- Aug 4, 2009

- 280,553

- 138,887

- 2,300

Most get back what they contributed, many get much moreThe fucking government confiscating 12.4% of your lifetime income to give you 1200 a month in retirement sounds like a good deal if you're a fucking retard.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Most get back what they contributed, many get much moreThe fucking government confiscating 12.4% of your lifetime income to give you 1200 a month in retirement sounds like a good deal if you're a fucking retard.

Wrong again SkippyGotta have an income, Stupid.

Kids don't have to go to college. And the only reason a medical bill would be a problem is because of the ridiculously high deductibles on Obama care.

I lived most of my life with health insurance for catastrophic illness or injury that had a small deductible. Now I have to pay for all kinds of shit I don't want or need thanks to Obamacare

So Trump raised taxes on the rich.Wrong again Skippy

My SALT tax exemption was severely reduced and I ended up paying higher Federal Taxes

Raised taxes on Blue StatesSo Trump raised taxes on the rich.

A tax dodge for the wealthy....Raised taxes on Blue States

In Blue StatesA tax dodge for the wealthy....

Pay your FAIR SHARE, Assflap.

Who benefits from the SALT deduction?

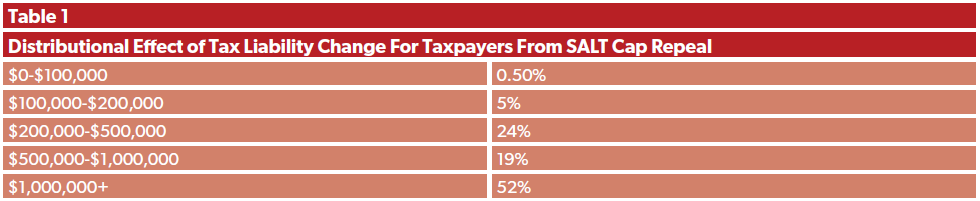

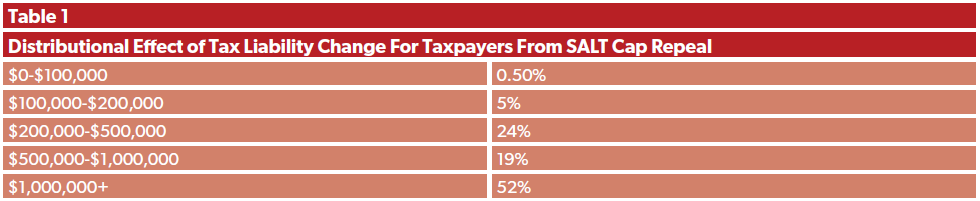

- The deduction primarily benefits wealthy taxpayers in high-tax states. There is widespread recognition across the political spectrum that the vast majority of the SALT deduction benefits the wealthy, and a repeal of the cap on the SALT deduction would amount to a tax break for the wealthiest Americans.

- Tax Policy Center: “Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Act’s (TCJA) $10,000 cap on the state and local property tax (SALT) deduction, and more than 96 percent of the tax cut would go to the highest-income 20 percent of households”

- Tax Foundation: “The SALT deduction tends to benefit states with many higher-earners and higher state taxes.”

- Joint Committee on Taxation: “The repeal [of the cap] is estimated to result in a decrease in tax liability for 13.1 million taxpayers, 94 percent of which have $100,000 or more of economic income. Additionally, approximately 99 percent of the decrease in tax liability accrues to taxpayers with $100,000 or more of economic income.”

What’s the Deal With the State and Local Tax Deduction?

(pdf) Introduction Some lawmakers are seeking to repeal the $10,000 cap (for single and married couples jointly filing) on state and local tax (SALT) deductions put in place under the Tax Cuts and Jobs Act (TCJA). The debate over whether to include SALT cap repeal in the budget resolution...www.ntu.org

So being in the top 10% you definitely pay someone else or better have someone on your staff to deal with IRS.When the top two tax brackets are restored which were cut by the Trump Administration and more brackets are added:

Federal Income Tax Brackets for Tax Year 1956 (Filed April 1957)

www.tax-brackets.org

We all agree that the national debt is in the Trillions of Dollars. The top earners have the most to lose if and when the economy collapses. I'm in the top 10%, and the 90% of the tax payers are consumers who spend their income on Main St.

