Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

budget, budget, who has the budget?

- Thread starter emptystep

- Start date

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #62

McCollum's amendment: Protect the Affordable Care Act. Assure that all woman will have access to affordable healthcare.

Bonamici: Affordable Care Act reduced discrimination against women.

Moore: ACA assures basic care for individuals.

Opposition to amendment:

Black: Agencies and boards will make decisions for the women. 46% of the doctors are planning to leave medical practice when the Affordable Care Act kicks in. Doctor shortage will be huge and women will have less and less choice who will see them.

Closing statement: If you want woman to be treated equally then vote for this amendment.

Amendment was not adopted. Vote along party lines.

Bonamici: Affordable Care Act reduced discrimination against women.

Moore: ACA assures basic care for individuals.

Opposition to amendment:

Black: Agencies and boards will make decisions for the women. 46% of the doctors are planning to leave medical practice when the Affordable Care Act kicks in. Doctor shortage will be huge and women will have less and less choice who will see them.

Closing statement: If you want woman to be treated equally then vote for this amendment.

Amendment was not adopted. Vote along party lines.

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #63

Moore's amendment: Wants to disabuse the Budget Committee of the notion that block granting, vocherizing, cutting more money out of the safety net will somehow help people climb out of poverty. She goes through a series of the concepts given by the House Budget Republicans for their need to do things the way they do. Well worth the watch. Poor people are poor because of the recession and the economic condition of this country. Only 8% of the people who received food stamps received any other form of benefit like Temporary Assistance for Needy Families (TANF). 60% of them were working, they were working poor. Working people have time limits, only three months out of three years can they receive TANF. 80% of people who received food stamps had an elderly person in the family. 2/3 had kids and disabled people in the family. 45 million people use food stamps.

McCollum: 40% of those seeking hunger relief in Minnesota are children, 1001 public, private, and nonresidential child care institutions. For some of those children that is the only meal that they receive. On behalf of the children in her district, her state, and this nation she hopes they will support Mrs. Moore's amendment.

Moore: Taking money from programs like WIC is a shame.

Opposition:

Ribble: "Sounds like groundhog's day in here." (Don't know what that meant.) The insinuation that anyone in this Congress wants to vilify the poor is stunning to him. In the fifteen months he has been there he has not seen it. What does vilify the poor is a tax code that attacks businesses and they don't hire people. That attacks the poor, that vilifies the poor. A tax rate that was put on by President Obama, Pelosi, and Reid that offered up tax deductions for corporate jets. Go after the 1/10 of 1% percent that buy corporate jets. What you are going to get at are the men and woman who build those jets. You're going to get at poor people this way. You want more people to go on SNAP, you want more children to go hungry, steal a job from their mom and dad. Give them more regulation, We want more taxes. Who do you think pays taxes. "Corporations don't pay taxes, customers pay taxes" (yes, he actually said that), and that is just the harsh reality of it. You have to create jobs and that is exactly what he believes this budget will do. It simplifies the corporate rate. It simplifies the tax code. You help poor people by lifting them up.

Stutzman: He didn't know he was poor until the government told him his was poor. He grew up on a farm and his parents made sure there was food on the table every day. The worst thing we can do right now is lull people into government handouts. Supplemental Nutrition Assistance Programs (SNAP) has grown from $18B in 2001 to over %80B today. What that reflects a recession but also a government that wants to take care of people cradle to grave. What we have to do get back to the principles that made this country great where people worked, give them opportunity, and they will take care of themselves.

Huelskamp: We need to be passing job creating legislation. We make people not poor by making sure mom and dad have a job. The idea that if we do not keep the number of people on food stamps at 44 million, the idea that if we don't keep them harnessed to the government check, that we are not being charitable. Because of the failure of this administration we have an unemployment rate of 8.3%

Closing statements:

Cutting $750 million out of WIC, a program that feeds babies was upsetting. I do want to see you create jobs which is why I would like to see you pass a decent transportation bill.

Amendment not adopted. Vote along party lines.

Personal note: As someone who used to clean his plate every day in elementary school that I was receiving free lunch and now my wife pays enough taxes to buy someone a new car every year I would have liked to seen the amendment adopted. (Edit was to add smilie. Ironic name in this case.)

(Edit was to add smilie. Ironic name in this case.)

From page 14 of the pp:

Women, Infants, and Children (WIC) | Food and Nutrition Service

Supplemental Nutrition Assistance Program (SNAP) | Food and Nutrition Service

McCollum: 40% of those seeking hunger relief in Minnesota are children, 1001 public, private, and nonresidential child care institutions. For some of those children that is the only meal that they receive. On behalf of the children in her district, her state, and this nation she hopes they will support Mrs. Moore's amendment.

Moore: Taking money from programs like WIC is a shame.

Opposition:

Ribble: "Sounds like groundhog's day in here." (Don't know what that meant.) The insinuation that anyone in this Congress wants to vilify the poor is stunning to him. In the fifteen months he has been there he has not seen it. What does vilify the poor is a tax code that attacks businesses and they don't hire people. That attacks the poor, that vilifies the poor. A tax rate that was put on by President Obama, Pelosi, and Reid that offered up tax deductions for corporate jets. Go after the 1/10 of 1% percent that buy corporate jets. What you are going to get at are the men and woman who build those jets. You're going to get at poor people this way. You want more people to go on SNAP, you want more children to go hungry, steal a job from their mom and dad. Give them more regulation, We want more taxes. Who do you think pays taxes. "Corporations don't pay taxes, customers pay taxes" (yes, he actually said that), and that is just the harsh reality of it. You have to create jobs and that is exactly what he believes this budget will do. It simplifies the corporate rate. It simplifies the tax code. You help poor people by lifting them up.

