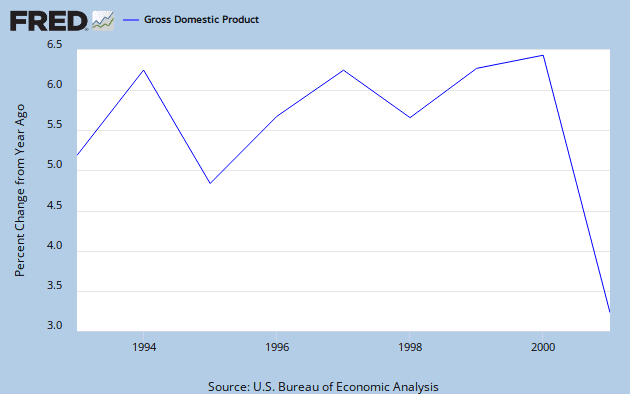

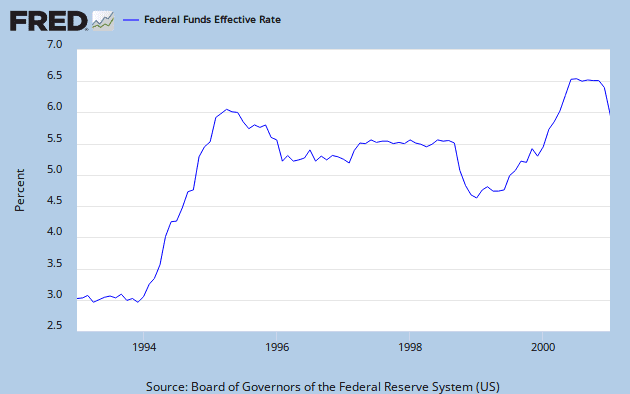

In the last two major changes to the tax code - an increase in 1993 and a decrease in the early 00s - it had no affect on the level of spending.

Tea Party to Orrin Hatch: Play It Our Way or You're Out | Capital Gains and Games

IOW, when taxes went up, spending as a percentage of GDP went down. When taxes went down, it had no affect on spending.

... following the 1993 tax increase, which he and every other Republican in Congress opposed, federal spending fell from 21.4 percent of GDP to 18.3 percent in 2000. And, contrary to starve-the-beast theory, when Republicans slashed taxes during the George W. Bush administration, it did not put any downward pressure whatsoever on spending, which rose to 20.7 percent of GDP in Bushs last year.

Tea Party to Orrin Hatch: Play It Our Way or You're Out | Capital Gains and Games

IOW, when taxes went up, spending as a percentage of GDP went down. When taxes went down, it had no affect on spending.