JiggsCasey

VIP Member

- Jan 12, 2010

- 991

- 121

- 78

Energy & Capital is an energy investment newsletter that advises its subscribers on all manner of profitable plays, from hydro-fracking to solar and everything in between. All they care about is profit. ... I've called in most of my investments and I don't play the market, but I still get their newsletter every day. It's entirely non-partisan, and I enjoy it. Some 95% of their essays are nauseating profit margin hit-and-run ploys. "Get your money in now on SunVex at this price point before this happens... sell by Christmas! Cash in!" etc. ... But 6 or 7 times a year, one of their analysts goes off and offers an epic essay espousing the over-arching fate of the industry going forward. It happened again this week:

2013 Oil Price Forecast

Bad News: Oil is Going Higher

I understand, Brian. No one here talks about decline rates either when I mention them. Then they'd have to acknowledge basic arithmetic that mocks their unsupported claims.

Their "new discoveries!" links end up being mired in words like "should contain" and "estimated to hold" and "technically recoverable reserves" deep under the seabed or cooked within mountain ranges. Lawl.

Good ole' Energy & Capital. Sabotaging the narrative of the "no problem" camp with each passing day. And getting rich at the same time.

2013 Oil Price Forecast

Bad News: Oil is Going Higher

It's all about accessibility. The more accessible a resource is, the cheaper it is to get. The less accessible, the more it will cost... pretty straightforward, if you ask me.

So, what's happening today?

Gasoline prices across America are still close to historical highs — and in California (though it's the result of local events), prices are at all-time highs!

This hasn’t stopped a plethora of investment analysts to come out and declare the global oil crisis is solved by the miracle of fracking... but most of their analysis is amateur at best.

Make no mistake; horizontal and hydraulic fracking in the United States is a miracle. In fact, America is in a bona fide energy supply boom, an oil and gas renaissance.

And that was the core thesis of my 2008 book: that the high price of oil would spawn a drilling boom by innovative companies responding to price and the profit motive — in other words, the free market. (We've seen exactly that in the Bakken and Eagle Ford Shale oil formations.)

But in all of the analysis, I haven’t read one shred of data that talks about the decline rates of existing oil fields...

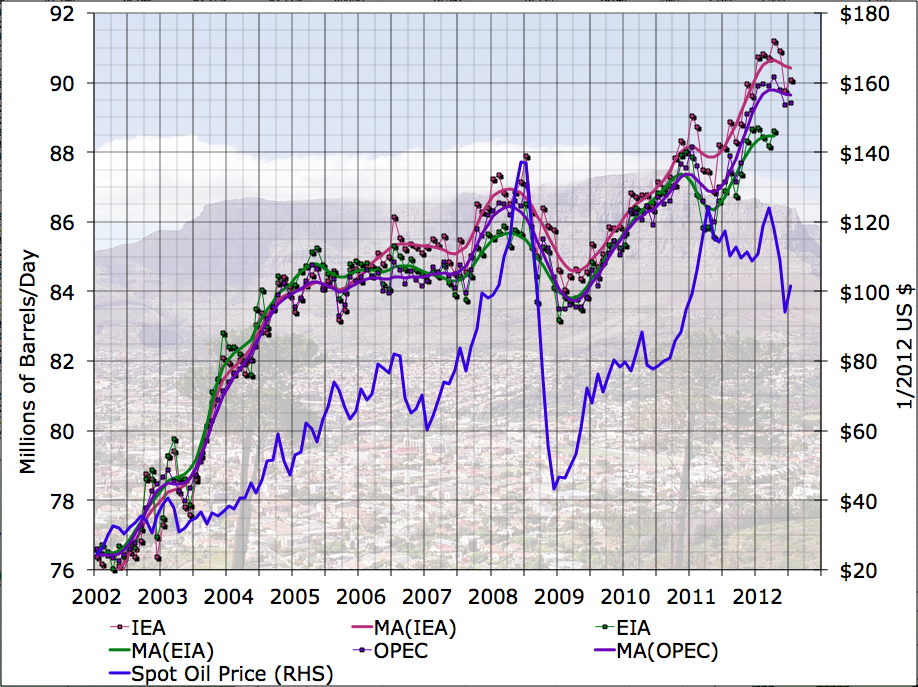

There’s no debate: The super giant oilfields are in decline.

We have covered this fact ad nauseam in Energy and Capital.

The 20 largest oil fields in the world account for roughly 25% of total global oil production. The majority of these giants are already in decline. And predictions point to Saudi — and much of Mideast — oil exports dropping to zero as their population growth surges.

In other words, the surge of domestic oil production in the U.S. is merely offsetting current decline rates of old production.

Here's why: ... (continued)

So, what's happening today?

Gasoline prices across America are still close to historical highs — and in California (though it's the result of local events), prices are at all-time highs!

This hasn’t stopped a plethora of investment analysts to come out and declare the global oil crisis is solved by the miracle of fracking... but most of their analysis is amateur at best.

Make no mistake; horizontal and hydraulic fracking in the United States is a miracle. In fact, America is in a bona fide energy supply boom, an oil and gas renaissance.

And that was the core thesis of my 2008 book: that the high price of oil would spawn a drilling boom by innovative companies responding to price and the profit motive — in other words, the free market. (We've seen exactly that in the Bakken and Eagle Ford Shale oil formations.)

But in all of the analysis, I haven’t read one shred of data that talks about the decline rates of existing oil fields...

There’s no debate: The super giant oilfields are in decline.

We have covered this fact ad nauseam in Energy and Capital.

The 20 largest oil fields in the world account for roughly 25% of total global oil production. The majority of these giants are already in decline. And predictions point to Saudi — and much of Mideast — oil exports dropping to zero as their population growth surges.

In other words, the surge of domestic oil production in the U.S. is merely offsetting current decline rates of old production.

Here's why: ... (continued)

I understand, Brian. No one here talks about decline rates either when I mention them. Then they'd have to acknowledge basic arithmetic that mocks their unsupported claims.

Their "new discoveries!" links end up being mired in words like "should contain" and "estimated to hold" and "technically recoverable reserves" deep under the seabed or cooked within mountain ranges. Lawl.

Good ole' Energy & Capital. Sabotaging the narrative of the "no problem" camp with each passing day. And getting rich at the same time.

Last edited: