Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

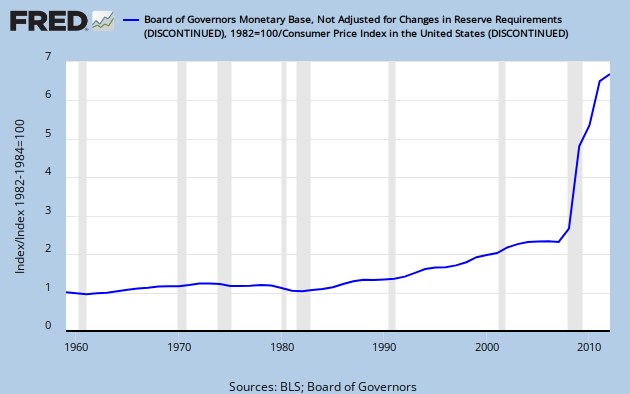

MV = PQ = GDP [$/time]

V = GDP / M [1/time]

= "spending [$/time] per dollar [$]" ("total spending per unit currency")

easy credit (low interest-rates) incentivizes borrowing "new Money", over (re-)spending existing Money. So, low Velocity "slow" money suggests ready access, to easy credit, i.e. well-developed financial institutions (banking system):V = GDP / M [1/time]

= "spending [$/time] per dollar [$]" ("total spending per unit currency")

"Velocity [V] is a useful indicator, of the relative size, of the financial sector, in countries lacking sophisticated capital markets -- particularly when the broad definition of money, M2, is used. The lower the Velocity, the higher the ratio of Money [M] to Gross Domestic Product (GDP), and hence, ceteris paribus, the larger the supply of domestic credit, and the relative size of the financial system" (Fry. The Afghan Economy, p.268).

"slow" Money suggests that borrowing new credit has become a first resort, as if currency was "used once, then abandoned". Cp. Say's Law, i.e. people produce Quantities (Q) so as to receive others' spendings as their own income (PQ), so as to spend themselves ("same dollar spent & re-spent", high-V "fast" Money); but, with easy credit, production ("hard work") may dwindle before borrowing ("easy credit") ("one dollar borrowed to spend, another to spend again", low-V "slow" Money).If "Money" is distinct from "credit"; then "Demand for [keeping existing] Money" (inversely proportional to V) is distinct from "Demand for [borrowing more] credit" (proportional to interest-rates)...

Demand for Money = "propensity to hoard circulating money" ("see it, stash it")

Demand for Credit = "propensity to dis-hoard de-circulated money" ("i'll pay you 30 points, man") and to borrow "new" credit-Money

Velocity is inversely proportional to the former (money stashed is not respect)

Interest-rates are proportional to the latter (points "pull" stashed Money "out of hiding")

M = Money-supply

MR = Money "hoarded" into Reserves

MC = Money circulating (MC + MR = M)

X = Demand for Money

r = Demand for Credit = interest rate

X MC = rate at which Money is hoarded [$/time]

r MR = rate at which Money is dis-hoarded [$/time]

X MC = r MR "in equilibrium"

with fractional Reserves (f), and Money-multiplier (1/f), r MR ---> (1/f) r MR once re-circulated bills become Reserves, and "multiply" into new loans

Last edited: