Dad2three

Gold Member

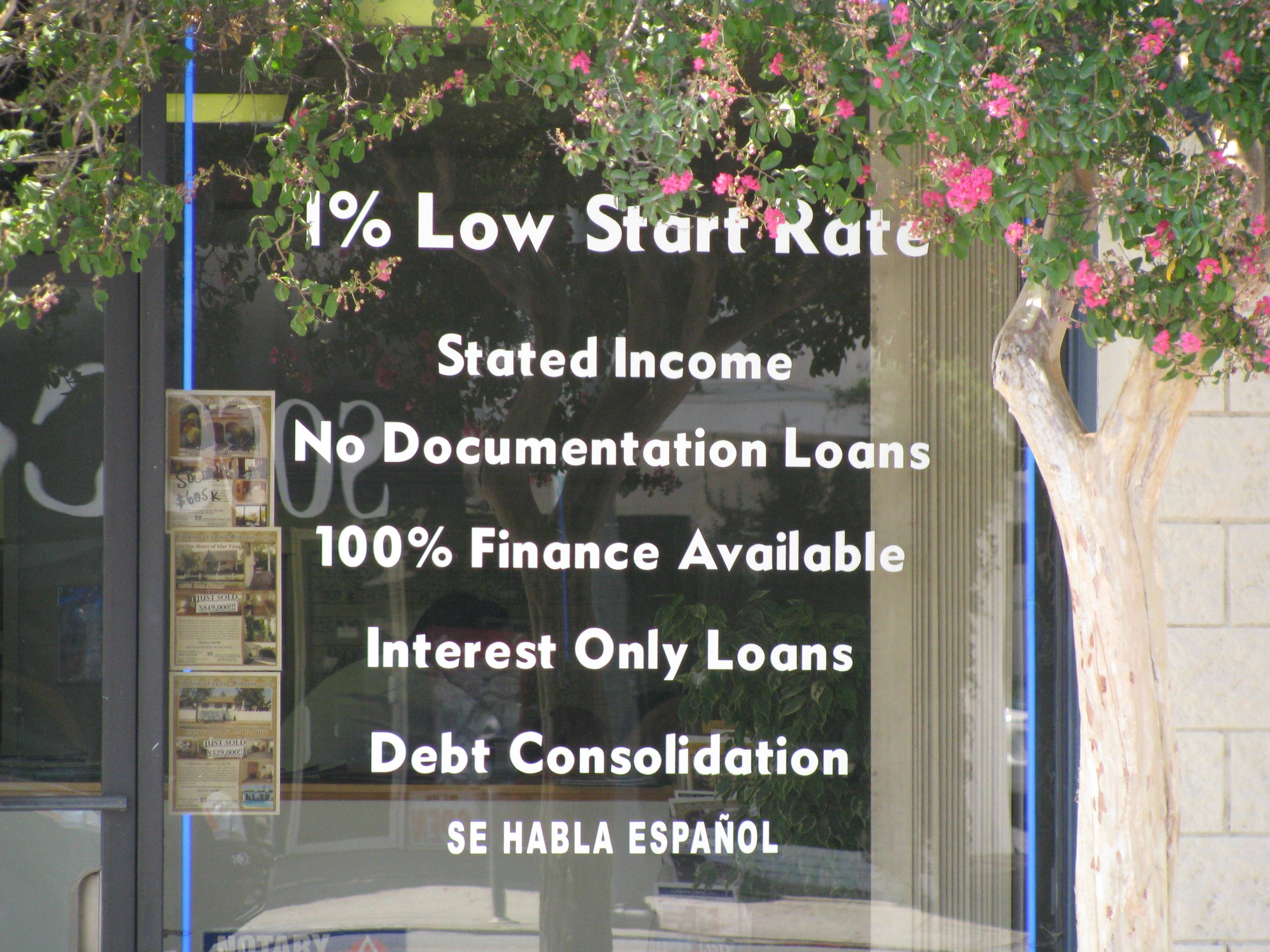

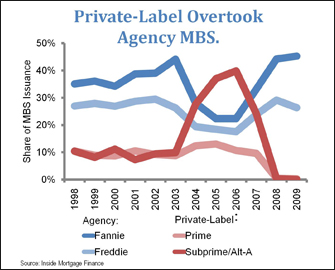

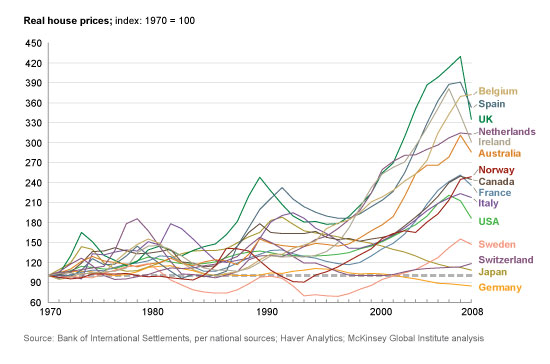

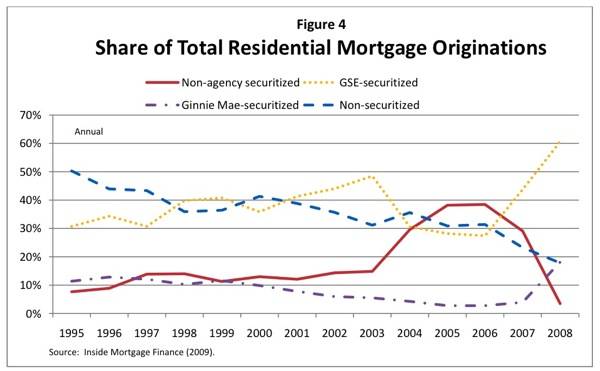

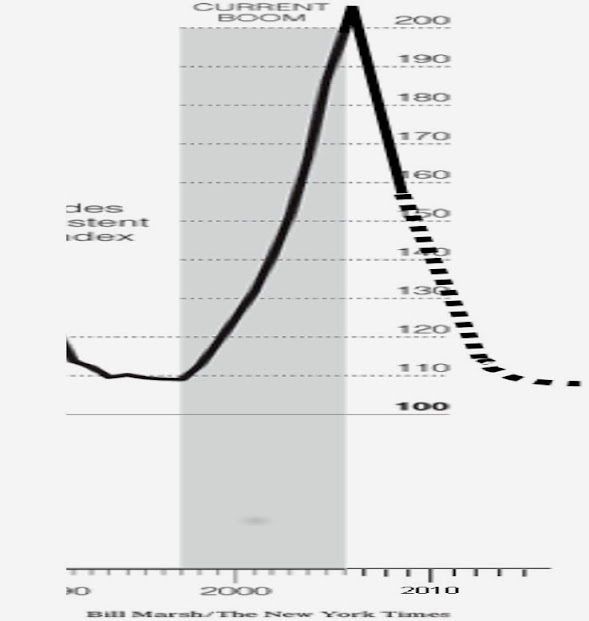

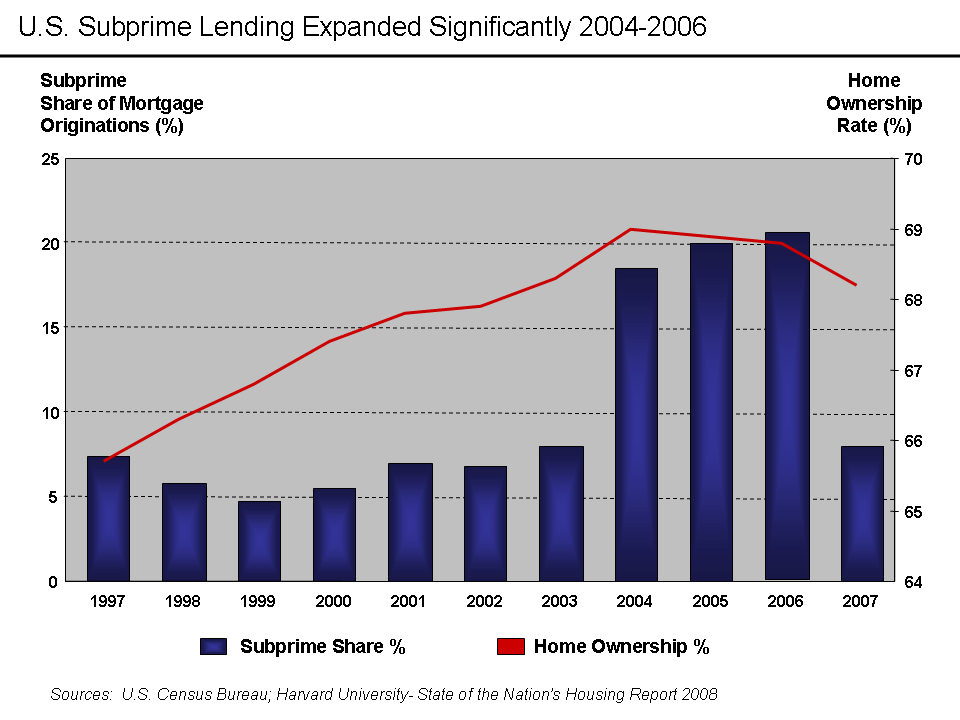

The biggest culprits in the housing fiasco came from the private sector, and more specifically from a mortgage industry that was out of control. These included lenders who originated home loans, investment bankers who packaged them into securities, rating agencies that misjudged these securities, and global investors who bought them without much, if any, study.

In other words, America’s mortgage securitization machine was fundamentally broken. It created millions of mortgage loans that, even under reasonable economic assumptions, stood little chance of being repaid — and were not.

Also to blame, of course, were regulators, who gave the private mortgage market little, if any, oversight. The market’s watchdogs were lulled to sleep by a misplaced view that self-interested private financial institutions would regulate themselves.

By Mark Zandi, GOPer and McCain adviser 2008

Fannie and Freddie don’t deserve blame for bubble

Fannie and Freddie don?t deserve blame for bubble - The Washington Post

In other words, America’s mortgage securitization machine was fundamentally broken. It created millions of mortgage loans that, even under reasonable economic assumptions, stood little chance of being repaid — and were not.

Also to blame, of course, were regulators, who gave the private mortgage market little, if any, oversight. The market’s watchdogs were lulled to sleep by a misplaced view that self-interested private financial institutions would regulate themselves.

By Mark Zandi, GOPer and McCain adviser 2008

Fannie and Freddie don’t deserve blame for bubble

Fannie and Freddie don?t deserve blame for bubble - The Washington Post