Stutzman: He didn't know he was poor until the government told him his was poor. He grew up on a farm and his parents made sure there was food on the table every day. The worst thing we can do right now is lull people into government handouts. Supplemental Nutrition Assistance Programs (SNAP) has grown from $18B in 2001 to over %80B today. What that reflects a recession but also a government that wants to take care of people cradle to grave. What we have to do get back to the principles that made this country great where people worked, give them opportunity, and they will take care of themselves.

Huelskamp: We need to be passing job creating legislation. We make people not poor by making sure mom and dad have a job. The idea that if we do not keep the number of people on food stamps at 44 million, the idea that if we don't keep them harnessed to the government check, that we are not being charitable. Because of the failure of this administration we have an unemployment rate of 8.3%

Closing statements:

Cutting $750 million out of WIC, a program that feeds babies was upsetting. I do want to see you create jobs which is why I would like to see you pass a decent transportation bill.

Amendment not adopted. Vote along party lines.

Personal note: As someone who used to clean his plate every day in elementary school that I was receiving free lunch and now my wife pays enough taxes to buy someone a new car every year I would have liked to seen the amendment adopted.

(Edit was to add smilie. Ironic name in this case.)

(Edit was to add smilie. Ironic name in this case.)From page 14 of the pp:

Prioritizing assistance for those in need: The welfare reforms of the 1990s, despite their success, were never extended beyond cash welfare to other means-*‐tested programs. This budget completes the successful work of transforming welfare by reforming other areas of Americas safety net to ensure that welfare does not entrap able-*‐bodied citizens into lives of complacency and dependency.

Women, Infants, and Children (WIC) | Food and Nutrition Service

The Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) provides Federal grants to States for supplemental foods, health care referrals, and nutrition education for low-income pregnant, breastfeeding, and non-breastfeeding postpartum women, and to infants and children up to age five who are found to be at nutritional risk.

Supplemental Nutrition Assistance Program (SNAP) | Food and Nutrition Service

Chart Book: SNAP Helps Struggling Families Put Food On The Table ? Center on Budget and Policy PrioritiesSNAP offers nutrition assistance to millions of eligible, low income individuals and families and provides economic benefits to communities. SNAP is the largest program in the domestic hunger safety net. The Food and Nutrition Service works with State agencies, nutrition educators, and neighborhood and faith-based organizations to ensure that those eligible for nutrition assistance can make informed decisions about applying for the program and can access benefits. FNS also works with State partners and the retail community to improve program administration and ensure program the integrity.

SNAP plays a major role in helping some households lift themselves out of poverty. By providing benefits that must be used to purchase food, SNAP can be an important part of a low-income households budget. A CBPP analysis using the National Academy of Science measures of poverty, which counts SNAP as income, found that SNAP kept about 4 million people out of poverty in 2010, including about 2 million children. SNAP also lifted 1.3 million children out of deep poverty (defined as 50 percent of the poverty line) in 2010, more than any other government assistance program.

Last edited:

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #64

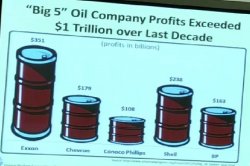

Ryan from Ohio's amendment: End tax subsidies to big oil and fund the commodities future trade commission, CFTC, to effectively enforce some of the gambling that is going on in the commodities market now. Lion share of the money would go to paying down the debt but some would go to funding the Dodd-Frank provisions to $308 million which is what the President's request needed to enforce the rules that came out of Dodd-Frank. Will curb excessive speculation while allowing bona fide hedge managers to continue operating in a legitimate way. CFTC has not been able to put the limits on excessive speculation and oil and other commodities.Seeks an injunction against the rule. The high gas prices are coming from the top 1% who have made over a trillion dollars over the last decade.

Hollen: CFTC has been trying to put in place rules that prevent market manipulation. This is one thing you can do in the short term which do so by sending a signal that we're going to put an end to the excessive speculation that's driving up the price through activities in the futures market.

Opposition to the amendment:

Lankford: The philosophic difference of increasing taxes on the people who produce the oil and the gas and by increasing the regulation. So if we only have more regulation and more taxes the price will come down.

Cole: It always amazes me that my friend from the other side legitimately decry high gasoline prices, worry about the outsourcing of American jobs then purpose policies that precisely meet those objectives. If you raise taxes on any oil company, any gas company and guess what? It is going to get added to the price. You are going to see it at the pump almost immediately. And the idea that we should frankly raising taxes discourage people from drilling here is an enormous mistake. Oil is a great employer in this country. And not just in the traditional energy states and now in states we didn't used to think of as energy states. 17,000 new jobs at $75,000 a piece in Western Pennsylvania that simply weren't there before. This is a simple recipe that will simply increase the cost of gasoline, that will cost American jobs, and slow down the economic recovery. Stop vilifying an industry that has a much lower profit margin than high tech and where the capital investment rates are incredibly high. Profit rates of oil companies are in line with the rest of American companies and are actually quite modest compared to high tech companies like Apple or Microsoft. A well intentioned but counterproductive proposal.

Flores: Have vilified the oil companies on the other side of the isle for decades. Apple makes four times as much money on this (holds up his ipad) as oil companies make on an equivalent barrel of oil. By the same logic we should tax Apple at 100% of their profits. Exxon's tax rate is about 42%, Apple's tax rate is about 24%. Oil companies profits are used to reinvest into the company. Money is being wasted on green companies. Green project companies have wasted $1.6 billion dollars. If you want to have lower gas prices approve the Keystone pipeline, approve more offshore leases, approve more oil activities on federal lands. Quit having eleven government agencies investigating fracking, just have one just pass the rules and go on down the road. Quit changing the goal post every time you get a chance.

Lankford: Energy producing states have the lowest unemployment rates. You hit energy producing states, you hit jobs, you decrease our economy.

