If the median is $51K, that means it's the 50th percentile.

NO IT FUCKING DOESN'T. All it means is that of all wages together, the median is $51K. But when you enter that median wage into a percentile of wages, you find that $51K is in the 63rd percentile. So that means there are more workers making under $51K than at or above it. The reason it's $51K is because of incomes at the top, skewing the median upward.

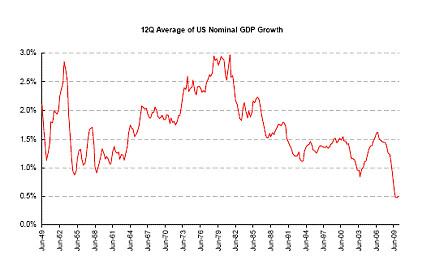

Fucking moron...wow. No wonder GDP growth was so terrible last quarter.

Seriously, did you even bother to figure this out for yourself? You can very easily see where $51K/yr falls in income percentiles. The fact that you don't do that means you're either too lazy or too ignorant to know better.

All it means is that of all wages together, the median is $51K.

Go back to your link. Type in 37990

Making $37,990.00 annually was percentile 50% in 2016.

This percentile ranged from $37,848.00 to $38,000.00 a year

So that means there are more workers making under $51K than at or above it.

Yes, wages at the 63rd percentile means 63% make less.

Wages at the 50th percentile, or median, is where half make more, half make less.

If you weren't a retard, you'd know that.

The reason it's $51K is because of incomes at the top, skewing the median upward.

Nope. Moron.

More income at the top skews the mean, or average, upward.

How many math classes did you fail before you just gave up?

Did you actually pass any math classes in high school?

Putin wants to know.