- Sep 19, 2011

- 28,472

- 10,047

- 900

There is a thread title: 'Healthcare should not be a PROFIT driven field " which triggered my title.

After all what is the source of almost all "non-profit" organizations?

Nonprofits can and do utilize the following sources of income to help them fulfill their missions:

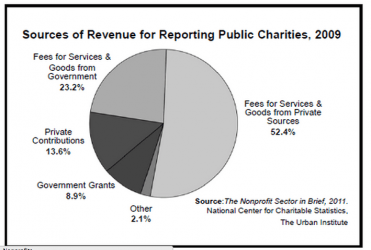

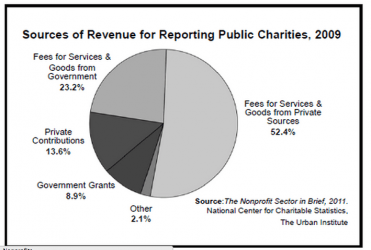

Sources of Revenue for Reporting Public Charities..

23.2% -- from Fees for goods and/or services from Government...

52.4% -- from Fees for goods and/or services from private sources

13.6% -- Corporate contributions/ Individual donations and major gifts Bequests

8.9% -- Foundation grants Government grants and contracts

2.1% -- Other

How are nonprofits funded

SO non-profits by definition make NO profits hence no taxes!

Right away non-profits are living off the fact that those evil profit making people/companies MAKE profits and then they pay taxes!

And then... after PAYING taxes 32.1% of payments from government collected TAX money goes for goods/services to non-profits and

government grants!

HOW will non-profits exist if most of the "for profits" are out of business?

After all Obama has stated clearly he'd prefer the 1,300 insurance companies go out of business that PAY $100 billion in taxes!

Where will the non-profits get money of billions of for profit companies TAX revenue goes away???

After all what is the source of almost all "non-profit" organizations?

Nonprofits can and do utilize the following sources of income to help them fulfill their missions:

Sources of Revenue for Reporting Public Charities..

23.2% -- from Fees for goods and/or services from Government...

52.4% -- from Fees for goods and/or services from private sources

13.6% -- Corporate contributions/ Individual donations and major gifts Bequests

8.9% -- Foundation grants Government grants and contracts

2.1% -- Other

How are nonprofits funded

SO non-profits by definition make NO profits hence no taxes!

Right away non-profits are living off the fact that those evil profit making people/companies MAKE profits and then they pay taxes!

And then... after PAYING taxes 32.1% of payments from government collected TAX money goes for goods/services to non-profits and

government grants!

HOW will non-profits exist if most of the "for profits" are out of business?

After all Obama has stated clearly he'd prefer the 1,300 insurance companies go out of business that PAY $100 billion in taxes!

Where will the non-profits get money of billions of for profit companies TAX revenue goes away???