Closing statements: You're acting like we want to take every dollar they made. We are asking for 1% of the 1 trillion dollars they made so we can have cops on the beat so we can chase down the speculators. It's not their oil either, it's our oil they're taking out. 1% is not a big ask and all of the constituents are paying $0.50 more for a gallon of gas. It would be a good investment, maybe not for the oil companies.

Amendment not adopted. Vote along party lines.

By now some times I am able to complete the Republican's sentence. Then again they seem to come up with stuff I could never think up. Too unbelievable to make up.

Hollen: CFTC has been trying to put in place rules that prevent market manipulation. This is one thing you can do in the short term which do so by sending a signal that we're going to put an end to the excessive speculation that's driving up the price through activities in the futures market.

Opposition to the amendment:

Lankford: The philosophic difference of increasing taxes on the people who produce the oil and the gas and by increasing the regulation. So if we only have more regulation and more taxes the price will come down.

Cole: It always amazes me that my friend from the other side legitimately decry high gasoline prices, worry about the outsourcing of American jobs then purpose policies that precisely meet those objectives. If you raise taxes on any oil company, any gas company and guess what? It is going to get added to the price. You are going to see it at the pump almost immediately. And the idea that we should frankly raising taxes discourage people from drilling here is an enormous mistake. Oil is a great employer in this country. And not just in the traditional energy states and now in states we didn't used to think of as energy states. 17,000 new jobs at $75,000 a piece in Western Pennsylvania that simply weren't there before. This is a simple recipe that will simply increase the cost of gasoline, that will cost American jobs, and slow down the economic recovery. Stop vilifying an industry that has a much lower profit margin than high tech and where the capital investment rates are incredibly high. Profit rates of oil companies are in line with the rest of American companies and are actually quite modest compared to high tech companies like Apple or Microsoft. A well intentioned but counterproductive proposal.

Flores: Have vilified the oil companies on the other side of the isle for decades. Apple makes four times as much money on this (holds up his ipad) as oil companies make on an equivalent barrel of oil. By the same logic we should tax Apple at 100% of their profits. Exxon's tax rate is about 42%, Apple's tax rate is about 24%. Oil companies profits are used to reinvest into the company. Money is being wasted on green companies. Green project companies have wasted $1.6 billion dollars. If you want to have lower gas prices approve the Keystone pipeline, approve more offshore leases, approve more oil activities on federal lands. Quit having eleven government agencies investigating fracking, just have one just pass the rules and go on down the road. Quit changing the goal post every time you get a chance.

Lankford: Energy producing states have the lowest unemployment rates. You hit energy producing states, you hit jobs, you decrease our economy.

Closing statements: You're acting like we want to take every dollar they made. We are asking for 1% of the 1 trillion dollars they made so we can have cops on the beat so we can chase down the speculators. It's not their oil either, it's our oil they're taking out. 1% is not a big ask and all of the constituents are paying $0.50 more for a gallon of gas. It would be a good investment, maybe not for the oil companies.

Amendment not adopted. Vote along party lines.

By now some times I am able to complete the Republican's sentence. Then again they seem to come up with stuff I could never think up. Too unbelievable to make up.

Attachments

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #65

Bonamici's amendment: Amendment in support of the Securities and Exchange Commission, SEC, and the Consumer Financial Protection Bureau, CFPB. The PP states, "The free enterprise system is being stifled by a federal bureaucracy fixated on depriving citizens and businesses of their ability to make social and economic decisions according to what is best for their own needs and interests." (pg. 8) We have seen what happens when we take the referees off the field and allow Wall Street to pursue policies and practices that focus purely on what is best for their own needs and interests. Support the SEC and the CFPB in their efforts to protect the consumer. Clear and fair rules and the enforcement of those rules are critical in fostering a robust economy and creating a level playing field. A vast majority of businesses follow the law but a lack of structure and enforcement put them at the mercy of the unscrupulous players. that gain an unfair competitive advantage. The work of the SEC and the CFPB is critical to our recovering economy.

Doggett: A law enforcement amendment. It is vital that it be fully funded. Those who opposed setting it up in the first place are doing everything they can to undermine and weaken this agency by defunding it.

Moore: Markets globally have crashed because of the lack of oversight. You don't defund agencies because they did not enforce it before the last debacle. We have a brand new framework where there is greater transparency not only here but with the regulators overseas.

Opposition to the amendment:

Garrett: You don't really have any consumer financial protection if there aren't going to be as many financial products moving forward and that is the outcome of the work of the CFPB and additionally work by the SEC here. If you lower down the potential for the industry to produce financial products, consumer loans, mortgages, home equity loans, car loans and student loans, and the like. Local banks and credit unions are going to go out and hire more compliance officers instead of saying let's hire more people who are going to be out in the front office of your local bank so your constituents can go out there and actually get a loan. Have to comply with not just the CFPB but with the 2300 pages of the Dodd-Frank. (actually 848 pages) SEC funding has grown 50% since 2008. More than 3,800 work at the SEC. They make on the average of $200,000 per employee over there. President's budget has the SEC at $2.25 billion in 2015. Hit the drivers of risk in the financial market Fannie Mae and Freddie Mack which this administration fails to do.

Flores: The real villain was Congress. The real villain in the meltdown was because Congress didn't police the agencies that they help create it, Fannie Mae and Freddie Mac, and they allowed the executives of those two organizations to make hundreds of millions of dollars into paid millions of dollars to lobby Congress and what they got for it was protection, protection from the other side of the isle. There were requests to reform Freddie Mae and Fannie Mac and they were all rebuffed by Democrats. Dodd-Frank shot all the innocent victims including dozens of community bank in my district. Because the cost of compliance has gone up so much for low dollar bank accounts banks will no longer take or set up bank accounts for the poor. They have been forced by Dodd-Frank to use payday lenders. Mandatory spending on the CFPB is going to be $5.5 billion. The solution is to repeal Dodd-Frank and put in regulations to make Freddie Mae and Fannie Mac be accountable.

