Brain357

Platinum Member

- Mar 30, 2013

- 37,068

- 4,189

- 1,130

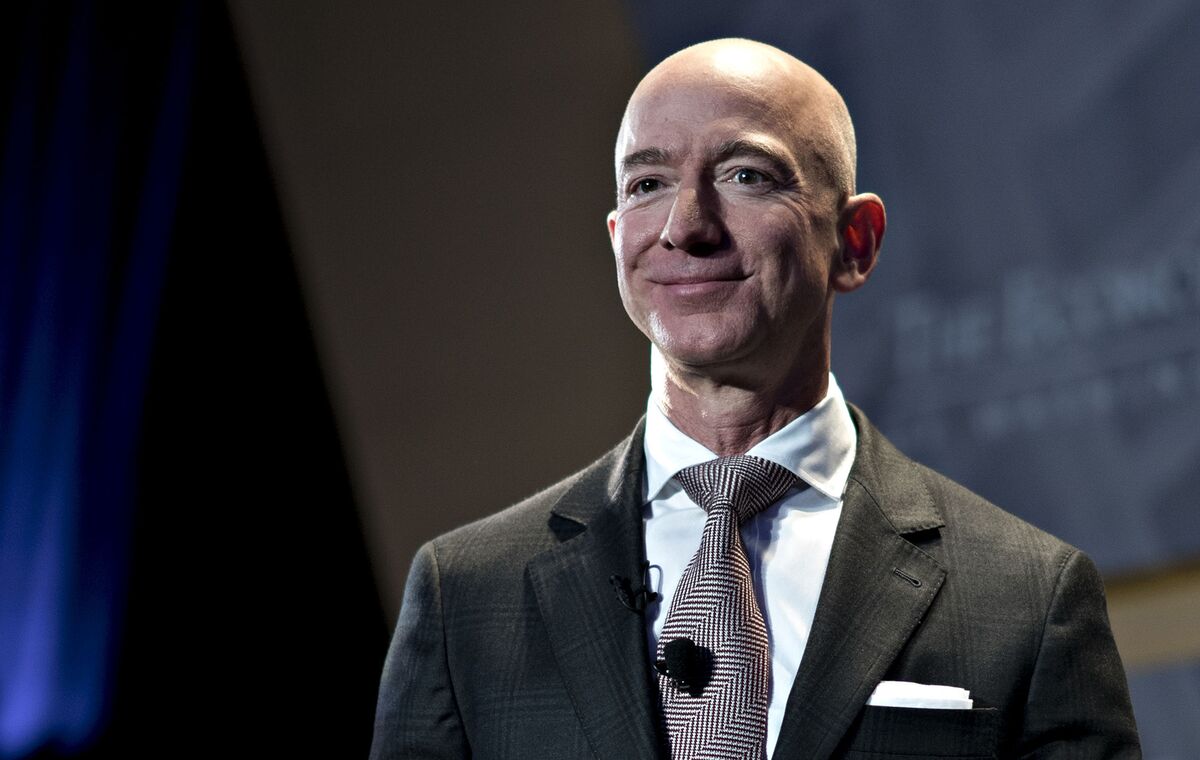

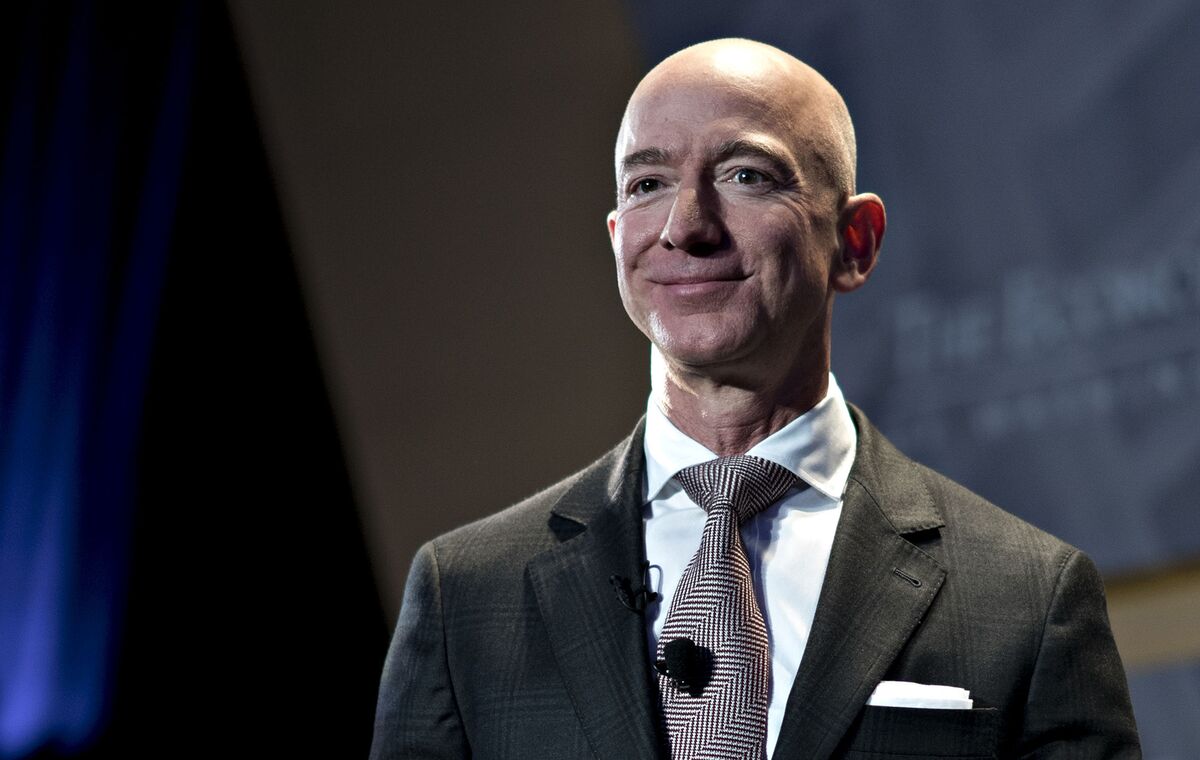

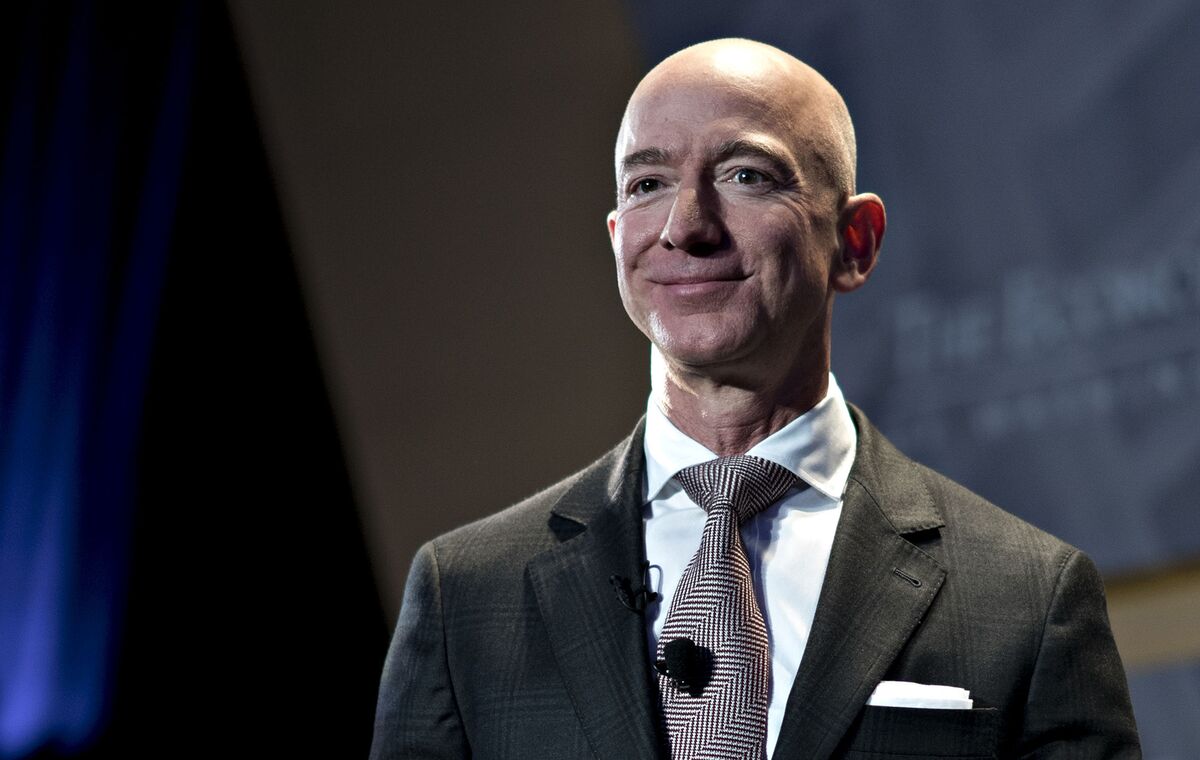

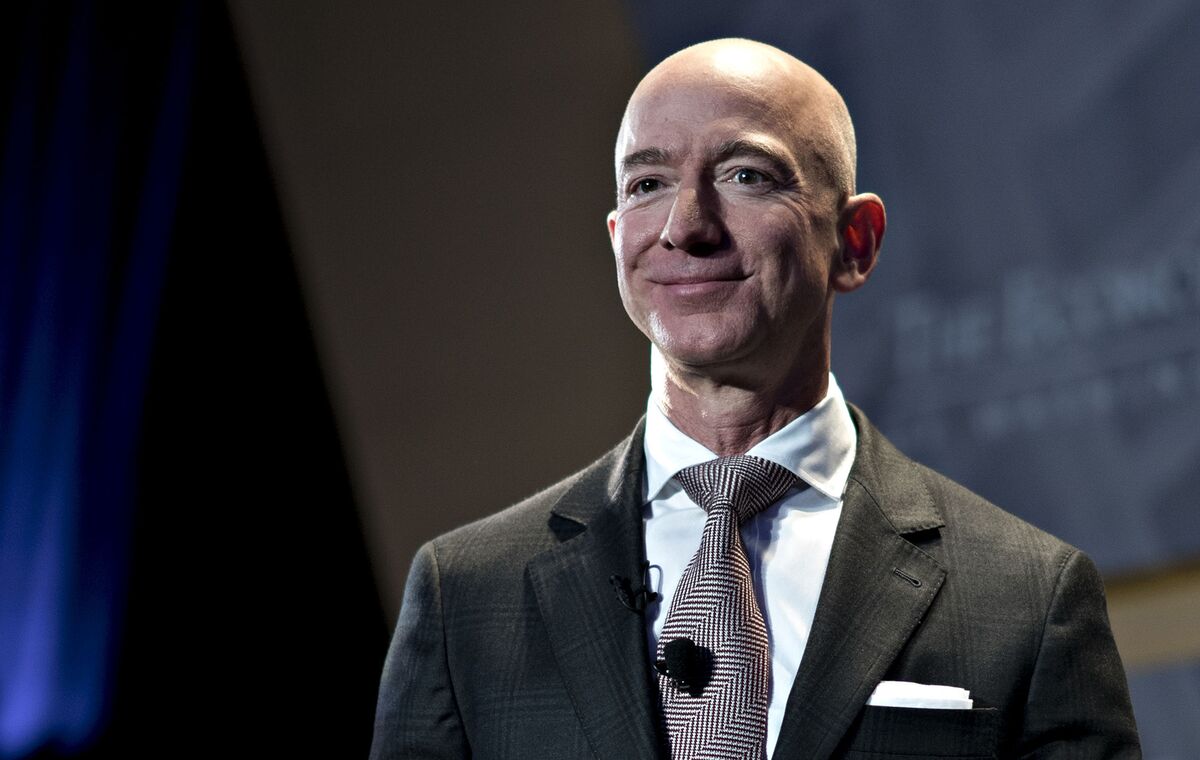

They would if taxes increased.Do you think Elon Musk and Jeff Bezo even care about paying off the debt?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

They would if taxes increased.Do you think Elon Musk and Jeff Bezo even care about paying off the debt?

www.ncfp.org

www.ncfp.org

But billionaires get to pocket more money.I’ve noticed deficits drastically increase with each tax cut...And we do that by cutting taxes for the billionaires.We will need to pay off debt somehow.

You haven’t been paying attention.

That's the point. Make people realize exactly how much the government is taking from them.That is a fun idea. We probably would have too many people owing however...I would argue we need to stop cutting taxes and require a tax increase for any spending. We keep cutting taxes so nobody cares about debt. They will care when taxes increase.We need to stop spending---------making billionaires and politicians richer.We will need to pay off debt somehow.

