Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why Tesla is flirting with 1000 on stock price

- Thread starter Old Rocks

- Start date

Persistence Of Memory

Diamond Member

- Oct 1, 2019

- 5,128

- 4,220

- 1,940

Tesla is far more than just vehicles;

Totally amazing for a company that never turned a profit and probably never will adding the losses.

I would scoop this stock up now. The business principles behind it are a winner. You should see my Enron stock profits too.

Old Rocks

Diamond Member

- Thread starter

- #3

Tesla is far more than just vehicles;

Totally amazing for a company that never turned a profit and probably never will adding the losses.

I would scoop this stock up now. The business principles behind it are a winner. You should see my Enron stock profits too.

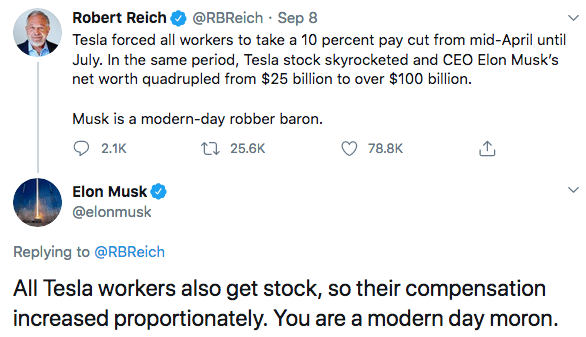

Such a dumb ass liar you are. Q2 of 2020 will likely be their fourth profitable quarter in a row;

Tesla is far more than just vehicles;

It's still risky though. The company has not yet turned a profit even once.

Further, the company is utterly dependent now, on government to even have a shot at turning a profit.

What we've seen throughout Europe is that eventually governments run out of other people's money to subsidize green energy, and when those subsidies fall, the entire green energy industry falls with it.

Especially right now, with the economy the way that it is, and the deficits, and the national debt....

All we need is one spike in the bond market... just one... and instantly the government will be forced to rethink the green energy grants, and the green energy tax deductions.

Because it's either that or cut entitlements, and we all know how that will end.

So those tax benefits for the green sector will vanish, and when they do, Tesla will be utterly screwed.

I mean the net income of Tesla was (-860 Million). Negative almost a billion dollars.

The only thing holding Tesla up, is the tax benefits that keep the products selling.

Now... Tesla could shape up, and turn a profit. I could happen for sure. But I think they need to get this done, before the tax advantages disappear, because if they are still in the negative, and then the market cracks when government lets those deductions and subsidies expire.... they will end up in bankruptcy very fast.

Persistence Of Memory

Diamond Member

- Oct 1, 2019

- 5,128

- 4,220

- 1,940

Tesla is far more than just vehicles;

Totally amazing for a company that never turned a profit and probably never will adding the losses.

I would scoop this stock up now. The business principles behind it are a winner. You should see my Enron stock profits too.

Such a dumb ass liar you are. Q2 of 2020 will likely be their fourth profitable quarter in a row;

Wow. I actually deleted a post. Lol

You rarely do what others can't, let me lose my temper. LOL...................Congrats on that, it is rare. Hope you did not see it.

Old Rocks

Diamond Member

- Thread starter

- #6

Fourth quarter profitable in a row for Tesla. And the stock at 1500, poised to go higher. Tesla's energy storage business may turn out to be as lucrative as it's auto's.

Tesla Inc. TSLA, 1.89% and PG&Electric Corp. PCG, 2.01% broke ground last week on a lithium-ion battery energy storage system at a PG&E electric substation in the central coast of California, the companies said in a statement that called the facility a "landmark." The system will be designed, constructed, and maintained by both companies, and owned and operated by PG&E, they said. Construction is expected to continue into early next year, with the goal of having it energized in early 2021 and fully operational in the second quarter of 2021. "Once operational, the Moss Landing substation system will be one of the largest utility-owned, lithium-ion battery energy storage systems in the world," the companies said. Stationary energy-storage systems help smooth out electric-grid peaks and valleys and make the grid more reliable. Shares of Tesla rose nearly 2% and shares of PG&E gained around 1% in midday trading Wednesday.