Closing remarks: As transactions have become more and more complex it is important for consumers to be able to understand them and the CFPB is doing that very important work.

Amendment not adopted. Party line vote.

(While I am editing or looking something up I like to get in a little Earth, Wind, and Fire and K.C. & The Sunshine Band and the like. Keeps me sane, more or less.)

CFPB > Consumer Financial Protection Bureau

[ame=http://www.youtube.com/watch?feature=player_embedded&v=6-r4JFDsVmA]We want to hear your story - YouTube[/ame]

Doggett: A law enforcement amendment. It is vital that it be fully funded. Those who opposed setting it up in the first place are doing everything they can to undermine and weaken this agency by defunding it.

Moore: Markets globally have crashed because of the lack of oversight. You don't defund agencies because they did not enforce it before the last debacle. We have a brand new framework where there is greater transparency not only here but with the regulators overseas.

Opposition to the amendment:

Garrett: You don't really have any consumer financial protection if there aren't going to be as many financial products moving forward and that is the outcome of the work of the CFPB and additionally work by the SEC here. If you lower down the potential for the industry to produce financial products, consumer loans, mortgages, home equity loans, car loans and student loans, and the like. Local banks and credit unions are going to go out and hire more compliance officers instead of saying let's hire more people who are going to be out in the front office of your local bank so your constituents can go out there and actually get a loan. Have to comply with not just the CFPB but with the 2300 pages of the Dodd-Frank. (actually 848 pages) SEC funding has grown 50% since 2008. More than 3,800 work at the SEC. They make on the average of $200,000 per employee over there. President's budget has the SEC at $2.25 billion in 2015. Hit the drivers of risk in the financial market Fannie Mae and Freddie Mack which this administration fails to do.

Flores: The real villain was Congress. The real villain in the meltdown was because Congress didn't police the agencies that they help create it, Fannie Mae and Freddie Mac, and they allowed the executives of those two organizations to make hundreds of millions of dollars into paid millions of dollars to lobby Congress and what they got for it was protection, protection from the other side of the isle. There were requests to reform Freddie Mae and Fannie Mac and they were all rebuffed by Democrats. Dodd-Frank shot all the innocent victims including dozens of community bank in my district. Because the cost of compliance has gone up so much for low dollar bank accounts banks will no longer take or set up bank accounts for the poor. They have been forced by Dodd-Frank to use payday lenders. Mandatory spending on the CFPB is going to be $5.5 billion. The solution is to repeal Dodd-Frank and put in regulations to make Freddie Mae and Fannie Mac be accountable.

Closing remarks: As transactions have become more and more complex it is important for consumers to be able to understand them and the CFPB is doing that very important work.

Amendment not adopted. Party line vote.

(While I am editing or looking something up I like to get in a little Earth, Wind, and Fire and K.C. & The Sunshine Band and the like. Keeps me sane, more or less.)

CFPB > Consumer Financial Protection Bureau

[ame=http://www.youtube.com/watch?feature=player_embedded&v=6-r4JFDsVmA]We want to hear your story - YouTube[/ame]

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #66

Shuler's amendment: Everything must be on the table in budget talks.

Hollen: Schuler sights Simpson-Bolwes as a guideline. Use both cuts and revenue to manage the budget.

Opposition to amendment:

Ryan: Bolwes-Simpson brings revenue up to 21% of GDP, a full percentage point higher than the President's budget does.

McClintock: 2002 to 2012 population and inflation increased by 35%. Revenues increased 33%. The problem is spending increased 76% in the same period. It's the spending that is killing us.

Stutzman: People say they would pay more taxes if they knew it would pay down the deficit. People don't trust Washington. May have to take one step at a time rather than trying to do comprehensive one big package. Until we tackle the debt and the deficit it will be difficult to do this in a comprehensive way. Focus on reducing the deficit, reducing the spending, and focusing on tax reform. People looking to Washington to get spending under control before we can start tax reform.

McClintock: Broaden, lower, and flatten our tax rates that produces explosive economic growth in every country that has taken that advice. The unhealthy way to generate revenue is increasing taxes in a brittle economy.

Closing statement:

I believe every word of this quote is accurate. "To reiterate, "spending cuts" in fact that was the very first thing I said but sometimes it's very difficult to hear when it's all about partisanship" and someday you are going to realize when I'm gone out of this body which thank goodness I have already announced retirement you guys are going to say, "You know what? That Shuler guy was right after all. He actually had it right when your constituents look at you someday and realize that partisanship is getting our country nowhere and we are responsible for that." So just wake up someday and you will realize that working together we will put our country back on the right path."

Ryan of Ohio: The idea the Reagan somehow got "snockered" is incorrect. Raising taxes at the time was the responsible thing to do.

SImpson "pass", Woodall "pass", Mulvaney "pass"

Simpson changed vote to 'aye', Woodall changed vote to 'aye'

Tie vote! 15-15 OMG, can't wait to see what happens next. OK, don't know. They just moved into tier 3 amendment so I will have to find out later what happens to a tied vote amendment. Grats to Shuler for introducing an amendment that did not get flatly turned down on party line vote. I hope he is enjoying his next endeavor.

Hollen: Schuler sights Simpson-Bolwes as a guideline. Use both cuts and revenue to manage the budget.

Opposition to amendment:

Ryan: Bolwes-Simpson brings revenue up to 21% of GDP, a full percentage point higher than the President's budget does.

