hvactec

VIP Member

Tuesday, September 20th, 2011, 10:39 am

Roughly 10.4 million mortgages, or one in five outstanding home loans in the U.S., will likely default if Congress refuses to implement new policy changes to prevent and sell more foreclosures, according to analyst Laurie Goodman from Amherst Securities Group.

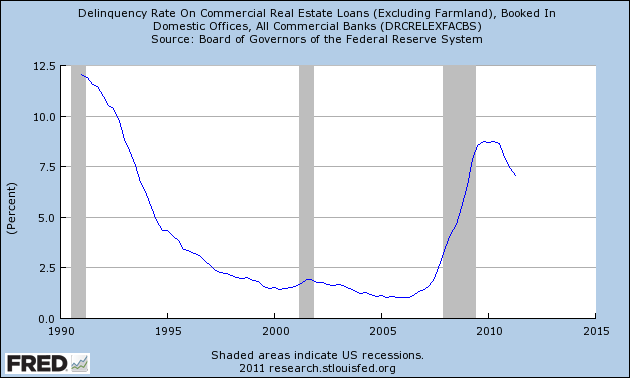

At the end of the second quarter, more than 2.7 million long-delinquent loans, others in foreclosure and REO properties sat in the shadow inventory, more than double what it was in the first quarter of 2010 (Click to expand the chart below). With the market averaging roughly 90,000 loan liquidations per month, it would take 32 months, nearly three years, to move through the overhang.

And that number is contingent on no other loans going into default.

Many analysts looking at the housing problem mistakenly assume it is limited to loans that are currently non-performing (or 60-plus days past due). Such borrowers have a high probability of eventually losing their homes. However, the problem also includes loans with a compromised pay history; these are re-defaulting at a rapid rate, Goodman told a Senate subcommittee Tuesday.

Under a reasonable estimate, which is calculated with more conservative market conditions than what is currently being experienced, Goodman found nearly 2 million re-performing mortgages would default again and another 3.6 million already troubled loans to default as well.

The rest of the 10.4 million estimate is made of always-performing loans at various stages of negative equity. Of the 2.5 million always-performing mortgages with loan-to-value ratios above 120%, nearly half will default. Even 5% of the always-performing mortgages that have some equity left will default, as well, Goodman said.

In August, the Obama administration asked the housing industry for ideas on how to more efficiently sell or unload this overhang, and the Senate heard testimony from various housing players Tuesday. Each, including Goodman, said the government should target private investors.

Robert Nielsen, chairman of the National Association of Homebuilders, said government programs should be revamped to assist small and local businesses in rehabbing and unloading these properties.

Nielsen said Fannie, Freddie and the FHA should avoid bulk sales to large investors that have no stake in the neighborhoods in which these properties are located.

Local and small businesses that have a stake in the future of the affected communities should be the driving force behind the disposition of the REO inventory. This will result in the creation of jobs and the stabilization of neighborhoods, Nielsen said.

NAHB also urged Congress to extend the current conforming loan limits for Fannie Mae, Freddie Mac and the FHA, which are due to be lowered on Oct. 1.

READ MORE 10 million more mortgages set to default, expert says « HousingWire « Heartfelt ! On…..

Roughly 10.4 million mortgages, or one in five outstanding home loans in the U.S., will likely default if Congress refuses to implement new policy changes to prevent and sell more foreclosures, according to analyst Laurie Goodman from Amherst Securities Group.

At the end of the second quarter, more than 2.7 million long-delinquent loans, others in foreclosure and REO properties sat in the shadow inventory, more than double what it was in the first quarter of 2010 (Click to expand the chart below). With the market averaging roughly 90,000 loan liquidations per month, it would take 32 months, nearly three years, to move through the overhang.

And that number is contingent on no other loans going into default.

Many analysts looking at the housing problem mistakenly assume it is limited to loans that are currently non-performing (or 60-plus days past due). Such borrowers have a high probability of eventually losing their homes. However, the problem also includes loans with a compromised pay history; these are re-defaulting at a rapid rate, Goodman told a Senate subcommittee Tuesday.

Under a reasonable estimate, which is calculated with more conservative market conditions than what is currently being experienced, Goodman found nearly 2 million re-performing mortgages would default again and another 3.6 million already troubled loans to default as well.

The rest of the 10.4 million estimate is made of always-performing loans at various stages of negative equity. Of the 2.5 million always-performing mortgages with loan-to-value ratios above 120%, nearly half will default. Even 5% of the always-performing mortgages that have some equity left will default, as well, Goodman said.

In August, the Obama administration asked the housing industry for ideas on how to more efficiently sell or unload this overhang, and the Senate heard testimony from various housing players Tuesday. Each, including Goodman, said the government should target private investors.

Robert Nielsen, chairman of the National Association of Homebuilders, said government programs should be revamped to assist small and local businesses in rehabbing and unloading these properties.

Nielsen said Fannie, Freddie and the FHA should avoid bulk sales to large investors that have no stake in the neighborhoods in which these properties are located.

Local and small businesses that have a stake in the future of the affected communities should be the driving force behind the disposition of the REO inventory. This will result in the creation of jobs and the stabilization of neighborhoods, Nielsen said.

NAHB also urged Congress to extend the current conforming loan limits for Fannie Mae, Freddie Mac and the FHA, which are due to be lowered on Oct. 1.

READ MORE 10 million more mortgages set to default, expert says « HousingWire « Heartfelt ! On…..