Toro

Diamond Member

... is coming.

Or something close to it.

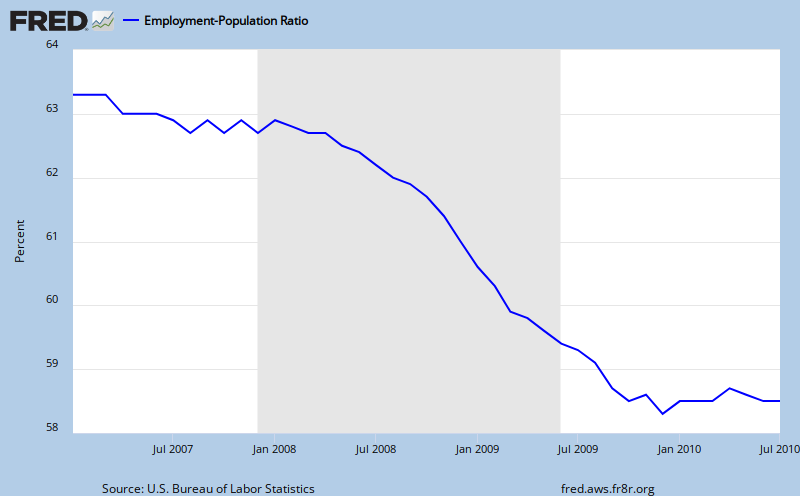

I think there is a fairly high chance that the economy with contract some time in the second half of the year. It may be happening now.

Or something close to it.

I think there is a fairly high chance that the economy with contract some time in the second half of the year. It may be happening now.