1srelluc

Diamond Member

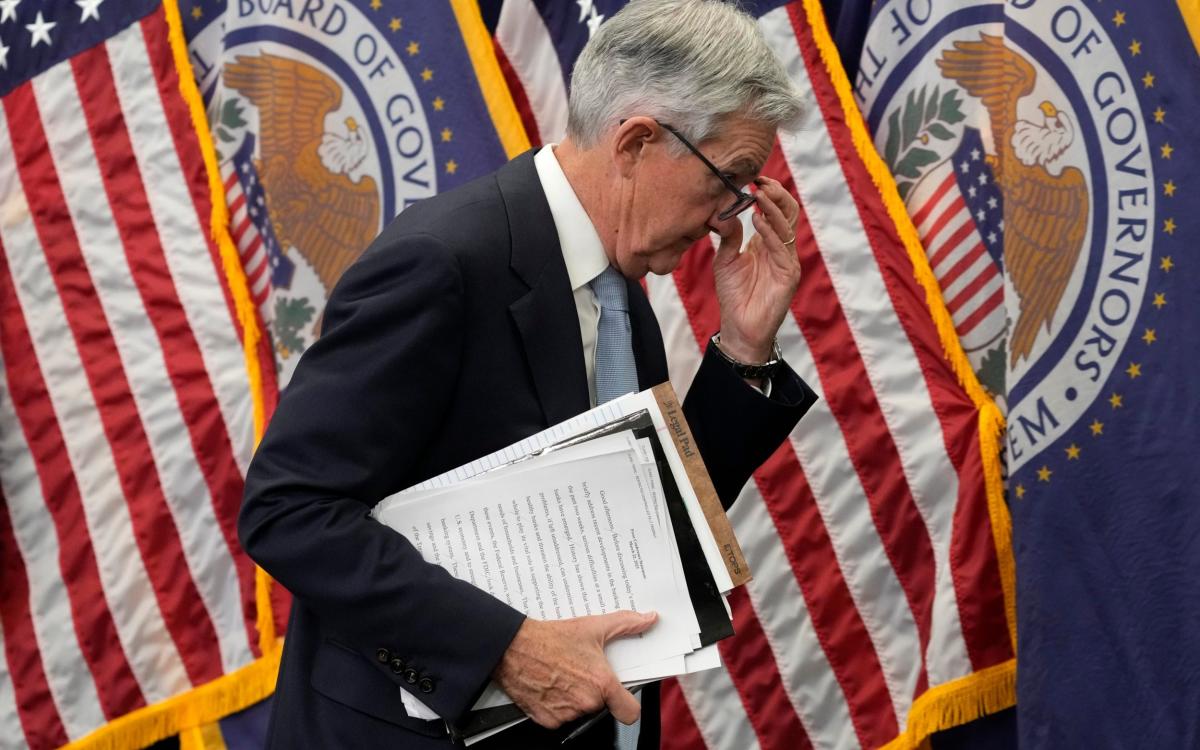

Half of America’s banks are potentially insolvent – this is how a credit crunch begins

The twin crashes in US commercial real estate and the US bond market have collided with $9 trillion uninsured deposits in the American banking system. Such deposits can vanish in an afternoon in the cyber age.

The second and third biggest bank failures in US history have followed in quick succession. The US Treasury and Federal Reserve would like us to believe that they are “idiosyncratic”. That is a dangerous evasion.

Almost half of America’s 4,800 banks are already burning through their capital buffers. They may not have to mark all losses to market under US accounting rules but that does not make them solvent. Somebody will take those losses.

“It’s spooky. Thousands of banks are underwater,” said Professor Amit Seru, a banking expert at Stanford University. “Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.”

The full shock of monetary tightening by the Fed has yet to hit. A great edifice of debt faces a refinancing cliff-edge over the next six quarters. Only then will we learn whether the US financial system can safely deflate the excess leverage induced by extreme monetary stimulus during the pandemic.

Blah.....That's just a side effect of “the best economy ever”.....Am I right?

All those cheap 2-3% loans are going to kill a lot of banks now that rates have doubled or tripled.

I'd like to think, even though it is entirely pie in the sky, that the fed is going to hold rates or even drop them to try and stabilize banks and get money flowing again.

That said with the jobs report today I'm not really seeing that happening.

I think we are just fucked.