By Sahil Kapur

This week Republicans will attempt to move the national political conversation back to a familiar theme with a series of attacks on President Obama over the national debt. The GOP released a web video Monday bashing his broken promises on the deficit and previewed a major speech Tuesday by likely presidential nominee Mitt Romney on the issue.

Divorced from context, the numbers are uncomfortable for the President and are ready-made for pointed partisan attacks. Under Obamas watch the national debt has risen from roughly $10 trillion to $15 trillion, a record high. But to what extent are his decisions while in office to blame? The answer: very little. The vast bulk of the debt is the result of policies enacted during the Bush administration coupled with automatic increases in federal spending and decreases in tax revenue triggered by the economic downturn.

Those are economic facts of life known to experts but that often gets lost in the political debate (and which Obamas opponents are willing to obscure). So with the GOPs push to return the deficit to the center of the political conversation, heres quick reminder of the basic facts that you may have forgotten.

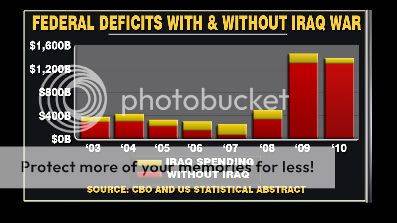

As the chart below reveals, the main drivers of projected deficits over the next decade are the wars of the oughts in Iraq and Afghanistan, the Bush tax cuts and the so-called automatic stabilizers unemployment insurance spending, lower tax burdens built into existing policy to combat economic downturns. Recovery measures by Bush and Obama caused a short-term spike in deficits but have mostly phased out and thus represent only modest fractions of the national debt.

The numbers, which come from the liberal-leaning Center on Budget and Policy Priorities, assume national policy as of a year ago would be renewed. Thus, they dont reflect expected peace dividends from the Iraq and Afghanistan wars, or revised economic growth projections, and it assumes the Bush tax cuts will be renewed in their entirety something President Obama has vowed will not happen, after he accepted a two-year extension of all the rates late 2010. But they broadly demonstrate that existing debt and projected deficits arent largely a consequence of Obama initiatives.

Since just after Obamas victory, and with greater fervor since reclaiming the House, Republicans have used deficits and debt (the aggregate of accumulating deficits) as cudgels to attack spending on social programs. But their calls for fiscal responsibility mask an agenda, enshrined in a number of GOP budget measures, thats aimed at slashing spending on programs for the poor and elderly, increasing defense spending, and cutting taxes on the rich a platform that would dramatically alter the scope and size of government services, but reduce deficits and debt slowly. Obamas budget proposal is projected to yield lower deficits over the next decade than the GOP alternative.

After agreeing to significant cuts in domestic spending in several legislative deals last year, President Obama and Democrats have insisted that further efforts to improve the nations fiscal outlook include new revenues. The GOP has balked at this demand, and as a result, Congress has gridlocked and isnt expected to resolve any significant tax and spending issues until after the November election.

Chart by TPMs Clayton Ashley

How Bush-Fueled Deficits Continue To Haunt Obama (CHART) | TPMDC