- May 17, 2013

- 67,778

- 32,948

- 2,290

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

go back and read though the thread stupidThe "banking debacle" was directly correlated with GOVERNMENT INVOLVEMENT in HOUSING, specifically

GOVERNMENT INSURED MORTGAGES

to

Democrat voters who COULD NOT PAY

You seem to have a real good grasp of these financial issues and explain really well.Please see post 58.Barney Frank was the real villain. When democrats took over the House majority mid way into Bush's second term Barney Frank became the chairperson of the powerful "House Banking Committee" which had fiscal oversight responsibility for Fannie Mae. Frank told America that Fannie was doing fine and was solvent while it was in terrible shape and on the verge of collapse. The timing is suspicious. Either Frank was so negligent that he was unaware of what was going on or he deliberately pushed Fannie Mae over the edge as the biggest October surprise in history. When Fannie went under it brought the world economy down with it. Maybe it wasn't Frank's intention of causing a major world wide event but he started it. True to form the criminal conspiracy in the media blamed Bush and didn't even ask Frank what the hell he was doing.

The Federal Reserve Purposely caused The GREAT DEPRESSION so that they could take over all of the Privately Held Community Banks and their assets, including Farms, Homes, Tractors, Cows, Horses, Crops, Cars, Trucks, Gold, Silver, Washing Machines, and anything that wasn't nailed down. They then replaced Constitutional Precious Metal Backed Currency with Private Bank Notes which are not currency but are a Debt Instrument and a loan taken out using The American People's earning potential, and tax potential.Federal Reserve Policies Cause Booms and Busts | Richard M. Ebeling

"Interest rates, like market prices in general, cannot tell the truth about real supply and demand conditions when governments and their central banks prevent them from doing their job. All that government produces from its interventions, regulations, and manipulations is false signals and bad information. And all of us suffer from this abridgement of our right to freedom of speech to talk honestly to each other through the competitive communication of market prices and interest rates, without governments and central banks getting in the way."

Are you Republican?

No one forced the middle class to take out HELOCs and spend them on SUVs, boats, Disney vacations, hookers and blow.The Federal Reserve Purposely caused The GREAT DEPRESSION so that they could take over all of the Privately Held Community Banks and their assets, including Farms, Homes, Tractors, Cows, Horses, Crops, Cars, Trucks, Gold, Silver, Washing Machines, and anything that wasn't nailed down. They then replaced Constitutional Precious Metal Backed Currency with Private Bank Notes which are not currency but are a Debt Instrument and a loan taken out using The American People's earning potential, and tax potential.Federal Reserve Policies Cause Booms and Busts | Richard M. Ebeling

"Interest rates, like market prices in general, cannot tell the truth about real supply and demand conditions when governments and their central banks prevent them from doing their job. All that government produces from its interventions, regulations, and manipulations is false signals and bad information. And all of us suffer from this abridgement of our right to freedom of speech to talk honestly to each other through the competitive communication of market prices and interest rates, without governments and central banks getting in the way."

Are you Republican?

Thus was born the Credit Debt Economy and the beginning of the Economic Enslavement of The American People.

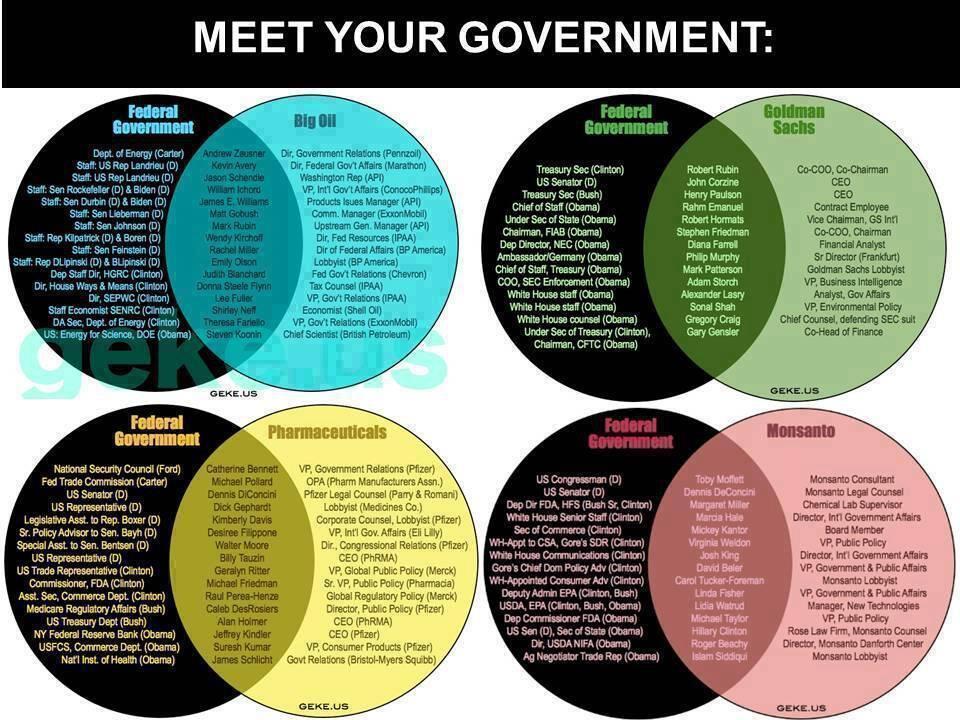

The Great American Bubble Machine – Rolling StoneGoldman-Sachs did to Greece what they and others did to US

How Goldman Sachs Profited From the Greek Debt Crisis

The Great American Bubble Machine – Rolling StoneGoldman-Sachs did to Greece what they and others did to US

How Goldman Sachs Profited From the Greek Debt Crisis

The formula is relatively simple: Goldman positions itself in the middle of a speculative bubble, selling investments they know are crap. Then they hoover up vast sums from the middle and lower floors of society with the aid of a crippled and corrupt state that allows it to rewrite the rules in exchange for the relative pennies the bank throws at political patronage

The basic idea isn’t hard to follow. You take a dollar and borrow nine against it; then you take that $10 fund and borrow $90; then you take your $100 fund and, so long as the public is still lending, borrow and invest $900. If the last fund in the line starts to lose value, you no longer have the money to pay back your investors, and everyone gets massacred.

The problem was, nobody told investors that the rules had changed. “Everyone on the inside knew,” the manager says. “Bob Rubin sure as hell knew what the underwriting standards were. They’d been intact since the 1930s.”

“Goldman, from what I witnessed, they were the worst perpetrator,” Maier said. “They totally fueled the bubble. And it’s specifically that kind of behavior that has caused the market crash.

In 2005, Goldman agreed to pay $40 million for its laddering violations — a puny penalty relative to the enormous profits it made

If you laddered and spun 50 Internet IPOs that went bust within a year, so what? By the time the Securities and Exchange Commission got around to fining your firm $110 million, the yacht you bought with your IPO bonuses was already six years old