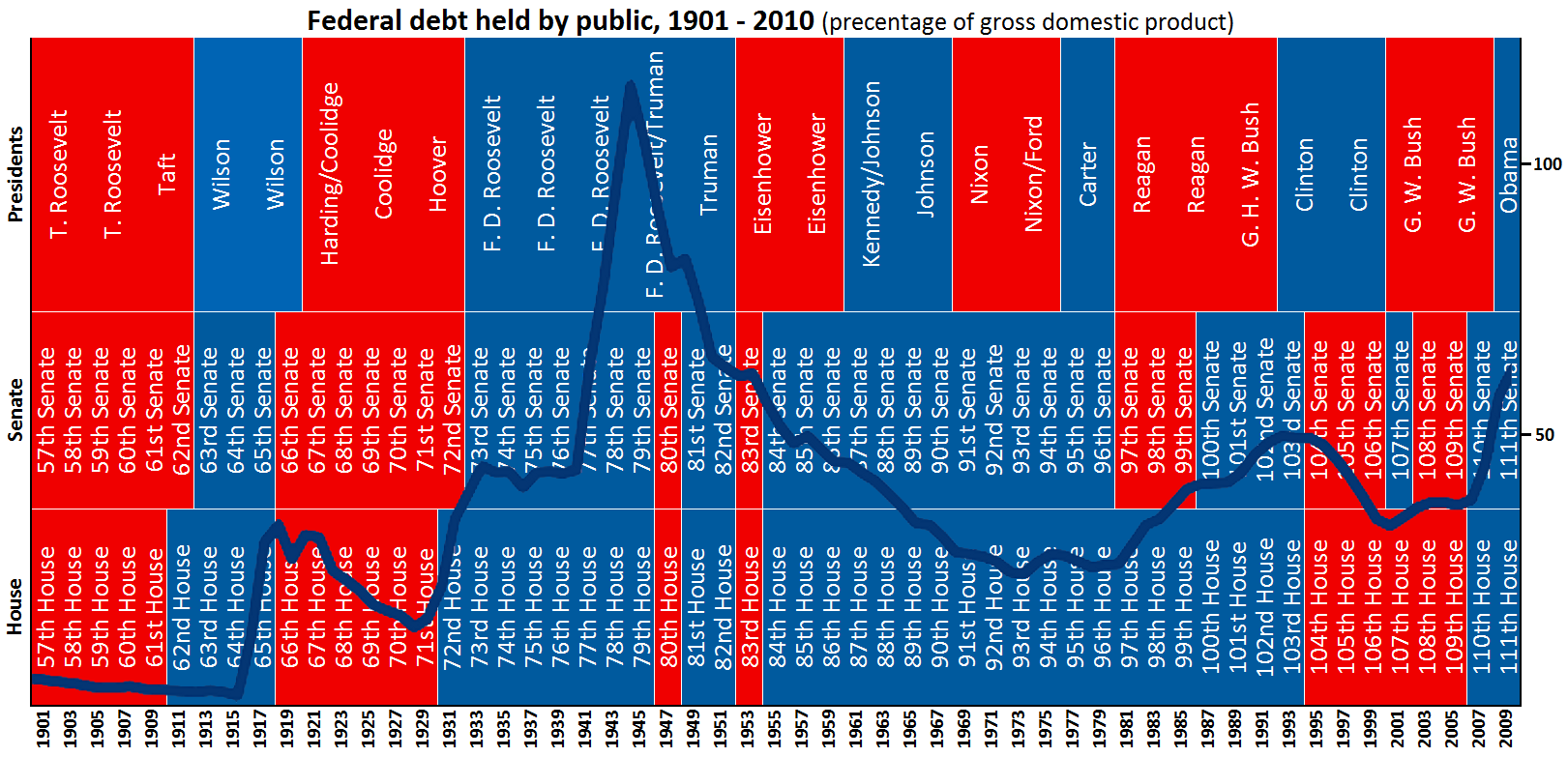

I'm amused by your contention that it was Republicans that are responsible for borrowing enormous amounts of money. Were the Democrats not THERE in Washington while this was going on? .

The U.S. Government has been in control of the democrats for 60+ years in part or whole since 1946

Progressives got thier asses back 100 years ago. 16th, 17th Amendments and the creation of the FED under Wilson...

The progressive disease has spread to the Republican party in certain sectors of it. It's why BOTH parties LOATHE the TEA Party (The people) asserting thier liberty.