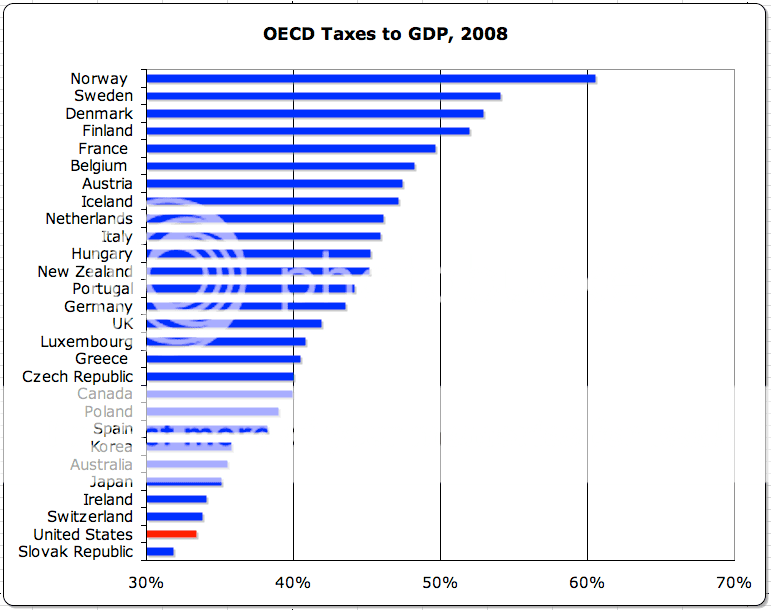

First we have the largest Corporate Tax in the World! Liberals, please recognize this drives business overseas. Now they want to add an energy tax on us! Smart move !

!

Do a quick Comparison to Israel, a tiny country that spends 16% of its GDP on defense and we should be outraged that we are being taxed so high!

NOTE: This has to deal nothing with Israel-Arab/Palestine Issue, this is comparing US to Israeli taxes, in which Americans to show that Americans are being taxed to dealth!

So Shogun if you want to talk about I/P problem go to a different thread, you have started millions of them!

Tax on interest: US 50% - Israel 20%

Capital Gains: US 50% - Israel 20%

Rent Income Tax: US 50% - Israel 10%

Inheritance Tax: US YES - Israel NO

Gift Tax: US YES - Israel NO

Corporate Tax: US 35% - Israel 26%

Income Tax: US 0-35% (Fed), - 0-10.5% (state)= 0-45.5% total - Israel 10-46%

Sales Tax: US 0-12% (in IL it gets up to 12% and Obama is talking about a federal sales tax) - Israel 8%

Payroll tax: US 15% - Israel 0%

Universial Health Care: US NO - Israel YES

The Israeli tax myth - Israel Opinion, Ynetnews

How can we be taxed more than them? Canada also beats us!

Tax on interest: US 50% - Canada 50%

Capital Gains: US 50% - Canada 50%

Inheritance Tax: US YES on beneficiary- Canada Yes but only to the estate!

Gift Tax: US YES - Canada NO

Corporate Tax: US 35% - Canada 29%

Income Tax: US 0-35% (Fed), - 0-10.5% (state)= 0-45.5% total - Canada 29%

Sales Tax: US 0-12% (in IL it gets up to 12% and Obama is talking about a federal sales tax) - Canada 5-12%

Payroll tax: US 15% - Canada 4.95%

Universial Health Care: US NO - Canada YES

Compare Property taxes, gas taxes, now the energy tax and we are getting killed!

Personal note on property taxes. My parents have a $500K home in IL they $11,000 a year in taxes on it. They also have a summer home worth $300K in Puerta Verta, Mexico and they pay $125 per year on it!

Americans are getting killed at all ends!

!

!Do a quick Comparison to Israel, a tiny country that spends 16% of its GDP on defense and we should be outraged that we are being taxed so high!

NOTE: This has to deal nothing with Israel-Arab/Palestine Issue, this is comparing US to Israeli taxes, in which Americans to show that Americans are being taxed to dealth!

So Shogun if you want to talk about I/P problem go to a different thread, you have started millions of them!

Tax on interest: US 50% - Israel 20%

Capital Gains: US 50% - Israel 20%

Rent Income Tax: US 50% - Israel 10%

Inheritance Tax: US YES - Israel NO

Gift Tax: US YES - Israel NO

Corporate Tax: US 35% - Israel 26%

Income Tax: US 0-35% (Fed), - 0-10.5% (state)= 0-45.5% total - Israel 10-46%

Sales Tax: US 0-12% (in IL it gets up to 12% and Obama is talking about a federal sales tax) - Israel 8%

Payroll tax: US 15% - Israel 0%

Universial Health Care: US NO - Israel YES

The Israeli tax myth - Israel Opinion, Ynetnews

46%, puts us at 13th spot among OECD states – which is about midway down the European rankings, below northern Europe, France, Holland, and many other countries.

Compared to the Americans, meanwhile, life here is great. The tax on interest in the US is 50%, while here it’s 20%. The tax on capital gains in the US is 50%, while in Israel it’s 20%. The rent income tax rate in America is 50%, while in Israel it’s 10%.

Moreover, as opposed to America, here in Israel we do not have an inheritance tax, we do not pay a gift tax, and we have no state tax. Also, let’s keep in mind that in the US there is no such thing as universal health insurance, a fact that eats up another considerable chunk of one’s income over there. Those poor Americans; how do they make ends meet?

How can we be taxed more than them? Canada also beats us!

Tax on interest: US 50% - Canada 50%

Capital Gains: US 50% - Canada 50%

Inheritance Tax: US YES on beneficiary- Canada Yes but only to the estate!

Gift Tax: US YES - Canada NO

Corporate Tax: US 35% - Canada 29%

Income Tax: US 0-35% (Fed), - 0-10.5% (state)= 0-45.5% total - Canada 29%

Sales Tax: US 0-12% (in IL it gets up to 12% and Obama is talking about a federal sales tax) - Canada 5-12%

Payroll tax: US 15% - Canada 4.95%

Universial Health Care: US NO - Canada YES

Compare Property taxes, gas taxes, now the energy tax and we are getting killed!

Personal note on property taxes. My parents have a $500K home in IL they $11,000 a year in taxes on it. They also have a summer home worth $300K in Puerta Verta, Mexico and they pay $125 per year on it!

Americans are getting killed at all ends!

Last edited: