiums, creating additional market incentives for efficiency.