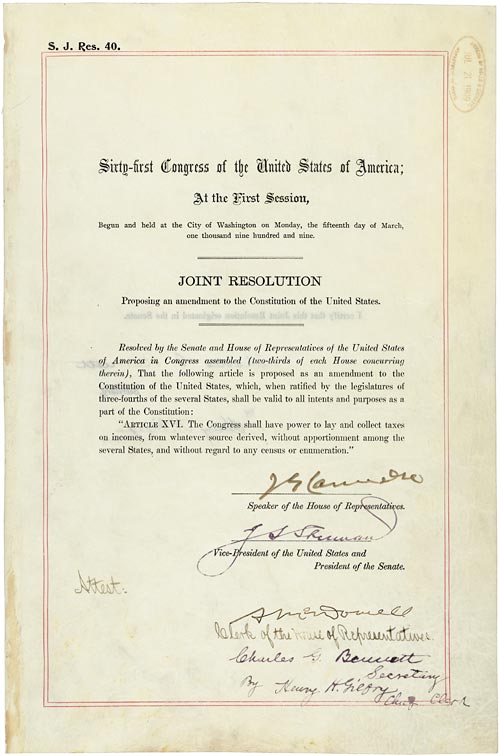

For the record, let us all acknowledge that the Sixteenth Amendment is part of our Constitution, and it declares:

”The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Now keep in mind the Sixteenth Amendment does not declare:

”The Congress shall have power to lay and collect direct taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Nor does the Sixteenth Amendment declare:

"The Congress shall have power to lay and collect taxes on earned wages, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

Additionally, our Supreme Court has repeatedly confirmed, after the adoption of the Sixteenth Amendment, direct taxes laid by Congress are still required to be apportioned.

For example, if Congress, under the authority of the Sixteenth Amendment, asserts to be taxing incomes, but the tax, as it is applied, takes the form of a direct tax, and it is not being apportioned, the Supreme Court will strike the tax down as violating the constitutional protection requiring direct taxes to be apportioned, "notwithstanding the Sixteenth Amendment", as stated in EISNER v. MACOMBER , 252 U.S. 189 (1920):

"Thus, from every point of view we are brought irresistibly to the conclusion that neither under the Sixteenth Amendment nor otherwise has Congress power to tax without apportionment a true stock dividend made lawfully and in good faith, or the accumulated profits behind it, as income of the stockholder. The Revenue Act of 1916, in so far as it imposes a tax upon the stockholder because of such dividend, contravenes the provisions of article 1, 2, cl. 3, and article 1, 9, cl. 4, of the Constitution, and to this extent is invalid, notwithstanding the Sixteenth Amendment."

.

.

Seems relatively obvious when considering the above stated FACTS, the contention made by some that today's federal tax on a working person's earned wages may very well violate our federal constitution and has great merit for the following reasons:

Today's federal tax on earned wages is not in harmony with the original objective of adopting the Sixteenth Amendment which was to allow for a federal tax on “unearned” incomes [stocks, bonds, etc.] as can be contrasted from “earned” wages.

Today’s federal tax on a working person’s earned wages takes the form of a direct tax, is not being apportioned, and thus violates the constitutional protection requiring direct taxes to be apportioned.

Finally, and in respect of the Sixteenth Amendment and calculating today’s federal tax on earned wages “ . . . it becomes essential to distinguish between what is and what is not "income," as the term is there used; and to apply the distinction, as cases arise, according to truth and substance, without regard to form. Congress cannot by any definition it may adopt conclude the matter, since it cannot by legislation alter the Constitution, from which alone it derives its power to legislate, and within whose limitations alone that power can be lawfully exercised.” EISNER v. MACOMBER , 252 U.S. 189 (1920)

Today’s federal tax on earned wages does not follow the set rules laid out in EISNER V. MACOMBER to calculate and distinguish what portion, if any, of a working person’s earn wages falls within the definition of “incomes” as the term is used in the Sixteenth Amendment.

JWK

Why have a written constitution, approved by the people, if those who it is meant to control are free to make it mean whatever they wish it to mean?

”The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Now keep in mind the Sixteenth Amendment does not declare:

”The Congress shall have power to lay and collect direct taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Nor does the Sixteenth Amendment declare:

"The Congress shall have power to lay and collect taxes on earned wages, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

Additionally, our Supreme Court has repeatedly confirmed, after the adoption of the Sixteenth Amendment, direct taxes laid by Congress are still required to be apportioned.

For example, if Congress, under the authority of the Sixteenth Amendment, asserts to be taxing incomes, but the tax, as it is applied, takes the form of a direct tax, and it is not being apportioned, the Supreme Court will strike the tax down as violating the constitutional protection requiring direct taxes to be apportioned, "notwithstanding the Sixteenth Amendment", as stated in EISNER v. MACOMBER , 252 U.S. 189 (1920):

"Thus, from every point of view we are brought irresistibly to the conclusion that neither under the Sixteenth Amendment nor otherwise has Congress power to tax without apportionment a true stock dividend made lawfully and in good faith, or the accumulated profits behind it, as income of the stockholder. The Revenue Act of 1916, in so far as it imposes a tax upon the stockholder because of such dividend, contravenes the provisions of article 1, 2, cl. 3, and article 1, 9, cl. 4, of the Constitution, and to this extent is invalid, notwithstanding the Sixteenth Amendment."

.

.

Seems relatively obvious when considering the above stated FACTS, the contention made by some that today's federal tax on a working person's earned wages may very well violate our federal constitution and has great merit for the following reasons:

Today's federal tax on earned wages is not in harmony with the original objective of adopting the Sixteenth Amendment which was to allow for a federal tax on “unearned” incomes [stocks, bonds, etc.] as can be contrasted from “earned” wages.

Today’s federal tax on a working person’s earned wages takes the form of a direct tax, is not being apportioned, and thus violates the constitutional protection requiring direct taxes to be apportioned.

Finally, and in respect of the Sixteenth Amendment and calculating today’s federal tax on earned wages “ . . . it becomes essential to distinguish between what is and what is not "income," as the term is there used; and to apply the distinction, as cases arise, according to truth and substance, without regard to form. Congress cannot by any definition it may adopt conclude the matter, since it cannot by legislation alter the Constitution, from which alone it derives its power to legislate, and within whose limitations alone that power can be lawfully exercised.” EISNER v. MACOMBER , 252 U.S. 189 (1920)

Today’s federal tax on earned wages does not follow the set rules laid out in EISNER V. MACOMBER to calculate and distinguish what portion, if any, of a working person’s earn wages falls within the definition of “incomes” as the term is used in the Sixteenth Amendment.

JWK

Why have a written constitution, approved by the people, if those who it is meant to control are free to make it mean whatever they wish it to mean?