Statistikhengst

Diamond Member

- Banned

- #1

UBS Time to join the solar EV storage revolution Renew Economy

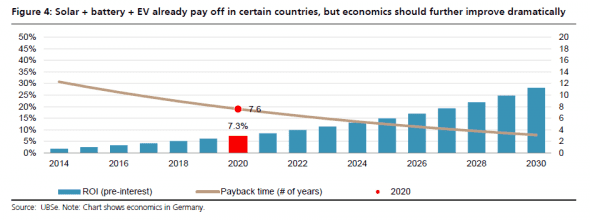

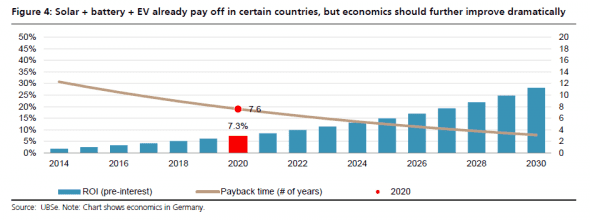

This is the graph:

And by the way, we are talking about a Tipping-Point and payback rate for alternative energy WITHOUT SUBSIDIES:

Why EVs will make solar viable without subsidies Renew Economy

(it's all in the report).

-----------------------------------------------------------------------------------------

Now, fossil-fuel dinosaurs out there can make the claim that petroleum products are used in the making of alternative energy devices and this is mostly true, but the amount needed is a mere fraction of what we are just burning to create energy every day. Plus, the new devices are lasting longer and longer and longer.

Wind turbines

Underwater turbines

Solar

And one day soon: fusion

The future is closer to our doorsteps than we realize.

Leading investment bank UBS says the payback time for unsubsidised investment in electric vehicles plus rooftop solar plus battery storage will be as low as 6-8 years by 2020 – triggering a massive revolution in the energy industry.

“It’s time to join the revolution,” UBS says in a note to clients, in what could be interpreted as a massive slap-down to those governments and corporates who believe that centralised fossil fuel generation will dominate for decades to come...

..By the end of the decade, it says, the combination of will deliver a pay-back time of between six to 8 years, as this graph below shows. It will fall to around 3 years by 2030. Right now, the payback is probably around 12 years,

This is the graph:

The UBS report is focused on Europe, where it says that Germany, Spain, and Italy will be leaders because of their high electricity and fuel costs. But it could equally apply to Australia, which has both high electricity and high fuel costs, and a lot more sun – so solar is much cheaper.

UBS forecasts that EVs and plug-in hybrid will account for around 10 per cent of the market in Europe by 2025...

...

“Our view is that the ‘we have done it like this for a century’ value chain in developed electricity markets will be turned upside down within the next 10-20 years, driven by solar and batteries.

“As a virtuous circle, lower battery cost will also spur EV sales, which should bring further economies of scale to batteries, also for stationary applications. Power is no longer something that is exclusively produced by huge, centralised units owned by large utilities.

“By 2025, everybody will be able to produce and store power. And it will be green and cost competitive, ie, not more expensive or even cheaper than buying power from utilities.

“It is also the most efficient way to produce power where it is consumed, because transmission losses will be minimised.

And by the way, we are talking about a Tipping-Point and payback rate for alternative energy WITHOUT SUBSIDIES:

Why EVs will make solar viable without subsidies Renew Economy

(it's all in the report).

-----------------------------------------------------------------------------------------

Now, fossil-fuel dinosaurs out there can make the claim that petroleum products are used in the making of alternative energy devices and this is mostly true, but the amount needed is a mere fraction of what we are just burning to create energy every day. Plus, the new devices are lasting longer and longer and longer.

Wind turbines

Underwater turbines

Solar

And one day soon: fusion

The future is closer to our doorsteps than we realize.