We should stop making employers send in their employee's taxes and people should have to write a check and pay quarterly taxes.

After that we should make tax day the day before election day so people will still be sore from the big wet bite the fucking government just took out of their asses.

I don't think it really raises enough revenue to have much of an effect. But lifting the cap on soc sec and doing some means testing on medicare are probably inevitable ... assuming we want to continue having the largest economy. And there's no way to get people to accept that unless they see the 100 or so who most benefited from the "supply side bubble" getting it stuck to them too. What pisses me off the most about the uber progressives like AOC and Bernie is they killed off the 12 dems we would need in the House to do this in 22-24.We will need to pay off debt somehow.

I understand the point and agree me with it. But if everyone’s money is spent come tax time we have created a whole new problem. And believe me it will be spent for many.That's the point. Make people realize exactly how much the government is taking from them.That is a fun idea. We probably would have too many people owing however...I would argue we need to stop cutting taxes and require a tax increase for any spending. We keep cutting taxes so nobody cares about debt. They will care when taxes increase.We need to stop spending---------making billionaires and politicians richer.We will need to pay off debt somehow.

We should stop making employers send in their employee's taxes and people should have to write a check and pay quarterly taxes.

After that we should make tax day the day before election day so people will still be sore from the big wet bite the fucking government just took out of their asses.

The corrupt politicians know that the middle class is where the money is. Why do you think the income tax is the tax of choice for the bulk of government revenue?

I think increasing taxes sends the right message though. We need to pay for spending.I don't think it really raises enough revenue to have much of an effect. But lifting the cap on soc sec and doing some means testing on medicare are probably inevitable ... assuming we want to continue having the largest economy. And there's no way to get people to accept that unless they see the 100 or so who most benefited from the "supply side bubble" getting it stuck to them too. What pisses me off the most about the uber progressives like AOC and Bernie is they killed off the 12 dems we would need in the House to do this in 22-24.We will need to pay off debt somehow.

That's about half of what we spent on stimulus in the past 2 years, and even that is never going to pass. A 10% surtax?A wealth tax would raise 4.35 TRILLION over a ten year period and the uber-wealthy wouldn't even notice it.

Great idea - DO IT!

How Much Revenue Would a Wealth Tax Raise?

Former Democratic presidential candidates Sen. Bernie Sanders, I-Vt., and Sen. Elizabeth Warren, D-Mass., have proposed progressive annual wealth taxes. Warren’s proposal would enact a wealth tax with a rate of 2 percent per year on net worth between $50 million and $1 billion and 6 percent per...www.aei.org

Be sure to let us know if it ever comes out of committee. Kind of doubt you will see it.Lizzy Cheekbones teamed up with Bernie "Please may I have another screwing over at the voting Booth" Sanders to propose a "wealth tax"

It's slated to be only 2% annual tax on wealth over $50MM, but why stop there?

Are CCPdemocrats aiming too low? I mean the Gate Trust alone must have $50 BILLION!!! Why aren't dems targeting that idle wealth?

I understand the point and agree me with it. But if everyone’s money is spent come tax time we have created a whole new problem. And believe me it will be spent for many.That's the point. Make people realize exactly how much the government is taking from them.That is a fun idea. We probably would have too many people owing however...I would argue we need to stop cutting taxes and require a tax increase for any spending. We keep cutting taxes so nobody cares about debt. They will care when taxes increase.We need to stop spending---------making billionaires and politicians richer.We will need to pay off debt somehow.

We should stop making employers send in their employee's taxes and people should have to write a check and pay quarterly taxes.

After that we should make tax day the day before election day so people will still be sore from the big wet bite the fucking government just took out of their asses.

The corrupt politicians know that the middle class is where the money is. Why do you think the income tax is the tax of choice for the bulk of government revenue?

A wealth tax would raise 4.35 TRILLION over a ten year period and the uber-wealthy wouldn't even notice it.

Great idea - DO IT!

How Much Revenue Would a Wealth Tax Raise?

