McRocket

Gold Member

- Apr 4, 2018

- 5,031

- 707

- 275

- Banned

- #1

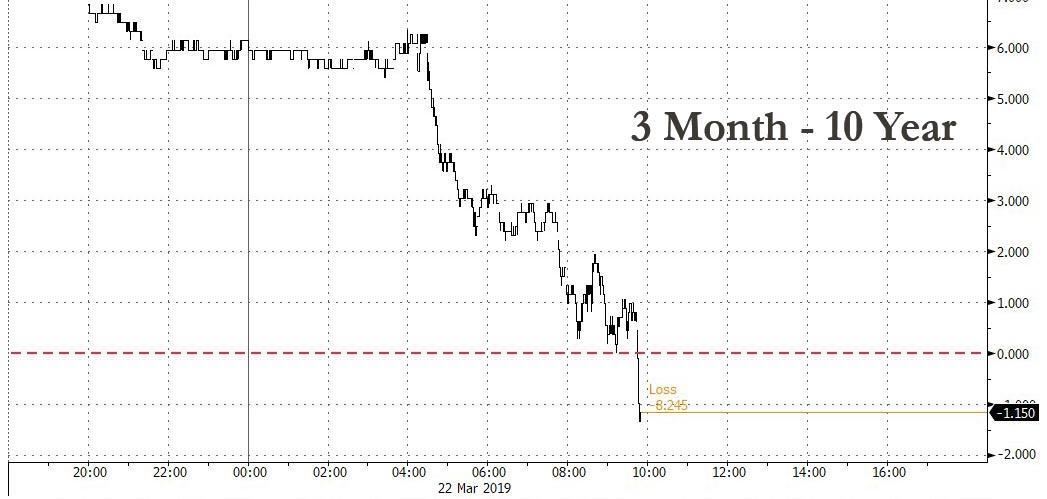

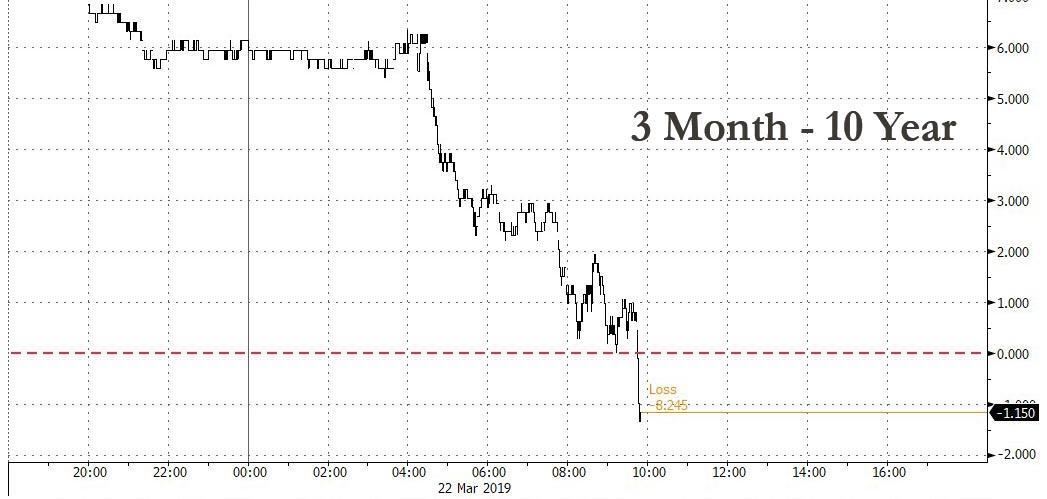

Update: The most prescient recession indicator the market just inverted for the first time since 2007.

Don't believe us? Here is Larry Kudlow last summer explaining that everyone freaking out about the 2s10s spread is silly, they focus on the 3-month to 10-year spread that has preceded every recession in the last 50 years (with few if any false positives)... (fwd to 4:20)

(...I don't know how to include the video - so here is the link to it...)

Yield Curve Inverts For The First Time Since 2007: Recession Countdown Begins

Not good.

Don't believe us? Here is Larry Kudlow last summer explaining that everyone freaking out about the 2s10s spread is silly, they focus on the 3-month to 10-year spread that has preceded every recession in the last 50 years (with few if any false positives)... (fwd to 4:20)

(...I don't know how to include the video - so here is the link to it...)

Yield Curve Inverts For The First Time Since 2007: Recession Countdown Begins

Not good.