Wiseacre

Retired USAF Chief

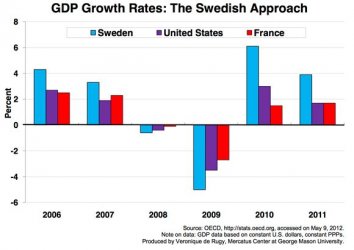

Lots of talk about the European countries moving away from austerity and instead stressing economic growth and more jobs. Well hooray for that, but raising taxes and spending more money growing the public sector ain't going to further those ends. I believe most of the austerity measures thus far have been much more along the lines of tax increases anyway, with not much in the way of spending cuts. Which is mostly limiting the amount of additional spending in the future rather than actually spending less money.

So, a french guy has to retire at 62 instead of 60? Geez, life's a bitch. Don't get a 35 hour work week and 8 weeks of paid vacation? What inhumanity. Some call that austerity, but I call it reality. I call it living within your means. Don't know what they're going to do over there in Europe, or what we'll do here for states like California. We still got some road left to kick the proverbial can down. But I'm not seeing much change in attitudes, just more spending and more debt. But sooner or later reality will hit, and hit hard.

So, a french guy has to retire at 62 instead of 60? Geez, life's a bitch. Don't get a 35 hour work week and 8 weeks of paid vacation? What inhumanity. Some call that austerity, but I call it reality. I call it living within your means. Don't know what they're going to do over there in Europe, or what we'll do here for states like California. We still got some road left to kick the proverbial can down. But I'm not seeing much change in attitudes, just more spending and more debt. But sooner or later reality will hit, and hit hard.