Former Democratic presidential candidates Sen. Bernie Sanders, I-Vt., and Sen. Elizabeth Warren, D-Mass., have proposed progressive annual wealth taxes. Warren’s proposal would enact a wealth tax with a rate of 2 percent per year on net worth between $50 million and $1 billion and 6 percent per...www.aei.org

Why not treat the debts like a credit card bill?We will need to pay off debt somehow.

I do too. But I think it would be a huge hit to revenue. And then do we jail lots of people? Too many new problems.I understand the point and agree me with it. But if everyone’s money is spent come tax time we have created a whole new problem. And believe me it will be spent for many.That's the point. Make people realize exactly how much the government is taking from them.That is a fun idea. We probably would have too many people owing however...I would argue we need to stop cutting taxes and require a tax increase for any spending. We keep cutting taxes so nobody cares about debt. They will care when taxes increase.We need to stop spending---------making billionaires and politicians richer.We will need to pay off debt somehow.

We should stop making employers send in their employee's taxes and people should have to write a check and pay quarterly taxes.

After that we should make tax day the day before election day so people will still be sore from the big wet bite the fucking government just took out of their asses.

The corrupt politicians know that the middle class is where the money is. Why do you think the income tax is the tax of choice for the bulk of government revenue?

That's their problem. People need to learn how to handle their own money.

I always managed to pay my quarterly taxes on time so can everyone else.

That's about half of what we spent on stimulus in the past 2 years, and even that is never going to pass. A 10% surtax?A wealth tax would raise 4.35 TRILLION over a ten year period and the uber-wealthy wouldn't even notice it.

Great idea - DO IT!

How Much Revenue Would a Wealth Tax Raise?

Former Democratic presidential candidates Sen. Bernie Sanders, I-Vt., and Sen. Elizabeth Warren, D-Mass., have proposed progressive annual wealth taxes. Warren’s proposal would enact a wealth tax with a rate of 2 percent per year on net worth between $50 million and $1 billion and 6 percent per...www.aei.org

Well, imo wealth disparity is just because the % of income growth in the top 1% and more so the top .1% grew much faster than workers' incomes, and their taxes did not rise in % to their income growth. The supply siders and tools of Norquist who dream they too could invent the computer will say "but the top 10% pay by far most of the total taxes." While that's true, it's actually evidence of the unequal share of who earned the increases in gnp. It's totally opposite to what occurred from 1950-1980 when the middle class emerged. Partially, post-1980 was the decline in unions and globalization.That's about half of what we spent on stimulus in the past 2 years, and even that is never going to pass. A 10% surtax?A wealth tax would raise 4.35 TRILLION over a ten year period and the uber-wealthy wouldn't even notice it.

Great idea - DO IT!

How Much Revenue Would a Wealth Tax Raise?

Former Democratic presidential candidates Sen. Bernie Sanders, I-Vt., and Sen. Elizabeth Warren, D-Mass., have proposed progressive annual wealth taxes. Warren’s proposal would enact a wealth tax with a rate of 2 percent per year on net worth between $50 million and $1 billion and 6 percent per...www.aei.org

We'd better figure out something to address wealth inequality and pay down the national debt or we'll all be F'd. Cleaning up and simplifying a tax code that enables a company like Amazon to pay nothing or a cheat like Rump to pay $750 two years in a row is also essential.

Jeff Bezos Adds Record $13 Billion in Single Day to Fortune

Jeff Bezos added $13 billion to his net worth on Monday, the largest single-day jump for an individual since the Bloomberg Billionaires Index was created in 2012.www.bloomberg.com

Our wage problems are from too many near monopolies and wage collusion. We had super low unemployment and wages barely moved.Well, imo wealth disparity is just because the % of income growth in the top 1% and more so the top .1% grew much faster than workers' incomes, and their taxes did not rise in % to their income growth. The supply siders and tools of Norquist who dream they too could invent the computer will say "but the top 10% pay by far most of the total taxes." While that's true, it's actually evidence of the unequal share of who earned the increases in gnp. It's totally opposite to what occurred from 1950-1980 when the middle class emerged. Partially it was the decline in unions and globalization.That's about half of what we spent on stimulus in the past 2 years, and even that is never going to pass. A 10% surtax?A wealth tax would raise 4.35 TRILLION over a ten year period and the uber-wealthy wouldn't even notice it.

Great idea - DO IT!

How Much Revenue Would a Wealth Tax Raise?