McClintock: 2002 to 2012 population and inflation increased by 35%. Revenues increased 33%. The problem is spending increased 76% in the same period. It's the spending that is killing us.

Stutzman: People say they would pay more taxes if they knew it would pay down the deficit. People don't trust Washington. May have to take one step at a time rather than trying to do comprehensive one big package. Until we tackle the debt and the deficit it will be difficult to do this in a comprehensive way. Focus on reducing the deficit, reducing the spending, and focusing on tax reform. People looking to Washington to get spending under control before we can start tax reform.

McClintock: Broaden, lower, and flatten our tax rates that produces explosive economic growth in every country that has taken that advice. The unhealthy way to generate revenue is increasing taxes in a brittle economy.

Closing statement:

I believe every word of this quote is accurate. "To reiterate, "spending cuts" in fact that was the very first thing I said but sometimes it's very difficult to hear when it's all about partisanship" and someday you are going to realize when I'm gone out of this body which thank goodness I have already announced retirement you guys are going to say, "You know what? That Shuler guy was right after all. He actually had it right when your constituents look at you someday and realize that partisanship is getting our country nowhere and we are responsible for that." So just wake up someday and you will realize that working together we will put our country back on the right path."

Ryan of Ohio: The idea the Reagan somehow got "snockered" is incorrect. Raising taxes at the time was the responsible thing to do.

SImpson "pass", Woodall "pass", Mulvaney "pass"

Simpson changed vote to 'aye', Woodall changed vote to 'aye'

Tie vote! 15-15 OMG, can't wait to see what happens next. OK, don't know. They just moved into tier 3 amendment so I will have to find out later what happens to a tied vote amendment. Grats to Shuler for introducing an amendment that did not get flatly turned down on party line vote. I hope he is enjoying his next endeavor.

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #67

[On the last amendment "simple majority required" so last amendment was not adopted.]

Bass's amendment: Interest on subsidized Stanford student loans is due to double from 3.4% to 6.8%. Interest rate was lower by the 2009 College Cost Reduction Act passed by the 110th Congress. Extend current interest rate of 3.4% on these student loans.

Schultz: The average student faces $25,000 of debt upon graduating. The choice we make will strike vastly different visions for America's future. Insuring that students are able to graduate with a better education and less debt is the best way to insure that America stays competitive long into the future.

Opposition to the amendment:

Amash: It seems we have been debating various versions of the same amendment all day. Amendment after amendment has suggested increasing the amount of funding on the department of education. Each time we are guaranteed the measure is going to insure we give a quality, affordable college education. Cost of education has increased at double the rate of inflation for the last three decades. This begs the question, "Where has all those billions of tax payer's dollars gone?" Maybe administrators, insulated from parent's incomes or student's future earning potential, have not had to be as focused spending each tuition dollar efficiently. We can not keep taxing the American people and running up the tab to hand to university administrators. It encourages the kind of tuition spiral we have seen over the last three decades and in the end it make college education less affordable, not more affordable for the poor. We need to reform our federal education programs. We need to simplify the more that dozen different federal credits for tuition. And where possible we need to encourage state and local solutions rather than federal fixes to these problems.

Rokita: He asks the question he asked before, which is now becoming the eternal question, which is without an answer, "Why do the children of tomorrow have to pay so that we can have more on our plate today?" We are creating an education bubble. When you simply throw money at college you needlessly raise the pay of professors, raise the tuition of scholars, and distort the fair market. We need more competition in education and this does not do it.

Closing: Responsibility of our generation. This is not about paying university professors more, this is about kids who graduate college today who are essentially burdened with debt which is equal to what a mortgage would be a couple of decades ago. And it is not like this is not paid for. We do have an offset.

Amendment is not adopted. Vote along party lines.

[I just noticed there might be a trend here.]

Bass's amendment: Interest on subsidized Stanford student loans is due to double from 3.4% to 6.8%. Interest rate was lower by the 2009 College Cost Reduction Act passed by the 110th Congress. Extend current interest rate of 3.4% on these student loans.

Schultz: The average student faces $25,000 of debt upon graduating. The choice we make will strike vastly different visions for America's future. Insuring that students are able to graduate with a better education and less debt is the best way to insure that America stays competitive long into the future.

Opposition to the amendment:

Amash: It seems we have been debating various versions of the same amendment all day. Amendment after amendment has suggested increasing the amount of funding on the department of education. Each time we are guaranteed the measure is going to insure we give a quality, affordable college education. Cost of education has increased at double the rate of inflation for the last three decades. This begs the question, "Where has all those billions of tax payer's dollars gone?" Maybe administrators, insulated from parent's incomes or student's future earning potential, have not had to be as focused spending each tuition dollar efficiently. We can not keep taxing the American people and running up the tab to hand to university administrators. It encourages the kind of tuition spiral we have seen over the last three decades and in the end it make college education less affordable, not more affordable for the poor. We need to reform our federal education programs. We need to simplify the more that dozen different federal credits for tuition. And where possible we need to encourage state and local solutions rather than federal fixes to these problems.

Rokita: He asks the question he asked before, which is now becoming the eternal question, which is without an answer, "Why do the children of tomorrow have to pay so that we can have more on our plate today?" We are creating an education bubble. When you simply throw money at college you needlessly raise the pay of professors, raise the tuition of scholars, and distort the fair market. We need more competition in education and this does not do it.

Closing: Responsibility of our generation. This is not about paying university professors more, this is about kids who graduate college today who are essentially burdened with debt which is equal to what a mortgage would be a couple of decades ago. And it is not like this is not paid for. We do have an offset.

Amendment is not adopted. Vote along party lines.

[I just noticed there might be a trend here.]

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #68

Castor's amendment: Disallow the privation of Social Security and protect workers and retirees. Guards on a raid on the Social Security trust fund to decrease the deficit.

