Widdekind

Member

- Mar 26, 2012

- 813

- 35

- 16

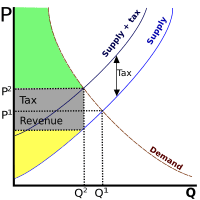

Government Force "should" protect-and-serve markets, guarding economies against thievery (e.g. via en-Force-ing contracts). Ergo, every economic market-place transaction "should" be guarded by Government, and "should" be sales-Taxed to cover costs ("paying the security guards"). If Government were economically neutral, then Government would apply a single flat-rate sales-Tax (e.g. 10%), on every dollar spent, in the market-place, on every commodity bought-and-sold (e.g. income, the "sale" of Labor).

However, business profits are "what's left over after the trading-day is done"; business profits do not reflect economic trans-activity, but the after-effects of the same. Ergo, Taxes on business profits are not "paying the guards in the market-place"; are "paying the guards back at home whilst counting money". Ipso facto, Taxes on profits economically resemble "muggings", of merchants, "on their ways back home", after-hours.

if business pay Taxes on profits (Revenues - Expenses); then people should pay Taxes on their net-incomes ("how much you got in your account?"); if people recognize the latter as a Taxation-after-Taxes ("double jeopardy"), then they should recognize the former, as precisely the same ("Taxed for standing around with money in your wallet").

However, business profits are "what's left over after the trading-day is done"; business profits do not reflect economic trans-activity, but the after-effects of the same. Ergo, Taxes on business profits are not "paying the guards in the market-place"; are "paying the guards back at home whilst counting money". Ipso facto, Taxes on profits economically resemble "muggings", of merchants, "on their ways back home", after-hours.

if business pay Taxes on profits (Revenues - Expenses); then people should pay Taxes on their net-incomes ("how much you got in your account?"); if people recognize the latter as a Taxation-after-Taxes ("double jeopardy"), then they should recognize the former, as precisely the same ("Taxed for standing around with money in your wallet").