Former Democratic presidential candidates Sen. Bernie Sanders, I-Vt., and Sen. Elizabeth Warren, D-Mass., have proposed progressive annual wealth taxes. Warren’s proposal would enact a wealth tax with a rate of 2 percent per year on net worth between $50 million and $1 billion and 6 percent per...www.aei.org

We'd better figure out something to address wealth inequality and pay down the national debt or we'll all be F'd. Cleaning up and simplifying a tax code that enables a company like Amazon to pay nothing or a cheat like Rump to pay $750 two years in a row is also essential.

Jeff Bezos Adds Record $13 Billion in Single Day to Fortune

Jeff Bezos added $13 billion to his net worth on Monday, the largest single-day jump for an individual since the Bloomberg Billionaires Index was created in 2012.www.bloomberg.com

We taxed the shit out of the rich before Reagan. I'd say our problem was not how much we taxed them, but the ways we let them avoid any tax by not earning profit on their "nut." But we had the Reagan boom because so much money sought productive investments. Now we have the opposite problem. Not enough places to invest. So we have housing and equity bubbles faster than we did before.

I do too. But I think it would be a huge hit to revenue. And then do we jail lots of people? Too many new problems.I understand the point and agree me with it. But if everyone’s money is spent come tax time we have created a whole new problem. And believe me it will be spent for many.That's the point. Make people realize exactly how much the government is taking from them.That is a fun idea. We probably would have too many people owing however...I would argue we need to stop cutting taxes and require a tax increase for any spending. We keep cutting taxes so nobody cares about debt. They will care when taxes increase.We need to stop spending---------making billionaires and politicians richer.We will need to pay off debt somehow.

We should stop making employers send in their employee's taxes and people should have to write a check and pay quarterly taxes.

After that we should make tax day the day before election day so people will still be sore from the big wet bite the fucking government just took out of their asses.

The corrupt politicians know that the middle class is where the money is. Why do you think the income tax is the tax of choice for the bulk of government revenue?

That's their problem. People need to learn how to handle their own money.

I always managed to pay my quarterly taxes on time so can everyone else.

Well, imo wealth disparity is just because the % of income growth in the top 1% and more so the top .1% grew much faster than workers' incomes, and their taxes did not rise in % to their income growth. The supply siders and tools of Norquist who dream they too could invent the computer will say "but the top 10% pay by far most of the total taxes." While that's true, it's actually evidence of the unequal share of who earned the increases in gnp. It's totally opposite to what occurred from 1950-1980 when the middle class emerged. Partially, post-1980 was the decline in unions and globalization.That's about half of what we spent on stimulus in the past 2 years, and even that is never going to pass. A 10% surtax?A wealth tax would raise 4.35 TRILLION over a ten year period and the uber-wealthy wouldn't even notice it.

Great idea - DO IT!

How Much Revenue Would a Wealth Tax Raise?

Former Democratic presidential candidates Sen. Bernie Sanders, I-Vt., and Sen. Elizabeth Warren, D-Mass., have proposed progressive annual wealth taxes. Warren’s proposal would enact a wealth tax with a rate of 2 percent per year on net worth between $50 million and $1 billion and 6 percent per...www.aei.org

We'd better figure out something to address wealth inequality and pay down the national debt or we'll all be F'd. Cleaning up and simplifying a tax code that enables a company like Amazon to pay nothing or a cheat like Rump to pay $750 two years in a row is also essential.

Jeff Bezos Adds Record $13 Billion in Single Day to Fortune

Jeff Bezos added $13 billion to his net worth on Monday, the largest single-day jump for an individual since the Bloomberg Billionaires Index was created in 2012.www.bloomberg.com

But we taxed the shit out of the rich before Reagan. I'd say our problem was not how much we taxed them, but the ways we let them avoid any tax by not earning profit on their "nut." But we had the Reagan boom because so much money sought productive investments after we cut the top income tax rate to 33% or whatever. Now we have the opposite problem. Not enough places to invest. So we have housing and equity bubbles faster than we did before.

Lizzy Cheekbones teamed up with Bernie "Please may I have another screwing over at the voting Booth" Sanders to propose a "wealth tax"

It's slated to be only 2% annual tax on wealth over $50MM, but why stop there?

Are CCPdemocrats aiming too low? I mean the Gate Trust alone must have $50 BILLION!!! Why aren't dems targeting that idle wealth?