Schwartz: Social Security has been important in keeping seniors out of poverty.

Opposition to the amendment:

Mulvaney: Doesn't see the need to make up stuff to fight about. No where in the PP is Social Security except that if they see Social Security is going to go broke in 75 years they have to tell the President. (Which nothing like what it actually says. See below.) There is nothing in there about changing benefits. There is nothing in there about changing ages. We don't need to making things up to fight about.

Closing: "Better safe than sorry. This is the 'Better safe than sorry' amendment."

Amendment is not adopted. Vote along party lines.

pg. 48 of the PP

Schwartz: Social Security has been important in keeping seniors out of poverty.

Opposition to the amendment:

Mulvaney: Doesn't see the need to make up stuff to fight about. No where in the PP is Social Security except that if they see Social Security is going to go broke in 75 years they have to tell the President. (Which nothing like what it actually says. See below.) There is nothing in there about changing benefits. There is nothing in there about changing ages. We don't need to making things up to fight about.

Closing: "Better safe than sorry. This is the 'Better safe than sorry' amendment."

Amendment is not adopted. Vote along party lines.

pg. 48 of the PP

Social Security

In the words of President Franklin D. Roosevelt, Social Security was created to provide an antidote to the dreadful consequence of economic insecurity for the elderly and for vulnerable citizens in times of need.50 The program is financed through a pay-*‐as-*‐you-*‐go system, which means that current workers Social Security taxes are used to pay benefits for current retirees. In 1935 when Social Security was enacted, there were about 42 working-*‐age Americans for each retiree. The average life expectancy at birth for men in America was 60 years; for women it was 64.

The demographic situation has changed dramatically, however, since the creation of the program. This evolution in the demographic composition of the U.S. population was accompanied by the enactment of large expansions in eligibility for benefits and of taxes to finance those benefits. In 1950, there were 2.9 million beneficiaries. Currently, there are over 55 million beneficiaries an eighteen-*‐fold increase.51 When the program was created, workers and their employers each paid a 1 percent payroll tax. Today, they each pay a 6.2 percent payroll tax.

The explosion of payments in the 75 years since the Social Security system was enacted will be dwarfed by the demographic demands of the very near future. The first members of the baby-*‐boom generation those born between 1946 and 1964 are already eligible for early retirement. At the same time, thanks to innovations in medical technology and health care, life expectancies have lengthened to an average 75.9 years for men and 80.6 years for women, and are expected to grow further. This unquestionably positive development requires policymakers to respond with reforms that ensure that this 20th-*‐Century program can make good on its promise in the 21st Century.

Not only is the nation aging, but there has also been a demographic shift to a lower retirement age. In 1945, the average age of retirement was 69.6 years. In 2009, it was 63.8 years.

To put this in perspective: when Social Security was first enacted in 1935, each worker, on average, was contributing less than 2.5 percent of one retirees benefits. By 2030, each wage earner will be paying for nearly half of each retired persons full benefits.

This represents a massive shift of earnings away from younger families trying to build for their futures, toward Social Security recipients. No economy can grow and thrive under that heavy a tax burden.

Those who wish to solve this problem by raising taxes often ignore the economic damage that such large tax increases would entail. Just lifting the cap on income subject to Social Security taxes, as some have proposed, would, when combined with the Obama administrations other preferred tax policies, lift the top marginal tax rate to over 50 percent. Despite having a limited direct impact on the solvency of the program, these tax increases would impose adverse consequences to retirement security programs by weakening their most critical source of funding: a growing, prosperous economy.

Most economists agree that raising marginal tax rates that high would create a significant drag on economic growth, job creation, productivity and wages. This nation cannot fix its retirement-*‐security system by leaving young families with nothing to save.

If the nation acts now, those in and near retirement can enjoy the continuity of health and retirement arrangements around which they have organized their lives. If Washington continues to play politics with the future of these programs, however, then it wont just be future generations at risk: Current retirees will also find their benefits subject to a significant reduction of 23 percent when the Social Security trust funds are no longer able to pay full benefits.

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #69

Blumenauer: Is not going to ask for a recorded vote. In a rational world we would be working together and enact. From the Superfund. Petrol chemical were exempt from blame in exchange for a fee it was assigned, three small fees actually. These expired in 1995. We study, we stall, we sue. Superfund fees. It was a fee, it was not a tax, there were benefits from it, the companies go benefit from it, the communities got benefits from it. This is one thing the Congress at one point could do. It is not a big tax increase. It is a fee. The companies were given a benefit and the communities were given a benefit. When we come back and start acting like grownups I think we will enact it again.

Blumenauer withdrew the amendment. He introduced it so that people would think about it next time it came around.

Superfund | US EPA

Blumenauer withdrew the amendment. He introduced it so that people would think about it next time it came around.

Superfund | US EPA

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #70

Yarmuth's amendment: Rather than give the oil industry a subsidy give it to automobile owners.

McCollum's amendment: Average school building is 40 years old. $270B for repair of schools for the students and the jobs it will create.

Opposition: Riddle: Constitution does not give the federal government responsibility for education.

Schwartz's amendment: Keep the Affordable Care Act.

Opposition: Black & Ryan: Faith based issue.

Doggett's amendment: Save headstart program.

Hollen's amendment: Adhere to the Budget Control Act.

Opposing: Ryan: "We are getting ready for sequestration." [That is not exactly in context but I don't know how he meant that.]

Closing: "What you are doing here is breaking an agreement. It is going to throw the whole appropriations process into unnecessary chaos. Let's just hope we don't take this to the end of the wire and threaten a government shut down because of a broken deal at the end of the day."

Moore's amendment: Enforcing child support reduces poverty by 45%. Every dollar collected from child support we save a dollar of other programs.

Passed! Unanimous voice vote.

Technical amendment is passed. I think is was just to state that amendments were done.

House Budget, PP, passes the committee.

McCollum's amendment: Average school building is 40 years old. $270B for repair of schools for the students and the jobs it will create.

Opposition: Riddle: Constitution does not give the federal government responsibility for education.

Schwartz's amendment: Keep the Affordable Care Act.

Opposition: Black & Ryan: Faith based issue.

Doggett's amendment: Save headstart program.

Hollen's amendment: Adhere to the Budget Control Act.

Opposing: Ryan: "We are getting ready for sequestration." [That is not exactly in context but I don't know how he meant that.]

Closing: "What you are doing here is breaking an agreement. It is going to throw the whole appropriations process into unnecessary chaos. Let's just hope we don't take this to the end of the wire and threaten a government shut down because of a broken deal at the end of the day."

Moore's amendment: Enforcing child support reduces poverty by 45%. Every dollar collected from child support we save a dollar of other programs.

Passed! Unanimous voice vote.

Technical amendment is passed. I think is was just to state that amendments were done.

House Budget, PP, passes the committee.

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #71

Well, that's it folks. Not the most fun 8 hours 41 minutes I have ever spent in my life, plus a little time spent going back and forth over a particular statement or two to get the wording down exact. I don't know how the House Budget Committee Democrats could stand that. Actually listening to some of that was painful.

At the moment I don't have a summary other that to say the differences in philosophies are more stark than I could have ever imagined before going into this.

If anyone followed any of this I would really like to know what they took away from it.

At the moment I don't have a summary other that to say the differences in philosophies are more stark than I could have ever imagined before going into this.

If anyone followed any of this I would really like to know what they took away from it.

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #72

All that effort and I did not learn a dang thing. Well, maybe not nothing. The one piece of information I would really like to have but I can't find anywhere is who are the Republicans on the 113th House Budget Committee. Both the Republican and the House Budget Committee web pages have Republican members TBD, basically. The Wiki page also has the Democrats but not the Republicans listed. I did find that Rep. Price has been chosen as the House Budget Committee Vice President. That is good news and bad news.

First the bad news. In the Markup hearing Price (R) 6th Georgia: stated that the PP cuts deficit by $500B first year, saves $5T over ten years. I would say he is definitely aware the PP is draconian cuts and he supports as much. He also personally spoke against three of the amendments presented. First was against overly aggressive cuts to Medicare.

Castor presented an amendment to keep the preventative benefits from the Affordable Care Act. The PP would immediately affect millions of seniors. Price argued strongly against keeping the Affordable Care Act in place.

There were another amendment Price spoke against. He also voted against every single amendment he was present for except the one unanimously adopted agreeing parents should pay child support.

Schultz's amendment: THAT SENIOR CITIZENS WILL NOT LOSE VITAL MEDICAID ASSISTANCE TO COVER THE COST OF THEIR NURSING HOME CARE or their home and community based services. Also insures that low income seniors who are eligible for Medicaid get help paying their premiums and their out of pocket costs. PP jeopardizes health security for 5 million seniors, 10 million individuals with disabilities, and 28 million children. "By cutting $810 from Medicaid funding and converting the program into block grants this rations by straining state budgets and leading many states to end the care they provide."

Hollen: "In a budget that has lots of harmful things in it the Medicaid provisions in it are among the worst and the most harmful." CBO projects that by the tenth year over $800B is cut out of Medicaid, that is one third the Medicaid budget. CBO said cuts would be 75%. "To put it in a document and call it 'repairing the social safety net is, I have to say, positively Orwellian."

Price: States are required by law to waste money. In George there are 1.8M Medicaid recipients. By and large two thirds of those individuals are healthy moms and kids. They have to have a 'soup-to-nuts' healthcare plan as opposed to paying for every incident of care they receive out of the pocketbooks of the state and we would save money and have money left over to pay for those most in need of care. Right now however that is illegal, it is against federal law to do that.

I said there was good news and so there is. Price might be leaving the House.

Rep. Tom Price ramps up fundraising ahead of possible Senate run in Georgia - The Hill's Ballot Box

By Cameron Joseph - 02/01/13 12:52 PM ET

Rep. Tom Price (R-Ga.) is ramping up his fundraising activity ahead of a possible campaign for the Senate seat being vacated by Sen. Saxby Chambliss (R-Ga.). He has raised $250,000 in the last few days alone, according to a fundraising email obtained by The Hill.

First the bad news. In the Markup hearing Price (R) 6th Georgia: stated that the PP cuts deficit by $500B first year, saves $5T over ten years. I would say he is definitely aware the PP is draconian cuts and he supports as much. He also personally spoke against three of the amendments presented. First was against overly aggressive cuts to Medicare.

Castor presented an amendment to keep the preventative benefits from the Affordable Care Act. The PP would immediately affect millions of seniors. Price argued strongly against keeping the Affordable Care Act in place.

There were another amendment Price spoke against. He also voted against every single amendment he was present for except the one unanimously adopted agreeing parents should pay child support.

Schultz's amendment: THAT SENIOR CITIZENS WILL NOT LOSE VITAL MEDICAID ASSISTANCE TO COVER THE COST OF THEIR NURSING HOME CARE or their home and community based services. Also insures that low income seniors who are eligible for Medicaid get help paying their premiums and their out of pocket costs. PP jeopardizes health security for 5 million seniors, 10 million individuals with disabilities, and 28 million children. "By cutting $810 from Medicaid funding and converting the program into block grants this rations by straining state budgets and leading many states to end the care they provide."

Hollen: "In a budget that has lots of harmful things in it the Medicaid provisions in it are among the worst and the most harmful." CBO projects that by the tenth year over $800B is cut out of Medicaid, that is one third the Medicaid budget. CBO said cuts would be 75%. "To put it in a document and call it 'repairing the social safety net is, I have to say, positively Orwellian."

