- Apr 12, 2011

- 3,814

- 758

- 130

The rich pay lower tax rates than we do. Bush's tax cuts were only for the rich. Both the Reagan and Bush tax cuts were sops to the rich. Schmucks like you and me pay all the taxes so the rich can ride free.

You hear these lies every day.

In case you think I make these lies up, here are some examples.

"Changes in tax rates have strongly favored the very, very rich." -Paul Krugman

[snip]

"And that's why this plan eliminates tax loopholes that primarily go to the wealthiest taxpayers and biggest corporations -- tax breaks that small businesses and middle-class families don't get. And if tax reform doesn't get done, this plan asks the wealthiest Americans to go back to paying the same rates that they paid during the 1990s, before the Bush tax cuts." -President Obama

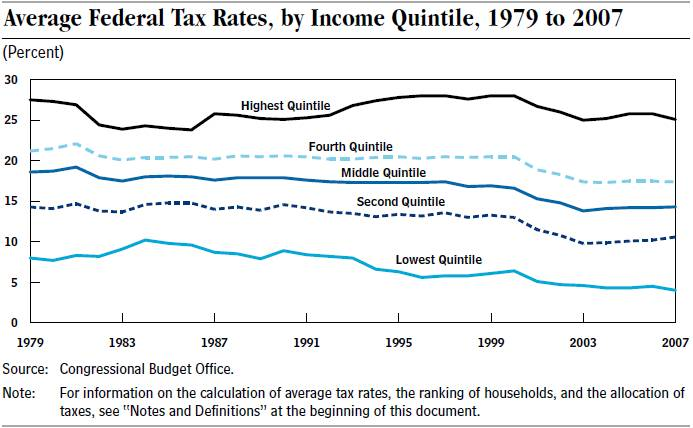

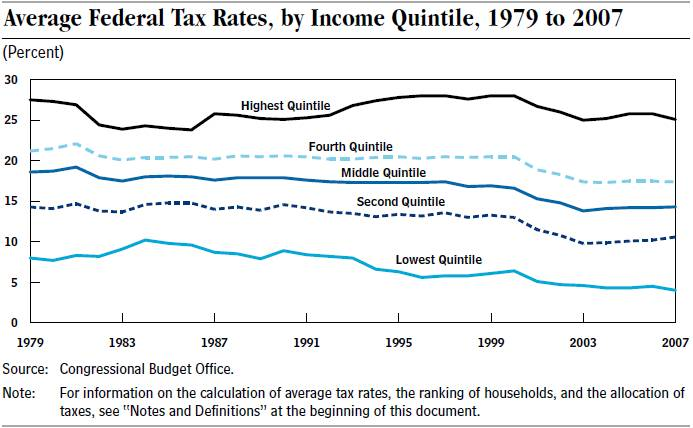

These lies are rebutted by a single graph produced by the Congressional Budget Office, below.

[snip]

* Reagan's tax cuts became fully effective in 1983. But look at the trend in average tax rate for the highest quintile of earners after that. It went up. That upward trend on the richest Americans went up for seventeen years after Reagan's tax cuts.

* The same cannot be said for the lower quintiles. Tax rates for the lower 80% of taxpayers remained virtually flat, or trended downward, from 1983 to 2000.

[snip]

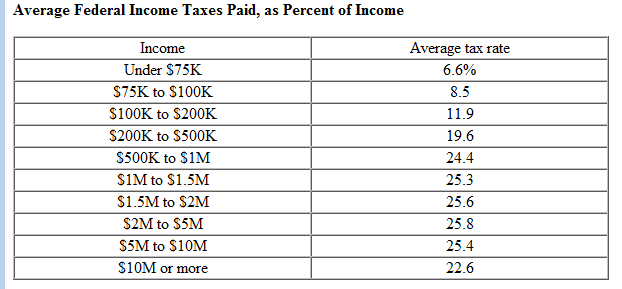

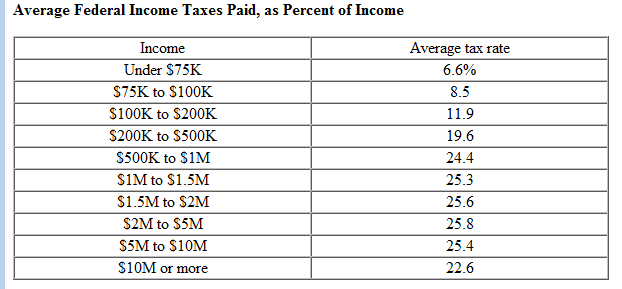

So let's look at that top quintile, shall we? The table below shows 2009 average federal income taxes as a percent of income (adjusted gross income less deficit) for the various income groups. The groups with incomes over $75,000 constitute the top quintile, approximately. (Data for the year 2009 is the latest available.)

The obvious observation from this data is that the rich pay higher taxes than the poor or middle-class. The rates are strictly progressive up to incomes of $5 M: each income group, up to $5M, paid a higher percentage of income in taxes than the next lower group.

[snip]

The full article is at The American Thinker including all the source links to quotes and data.

You hear these lies every day.

In case you think I make these lies up, here are some examples.

"Changes in tax rates have strongly favored the very, very rich." -Paul Krugman

[snip]

"And that's why this plan eliminates tax loopholes that primarily go to the wealthiest taxpayers and biggest corporations -- tax breaks that small businesses and middle-class families don't get. And if tax reform doesn't get done, this plan asks the wealthiest Americans to go back to paying the same rates that they paid during the 1990s, before the Bush tax cuts." -President Obama

These lies are rebutted by a single graph produced by the Congressional Budget Office, below.

[snip]

* Reagan's tax cuts became fully effective in 1983. But look at the trend in average tax rate for the highest quintile of earners after that. It went up. That upward trend on the richest Americans went up for seventeen years after Reagan's tax cuts.

* The same cannot be said for the lower quintiles. Tax rates for the lower 80% of taxpayers remained virtually flat, or trended downward, from 1983 to 2000.

[snip]

So let's look at that top quintile, shall we? The table below shows 2009 average federal income taxes as a percent of income (adjusted gross income less deficit) for the various income groups. The groups with incomes over $75,000 constitute the top quintile, approximately. (Data for the year 2009 is the latest available.)

The obvious observation from this data is that the rich pay higher taxes than the poor or middle-class. The rates are strictly progressive up to incomes of $5 M: each income group, up to $5M, paid a higher percentage of income in taxes than the next lower group.

[snip]

The full article is at The American Thinker including all the source links to quotes and data.