I guess creation of ghost towns is not a great idea.

---

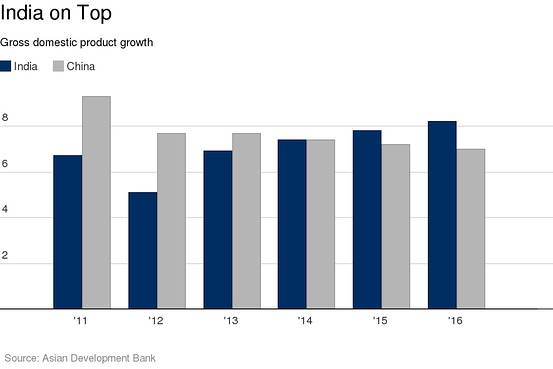

India to overtake China as world s fastest growing large economy - Jan. 21 2015

---

India to overtake China as world s fastest growing large economy - Jan. 21 2015