JBeukema

Rookie

- Banned

- #1

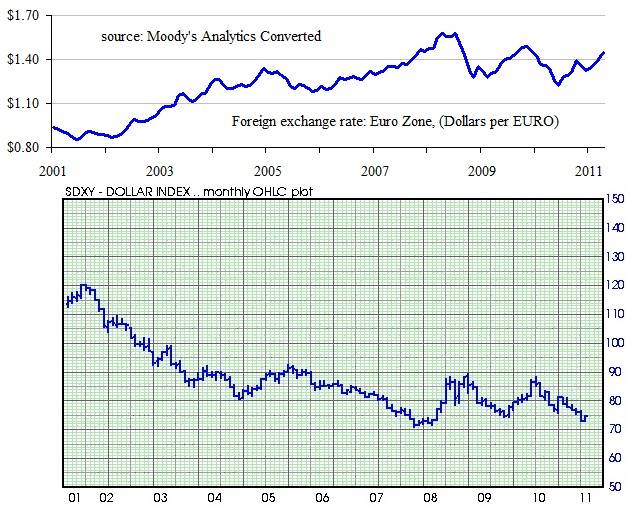

News Headlineser barrel oil. Cotton prices at record levels. Food prices at 2008 highs. Typically, such commodity price increases would send central banks running to the U.S. Dollar to secure the value of their savings. After all, the dollar has been the reserve currency since World War I. But not this time.

Central banks are shedding dollars, reducing their holdings by about $9 billion in previous quarter, according to Nomura Securities Jens Nordvig, global head of G10 FX Strategy.

What are they buying instead? Gold