Tesla Inc. TSLA, 1.89% and PG&Electric Corp. PCG, 2.01% broke ground last week on a lithium-ion battery energy storage system at a PG&E electric substation in the central coast of California, the companies said in a statement that called the facility a "landmark." The system will be designed, constructed, and maintained by both companies, and owned and operated by PG&E, they said. Construction is expected to continue into early next year, with the goal of having it energized in early 2021 and fully operational in the second quarter of 2021. "Once operational, the Moss Landing substation system will be one of the largest utility-owned, lithium-ion battery energy storage systems in the world," the companies said. Stationary energy-storage systems help smooth out electric-grid peaks and valleys and make the grid more reliable. Shares of Tesla rose nearly 2% and shares of PG&E gained around 1% in midday trading Wednesday.

People here keep trtashing it, even though by stock market casino standards it's doing great. Just goes to show how much gamblers really care about sound business models or how few even know what one is. Once again, boys n girlz, the stock market is just a casino, and has zilch to do with the real economy, which is still in the toilet.

The real economy is currently in the grips of growth like none of us have seen. The NY Fed's nowcaste is a 15.63% annualized growth for the current quarter.People here keep trtashing it, even though by stock market casino standards it's doing great. Just goes to show how much gamblers really care about sound business models or how few even know what one is. Once again, boys n girlz, the stock market is just a casino, and has zilch to do with the real economy, which is still in the toilet.

The midline estimate in the Blue Chip Consensus is 24%

Either number is faster growth than anyone has seen. But then when we have a president like Trump, an amazing performance is what we expect!

The real economy is currently in the grips of growth like none of us have seen. The NY Fed's nowcaste is a 15.63% annualized growth for the current quarter.People here keep trtashing it, even though by stock market casino standards it's doing great. Just goes to show how much gamblers really care about sound business models or how few even know what one is. Once again, boys n girlz, the stock market is just a casino, and has zilch to do with the real economy, which is still in the toilet.

The midline estimate in the Blue Chip Consensus is 24%

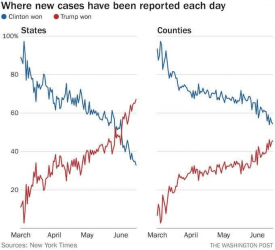

View attachment 390025

Either number is faster growth than anyone has seen. But then when we have a president like Trump, an amazing performance is what we expect!

So what? It's nearly concentrated in the financial sector, where it stays. It's in the toilet for 'everybody else', especially younger people. Just because a few gamblers guess right on some of their bets and do well isn't representative of the economy for over 90% of Americans. the stock market and Fed 'forecasts' mean nothing, especially for those who will nevre have saving to gamble with.

You think that GDP only matters to the stock market? GDP product directly relates to Gross Domestic Income. And forecasts are quite valuable if they are accurate. What is your forecast for the current quarter, let's see if yours is better than the Fed's or the Blue Chip consensus.... the stock market and Fed 'forecasts' mean nothing, especially for those who will nevre have saving to gamble with.The real economy is currently in the grips of growth like none of us have seen. The NY Fed's nowcaste is a 15.63% annualized growth for the current quarter.People here keep trtashing it, even though by stock market casino standards it's doing great. Just goes to show how much gamblers really care about sound business models or how few even know what one is. Once again, boys n girlz, the stock market is just a casino, and has zilch to do with the real economy, which is still in the toilet.

The midline estimate in the Blue Chip Consensus is 24%

View attachment 390025

Either number is faster growth than anyone has seen. But then when we have a president like Trump, an amazing performance is what we expect!

You think that GDP only matters to the stock market? GDP product directly relates to Gross Domestic Income. And forecasts are quite valuable if they are accurate. What is your forecast for the current quarter, let's see if yours is better than the Fed's or the Blue Chip consensus.... the stock market and Fed 'forecasts' mean nothing, especially for those who will nevre have saving to gamble with.The real economy is currently in the grips of growth like none of us have seen. The NY Fed's nowcaste is a 15.63% annualized growth for the current quarter.People here keep trtashing it, even though by stock market casino standards it's doing great. Just goes to show how much gamblers really care about sound business models or how few even know what one is. Once again, boys n girlz, the stock market is just a casino, and has zilch to do with the real economy, which is still in the toilet.

The midline estimate in the Blue Chip Consensus is 24%

View attachment 390025

Either number is faster growth than anyone has seen. But then when we have a president like Trump, an amazing performance is what we expect!

I said it only matters to afew people at the top, not most Americans, and I see no refutation of that. Most of those corporations' productivity and wealth is made overseas, and most of the new money is also from foreign investments inflating prices while the Fed continues to offer free money to companies to buy back theri own stocks and pay huge bonuses to execs, is all. Like I said, the GDP is highly concentrated in the financial sector, so no, it doesn't matter to most people except the stock market bubbles.

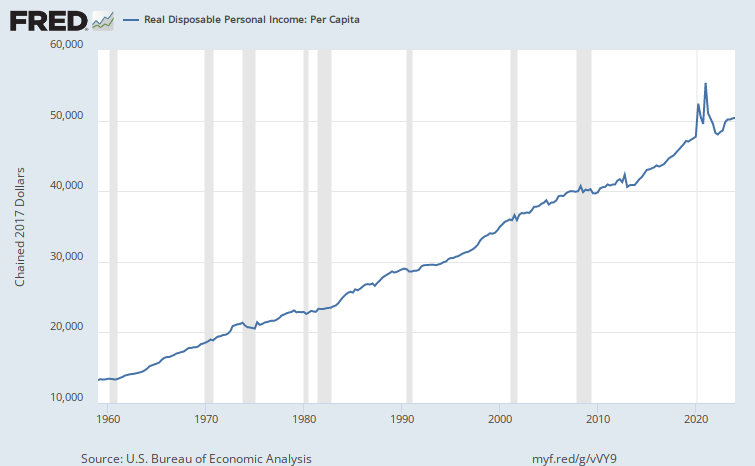

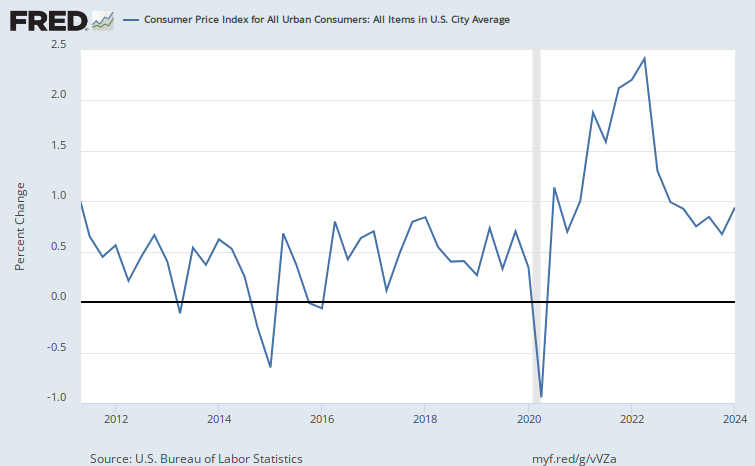

'15.63% annualized gorwth' in what??? Fast food service revenues? people getting cabin fever and buying more gas? Disposable incomes dropped and are still dropping, while inflation is rising, interest rates are zilch. The cost of shipping containers has more than doubled, though, so it is overseas production that is growing; it's back to school time, so more retail spending, and Christimas is coming up, more retail spending, mostly on credit, not genuine growth.

Fake News. The Fed is doing no such thing.You think that GDP only matters to the stock market? GDP product directly relates to Gross Domestic Income. And forecasts are quite valuable if they are accurate. What is your forecast for the current quarter, let's see if yours is better than the Fed's or the Blue Chip consensus.... the stock market and Fed 'forecasts' mean nothing, especially for those who will nevre have saving to gamble with.The real economy is currently in the grips of growth like none of us have seen. The NY Fed's nowcaste is a 15.63% annualized growth for the current quarter.People here keep trtashing it, even though by stock market casino standards it's doing great. Just goes to show how much gamblers really care about sound business models or how few even know what one is. Once again, boys n girlz, the stock market is just a casino, and has zilch to do with the real economy, which is still in the toilet.

The midline estimate in the Blue Chip Consensus is 24%

View attachment 390025

Either number is faster growth than anyone has seen. But then when we have a president like Trump, an amazing performance is what we expect!

I said it only matters to afew people at the top, not most Americans, and I see no refutation of that. Most of those corporations' productivity and wealth is made overseas, and most of the new money is also from foreign investments inflating prices while the Fed continues to offer free money to companies to buy back theri own stocks...

They are free to pay whatever bonuses they wish. They are private companies in a Free Market.... and pay huge bonuses to execs...

Fake News. That is the NY Fed's estimate for GDP. I don't know who told you that GDP only measures Fast food service, but it's actually a full measure of economic growth.... '15.63% annualized gorwth' in what??? Fast food service revenues?

Fake News. Disposable income has never been higher.... Disposable incomes dropped and are still dropping...

More Fake News. Inflation is falling, not rising.while inflation is rising

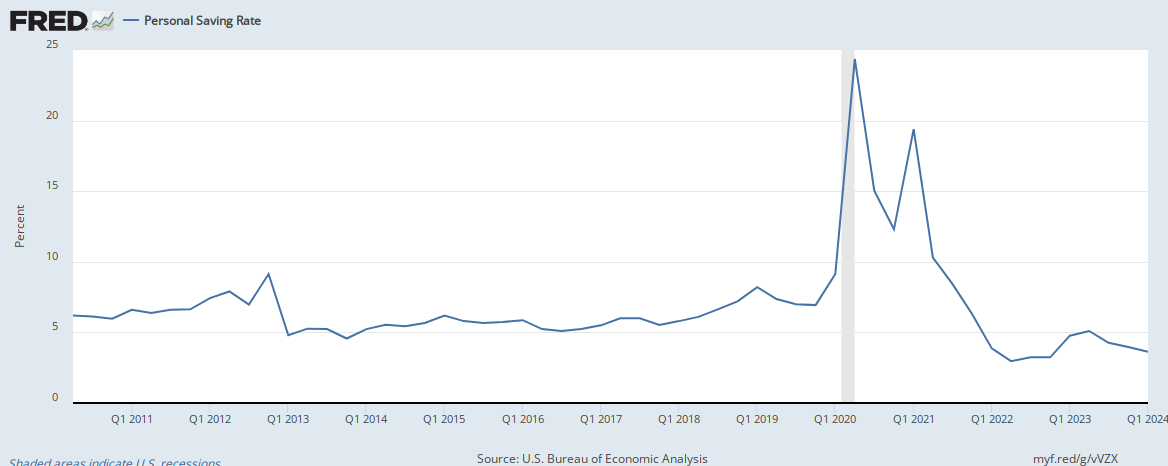

More Fake News. The personal savings rate has never been higher.... more retail spending, mostly on credit, not genuine growth.

You probably should quit listening to fake news and look this stuff up yourself. It's not that difficult to get accurate information.

Last edited:

Similar threads

- Replies

- 125

- Views

- 2K

- Replies

- 15

- Views

- 287

- Replies

- 16

- Views

- 406

- Replies

- 34

- Views

- 491

Latest Discussions

- Replies

- 0

- Views

- 1

- Replies

- 37

- Views

- 170

- Replies

- 18

- Views

- 127

Forum List

-

-

-

-

-

Political Satire 7995

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 465

-

-

-

-

-

-

-

-

-

-