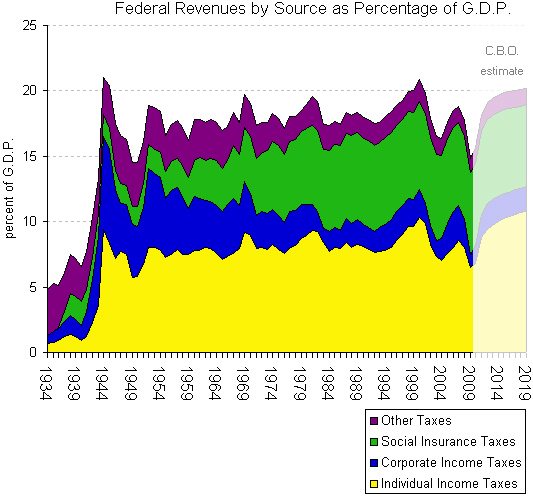

If corporations are Constitutionally the same as people, and the Supreme Court said they are, why shouldn't they pay income tax like we do? They used to and our economy boomed.

It wouldn't be that difficult to reverse the Reagan Revolution, which saw the majority of the tax burden shift from corporations to individuals...IF we first get rid of the corporate stoogies in Congress.

http://www.nytimes.com/2013/04/15/o...?nl=todaysheadlines&emc=edit_th_20130415&_r=0

It wouldn't be that difficult to reverse the Reagan Revolution, which saw the majority of the tax burden shift from corporations to individuals...IF we first get rid of the corporate stoogies in Congress.

http://www.nytimes.com/2013/04/15/o...?nl=todaysheadlines&emc=edit_th_20130415&_r=0