Andylusion

Platinum Member

The left?If the left hadn't screwed the economy to begin with, we wouldn't be here.

Who exactly was the President of the United States of America from jan-2001 to jan-2009 ?

Who was holding office when the mortgage bubble busted?

A leftist you say ?

Have the balls to call the man by his name : if George W Bush hadn't screwed the economy to begin with, we wouldn't be here.

This is another example of why the politicians can do whatever they want, knowing their brainless lemming followers will mindlessly find someone else to blame.

You people....... gah....

It doesn't matter who was in office when the mortgage bubble burst. Anyone who understand the least amount of economics knows that.

Once a bubble is started.... it's going to pop. When it pops, doesn't matter. Once it starts, there is only one possible outcome... it's going to pop.

So the real question is.... when did the bubble start.

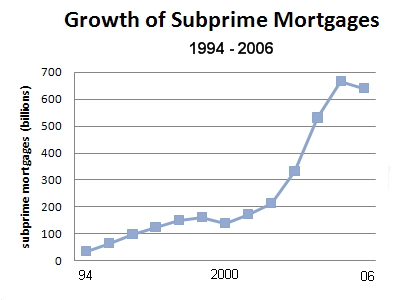

Now if you can read that, the housing bubble started in 1997.

Now what happened in 1997?

The government at all levels, had been pushing for more home ownership since the 1970s.

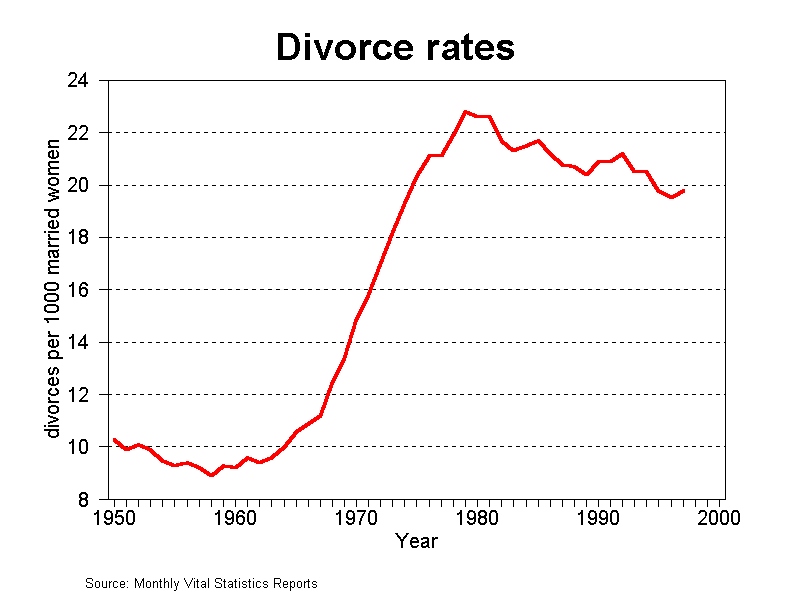

What happened in the 1970s? The cultural, sexual revolution happened, and suddenly divorce went through the roof.

Now tell me, what happens when you take one family which owns a home, and divorce them into poorer families, neither of which can own a home?

Answer... home ownership drops like a rock. As a result.... government thinking that they needed to fix falling home ownership, passed the CRA and other legislation to increase home ownership.

However, in the 70s and 80s, the CRA while on paper was supposed to push banks to invest in risky communities, in truth the act really didn't have any teeth.

That changed in the 90s, with groups using violations of the Community Reinvestment Act to sue banks.

Documents: Plaintiffs in 1995 Obama-led Citibank lawsuit submitted class action claims

In 1995, a lawsuit filed by Obama against Citibank, to make sub-prime loans.

In 1998, the Clinton Administration sued a bank in Texas, and required them to make sub-prime loans.

Andrew Cuomo proudly proclaiming the success of the lawsuit. And if you keep listening, he even admits... yes the default rates on these mortgages will be higher.

But that's only one side of the problem. The other side was incentives to make bad loans.

First Union Capital Markets Corp., Bear, Stearns & Co. Price Securities Offering Backed By Affordable Mortgages

This press release came out in 1997.

First Union Capital Markets Corp. and Bear, Stearns & Co. Inc. have priced a $384.6 million offering of securities backed by Community Reinvestment Act (CRA) loans - marking the industry's first public securitization of CRA loans.

Never before, had sub-prime loans been securitizied.

The $384.6 million in senior certificates are guaranteed by Freddie Mac and have an implied "AAA" rating. First Union Capital Markets Corp. is the investment banking subsidiary of First Union Corporation

Never before could you have Freddie Mac, arm of the government, guarantee a non-conforming loan, let alone give it a AAA rating.

So in 1997, sub-prime loans were forced by government lawsuits, and by action groups, and at the same time sub-prime loans were given AAA ratings and guaranteed by Freddie Mac.

This is what caused the crashed. This is where the bubble started. Government regulations and controls over the market, caused the whole deal.