Price: States are required by law to waste money. In George there are 1.8M Medicaid recipients. By and large two thirds of those individuals are healthy moms and kids. They have to have a 'soup-to-nuts' healthcare plan as opposed to paying for every incident of care they receive out of the pocketbooks of the state and we would save money and have money left over to pay for those most in need of care. Right now however that is illegal, it is against federal law to do that.

I said there was good news and so there is. Price might be leaving the House.

Rep. Tom Price ramps up fundraising ahead of possible Senate run in Georgia - The Hill's Ballot Box

By Cameron Joseph - 02/01/13 12:52 PM ET

Rep. Tom Price (R-Ga.) is ramping up his fundraising activity ahead of a possible campaign for the Senate seat being vacated by Sen. Saxby Chambliss (R-Ga.). He has raised $250,000 in the last few days alone, according to a fundraising email obtained by The Hill.

Kimura

VIP Member

Deficit spending is absolutely critical for economic growth. The US debt is simply just an expression of accrued budget deficits in the past. Basically, all it means is that the US has spent 16 trillion more than its collected in taxes over the course of 234 years.

In real terms, budget deficits add financial assets to the private sector, thus creating the demand for goods and services that have increased the wealth of the country and the end result is increased incomes. This very growth in incomes has allowed people to save and accrue net financial assets at a far greater pace than would have been possible without deficits.

Don't get me wrong, I'm not saying the US can spend endlessly, that's not the idea. The only risk involved in deficits is inflation, not insolvency. However, inflation is a risk with any type of overspending, whether it be financial investments, government spending, consumption or even exports. Basically, any one part of aggregate demand could create inflation, not just government spending.

In closing, here's what would constitute fiscal responsibility: government spending and taxation at a level that supports full employment.

In real terms, budget deficits add financial assets to the private sector, thus creating the demand for goods and services that have increased the wealth of the country and the end result is increased incomes. This very growth in incomes has allowed people to save and accrue net financial assets at a far greater pace than would have been possible without deficits.

Don't get me wrong, I'm not saying the US can spend endlessly, that's not the idea. The only risk involved in deficits is inflation, not insolvency. However, inflation is a risk with any type of overspending, whether it be financial investments, government spending, consumption or even exports. Basically, any one part of aggregate demand could create inflation, not just government spending.

In closing, here's what would constitute fiscal responsibility: government spending and taxation at a level that supports full employment.

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #74

You thought that the that series of posts from the 2013 Budget Markup would never end. Well you were right!

I am playing with the tools the C-SPAN video library has. One can clip out pieces of video and then post link to them. Unfortunately I can't splice clips together. I am hoping I can get proficient at this stuff so I can save time as my classes start tomorrow.

So many people were so shocked that Mittens said 47% are takes and how he was captured by the super secret flower pot cam. On the floor and in the committees Republicans say this stuff all the time. Sometimes they make LGS look rational.

This is the first one I am going to throw out. It is 7 minutes. I will try to keep them shorter. This does not have CC which can be useful. It does, as all do, have a list of automatically generated tags to jump around the video which is very useful. It is in HD.

OpeningStatementsDem - C-SPAN Video Library

I am playing with the tools the C-SPAN video library has. One can clip out pieces of video and then post link to them. Unfortunately I can't splice clips together. I am hoping I can get proficient at this stuff so I can save time as my classes start tomorrow.

So many people were so shocked that Mittens said 47% are takes and how he was captured by the super secret flower pot cam. On the floor and in the committees Republicans say this stuff all the time. Sometimes they make LGS look rational.

This is the first one I am going to throw out. It is 7 minutes. I will try to keep them shorter. This does not have CC which can be useful. It does, as all do, have a list of automatically generated tags to jump around the video which is very useful. It is in HD.

OpeningStatementsDem - C-SPAN Video Library

emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

- Thread starter

- #75

Watching videos is so much more fun than reading so I have made some fun videos with the C-SPAN tools for everyone to partake of. The last one listed the is the complete segment. The others are clips most relevant to conversation.

I used the transportation segment but there are hours and hours of the same type of back and forth. I will find a few of the best ones for everyone.

27 seconds which says it all.

sumsitup - C-SPAN Video Library

A more complete summing up.

1:00

Longsumitup - C-SPAN Video Library

There is another option available.

1:00

anotheroption - C-SPAN Video Library

Source of $4 billion dollars over the next 10 years

35 sec

publiclands - C-SPAN Video Library

Complete transportation segment.

13:25

CompleteTrans - C-SPAN Video Library

I used the transportation segment but there are hours and hours of the same type of back and forth. I will find a few of the best ones for everyone.

27 seconds which says it all.

sumsitup - C-SPAN Video Library

A more complete summing up.

1:00

Longsumitup - C-SPAN Video Library

There is another option available.

1:00

anotheroption - C-SPAN Video Library

Source of $4 billion dollars over the next 10 years

35 sec

publiclands - C-SPAN Video Library

Complete transportation segment.

13:25

CompleteTrans - C-SPAN Video Library

Similar threads

- Replies

- 62

- Views

- 744

- Replies

- 165

- Views

- 2K

- Replies

- 69

- Views

- 609

- Replies

- 3

- Views

- 120

- Replies

- 207

- Views

- 2K

Latest Discussions

- Replies

- 18

- Views

- 127

- Replies

- 44

- Views

- 187

- Replies

- 23

- Views

- 585

- Replies

- 0

- Views

- 2

- Replies

- 36

- Views

- 170

Forum List

-

-

-

-

-

Political Satire 7995

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 465

-

-

-

-

-

-

-

-

-

-