Think about this, when Main St. folds our entire economy collapses as we have all seen during the Pandemic.

Free Government Cell Phones: Plans, Devices, How to ApplyIt's hard to have sympathy for people who cry poor but have 3 TVs 5 laptops and smart phones for the kids and a bunch of other shit they don't really need

In Blue States

State and local taxes easily exceed $10,000

You don’t have to be Rich, only own a home

So, no

Trump did not cut taxes on everyone

Not actuallyI proved the vase majority of those using SALT are rich.

Stop whining about the rich paying their "fair share".

Why should anyone get more back than they put in?Most get back what they contributed, many get much more

LookWhy should anyone get more back than they put in?

Answer the question, asswipe.Look

You can’t have it both ways

You can’t complain that SS is a bad investment and then complain when it is in fact a good investment.

Bring a link showing the percentages.Not actually

Your propaganda ignores the high percentage of homeowners in blue states that lost the tax deduction

I retried in 2005. I have received a seven figure pension beginning in 2006 and received a 3% COLA every year since 2006. I resented Trump's greed and spending my income tax on an ego fence when too many hard working American citizens in the bottom 50% pay an income tax and when so many corporations pay very little or nothing.So being in the top 10% you definitely pay someone else or better have someone on your staff to deal with IRS.

But if you are so concerned about the rest of us bottom 50%, why would your solution require what Biden is doing

i.e. increasing IRS budget by 80 billion to make filing even more complicated for those of us with no one on the payroll who deals with IRS.

Biden seeks $80 Billion to Beef Up IRS...

Biden Seeks $80 Billion to Beef Up I.R.S. Audits of High-Earners (Published 2021)

The president’s “American Families Plan,” which he will detail this week, will be offset in part by a tax enforcement effort that administration officials believe will raise $700 billion over a decade.www.nytimes.com

Gee, if they have it good why don't you live in the same community and collect all this "free" stuff?Free Government Cell Phones: Plans, Devices, How to Apply

Thanks to the government’s Lifeline Assistance program, you can qualify for free cell phones and inexpensive cell phone plans. For those of you who struggle making your cell phone payment every month, this government program was made for you

A) we estimate that the number of free government cell phones is currently below 12,000,000.

Free Government Phones: Plans, devices, how to apply

In this guide we'll explain the government's Lifeline Assistance program, which gives low income Americans access to free cell phones and $9.25/month cell phone plans. A number of carriers participate in the program, like Lifeline, including QLink and Safelink Wireless.www.whistleout.com

B) Section 8 housing pays for 4,800,000 people's housing expenses.Fewer than half of qualifying households have free gov phones

Fewer than half the American households that qualify for the Lifeline Assistance program currently participate in the SNAP food stamp program.www.freegovernmentcellphones.net

C) 42.6 million Americans get free food.Section 8 (housing) - Wikipedia

en.wikipedia.org

So these people get:

The Number of People on Food Stamps is Falling

Almost 2 million fewer people are receiving Supplemental Nutrition Assistance Program (SNAP) benefits than were in 2016.www.newsweek.com

=== $12,000 free housing , Section 8 will pay up to $1,000/month

=== $ 2,400 free food,

=== $ 1,200 in free cell phone plus

=== $ 5,000 a year in free health care from Medicaid.

So this is about $26,000 a year in FREE MONEY, free goods and free services...

And then there’s 2008see, the demofks don't get it. SS pays out even if what you paid in is gone. Therefore, people living outside of their payback is stressing that system and why it is failing. If I would have invested the money I paid in on my own, my financial advisors would invest in much better long term investments and actually make me more money. Again, a demofk is only as smart as the poop he/she flushes