- May 12, 2022

- 7,964

- 6,384

- 1,938

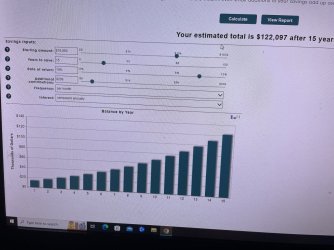

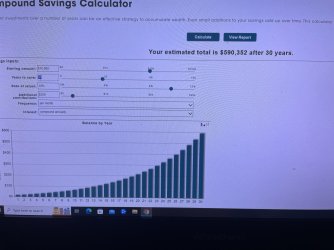

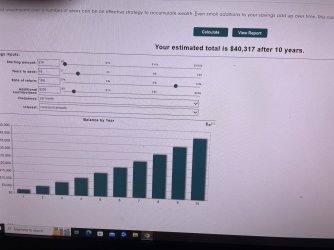

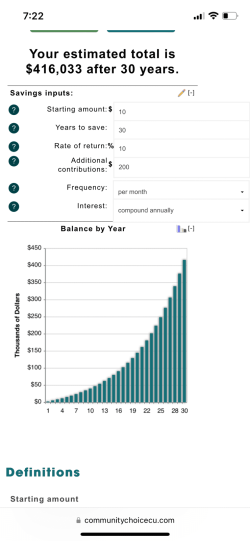

I was having some fun with this compound savings circulator. I’m in my mid 30s and I only wish I would’ve done this when I was 18. Take a look at these facts.

From January 1, 1970 to December 31st 2016, the average annual compounded rate of return for the S&P 500®, including reinvestment of dividends, was approximately 10.3% (source: www.standardandpoors.com).

Betting on the S&P 500 is betting on America. It’s the 500 best companies in the United States. I have to thank Tucker Carlson and Jordan Belfort for a segment They did talking about this.

They gave me an idea. Of course there’s no guarantees here there could be a cataclysmic event ie a world war three scenario that disrupts this opportunity ….but if that happens, I suppose we’re all screwed. If normalcy occurs, there is an expected return on investment in the top 500 companies in America. Frankly if America fails the western world and the rest of the world would fail anyway.

Anyway take a look at some of these numbersAnd take a look at further for even more long-term strategies. You don’t even have to put up 10 grand initially …. You can put up nothing initially but if you can invest $200 every month into the S&P 500 for 30 years you’re looking at a huge retirement fund down the road. Or something for your children or some kind of a community center perhaps after you pass on.

From January 1, 1970 to December 31st 2016, the average annual compounded rate of return for the S&P 500®, including reinvestment of dividends, was approximately 10.3% (source: www.standardandpoors.com).

Betting on the S&P 500 is betting on America. It’s the 500 best companies in the United States. I have to thank Tucker Carlson and Jordan Belfort for a segment They did talking about this.

They gave me an idea. Of course there’s no guarantees here there could be a cataclysmic event ie a world war three scenario that disrupts this opportunity ….but if that happens, I suppose we’re all screwed. If normalcy occurs, there is an expected return on investment in the top 500 companies in America. Frankly if America fails the western world and the rest of the world would fail anyway.

Anyway take a look at some of these numbersAnd take a look at further for even more long-term strategies. You don’t even have to put up 10 grand initially …. You can put up nothing initially but if you can invest $200 every month into the S&P 500 for 30 years you’re looking at a huge retirement fund down the road. Or something for your children or some kind of a community center perhaps after you pass on.

Attachments

Last edited: