Wiseacre

Retired USAF Chief

In this thread I want to talk about these things; what has Europe done and how did it work, and what we should do with our own fiscal problems. Someone wanted to know how I got the idea that various European countries have raised taxes more than they cut spending, so let's start with that.

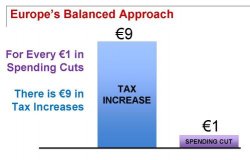

Below is a chart done by Veronique De Rugy from the Mercatus Center, but I found it at the Cato.org website. Note that taxes outpaced spending cuts by a factor of 9 euros to 1. And many of those spending cuts were really reductions in spending increases. The tax hikes were not just to the upper crust; middle incomes got hit too in some places, as well as higher VAT taxes that everyone pays and taxes on cigarettes, alcohol, fuel, and property taxes, and other things too.

European Politicians Share Obama

Here's the problem: this approach has not worked. The snippet below is looking at the question of which hurts an economy more, a tax increase or spending cuts.

Over at EconLog, George Mason University’s Garett Jones provides the answer: Tax increases. He looks at an IMF paper, often used by anti-spending cuts advocates to say that spending cuts hurt the economy, to show that actually fiscal adjustment based mostly on tax increases will hurt the economy the most. Here is Jones:

Quick summary of the method: The economists looked at 173 “fiscal consolidations” in rich countries, times when governments decided to reduce the long-run deficit. They then checked to see whether consolidations based mostly on tax hikes turned out better or worse than ones based on spending cuts (Inside baseball: They followed a version of the Romer and Romer event study methodology, but applied it to exogenous-looking fiscal tightening instead of exogenous-looking monetary tightening). . . .

Both GDP and consumer spending tell the same story: Spending cuts are the less painful path to fiscal rectitude. When countries tried to get right with the bond markets, this IMF study found that nations that mostly raised taxes suffered about twice as much as nations that mostly cut spending.

This is consistent with a new paper called “The Design of Fiscal Adjustments,” by Harvard economists Alberto Alesina and Silvia Ardagna. Building up on their previous work, they provide even more evidence that fiscal consolidations based mostly on the spending side result in smaller recessions, or none at all, when compared to tax-based adjustments. Additionally, they find that private investment tends to react more positively to spending-based adjustments. Thus, they argue that spending cuts are more sustainable and effective in reducing debt and raising economic growth; expansionary fiscal consolidation is possible.

Which Hurts More, Tax Increases or Spending Cuts? - By Veronique de Rugy - The Corner - National Review Online

Below is a chart done by Veronique De Rugy from the Mercatus Center, but I found it at the Cato.org website. Note that taxes outpaced spending cuts by a factor of 9 euros to 1. And many of those spending cuts were really reductions in spending increases. The tax hikes were not just to the upper crust; middle incomes got hit too in some places, as well as higher VAT taxes that everyone pays and taxes on cigarettes, alcohol, fuel, and property taxes, and other things too.

European Politicians Share Obama

Here's the problem: this approach has not worked. The snippet below is looking at the question of which hurts an economy more, a tax increase or spending cuts.

Over at EconLog, George Mason University’s Garett Jones provides the answer: Tax increases. He looks at an IMF paper, often used by anti-spending cuts advocates to say that spending cuts hurt the economy, to show that actually fiscal adjustment based mostly on tax increases will hurt the economy the most. Here is Jones:

Quick summary of the method: The economists looked at 173 “fiscal consolidations” in rich countries, times when governments decided to reduce the long-run deficit. They then checked to see whether consolidations based mostly on tax hikes turned out better or worse than ones based on spending cuts (Inside baseball: They followed a version of the Romer and Romer event study methodology, but applied it to exogenous-looking fiscal tightening instead of exogenous-looking monetary tightening). . . .

Both GDP and consumer spending tell the same story: Spending cuts are the less painful path to fiscal rectitude. When countries tried to get right with the bond markets, this IMF study found that nations that mostly raised taxes suffered about twice as much as nations that mostly cut spending.

This is consistent with a new paper called “The Design of Fiscal Adjustments,” by Harvard economists Alberto Alesina and Silvia Ardagna. Building up on their previous work, they provide even more evidence that fiscal consolidations based mostly on the spending side result in smaller recessions, or none at all, when compared to tax-based adjustments. Additionally, they find that private investment tends to react more positively to spending-based adjustments. Thus, they argue that spending cuts are more sustainable and effective in reducing debt and raising economic growth; expansionary fiscal consolidation is possible.

Which Hurts More, Tax Increases or Spending Cuts? - By Veronique de Rugy - The Corner - National Review Online

Attachments

Last edited: