I agree- Nothing goes up for ever.

-Geaux

By: David Chapman | Thu, Nov 28, 2013

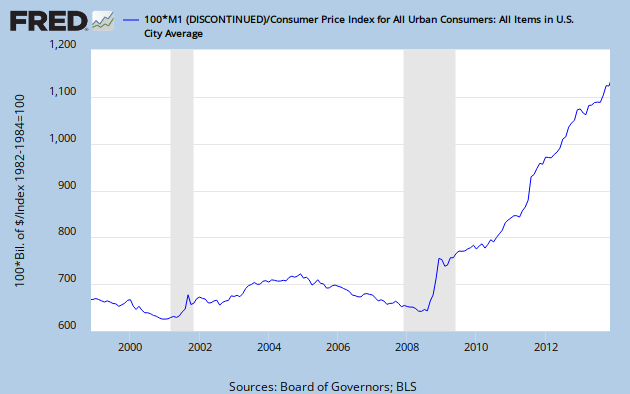

What is one to make of a balance sheet that has exploded from roughly $870 billion in 2007 to almost $4 trillion today. That is the balance sheet of the US Federal Reserve Board as the financial crisis of 2008 saw one of the largest bailouts in financial history followed by three rounds of quantitative easing (QE) plus Operation Twist whereby the Fed exchanged short dated Treasury maturities for longer dated Treasury maturities. It was with QE3 that the Fed began to purchase $40 billion a month of agency mortgage backed securities (MBS) every month greatly adding to its holdings of MBS.

Below is a timeline of QE since 2008 imposed on a chart of the Dow Jones Industrials (DJI). It makes for an interesting read.

The Fed's Exploding Balance Sheet! | David Chapman | Safehaven.com

-Geaux

By: David Chapman | Thu, Nov 28, 2013

What is one to make of a balance sheet that has exploded from roughly $870 billion in 2007 to almost $4 trillion today. That is the balance sheet of the US Federal Reserve Board as the financial crisis of 2008 saw one of the largest bailouts in financial history followed by three rounds of quantitative easing (QE) plus Operation Twist whereby the Fed exchanged short dated Treasury maturities for longer dated Treasury maturities. It was with QE3 that the Fed began to purchase $40 billion a month of agency mortgage backed securities (MBS) every month greatly adding to its holdings of MBS.

Below is a timeline of QE since 2008 imposed on a chart of the Dow Jones Industrials (DJI). It makes for an interesting read.

The Fed's Exploding Balance Sheet! | David Chapman | Safehaven.com