- Frank E. Nothaft, the chief economist at Freddie Mac, talking to the New York Times about a reported administration plan to offer lower mortgage rates to borrowers with bad credit.

Fannie, Freddie Takeover Could Be Key To Obama Jobs Plan | FoxNews.com

I believe we have been there--done this before -and anyone who who doesn't know that these two government agencies are GROUND ZERO for the current economic collapse-have been living in a very dark closet for several years.

TO REFRESH YOUR MEMORY:

Basically the Federal Government thought it would be a great idea to co-sign our names to 50% of the mortgages in this country-using Fannie/Freddie-while pressuring banks to lower their lending standards--no down payment--no collateral--and less than a desirable credit rating could get you a 500K custom home with sub-prime mortgage qualification.

Due to deregulation of Fannie/Freddie and the Glass/Steagall act of the 1930's Wall street bankers were able to buy up these mortgage backed securities and use them as collateral on the global market--in the mother of all casino's known as the derivatives market. All warnings of an imminent collapse were completely ignored by both congressional and senate banking boards. .

The Federal government basically built a house of cards that collapsed leaving the American taxpayer holding the bag.

And when did all this deregulation happen? Under Bill Clinton's watch. Now it appears that Obama may want to try it again.

Fannie Mae Eases Credit To Aid Mortgage Lending - NYTimes.com

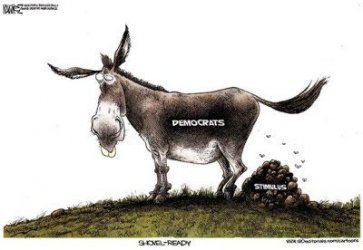

At the center of the Panic of 2008 were defaults on cheap mortgages for Americans with poor credit. The latest idea to reverse the resulting recession is for the government to offer cheap mortgages to Americans with poor credit.

There have been rumblings for weeks that the economic plan to be offered by President Obama after he returns from his vacation would be aimed, at least in part, at trying to re-inflate the American housing market.

Nearly non-existent interest rates, tax-rebates and free money for banks that refinanced underwater borrowers have not worked to reverse perhaps the steepest slide in home values ever. Even when there was hope for recovery, home values kept descending.

There are lots of problems for American homeowners, but one of the biggest is that foreclosures continue to hit the market. Rather than clearing the glut of foreclosures from the bubble burst that preceded the panic, lenders have been forced to delay the process.

Fannie, Freddie Takeover Could Be Key To Obama Jobs Plan | FoxNews.com

I believe we have been there--done this before -and anyone who who doesn't know that these two government agencies are GROUND ZERO for the current economic collapse-have been living in a very dark closet for several years.

TO REFRESH YOUR MEMORY:

Basically the Federal Government thought it would be a great idea to co-sign our names to 50% of the mortgages in this country-using Fannie/Freddie-while pressuring banks to lower their lending standards--no down payment--no collateral--and less than a desirable credit rating could get you a 500K custom home with sub-prime mortgage qualification.

Due to deregulation of Fannie/Freddie and the Glass/Steagall act of the 1930's Wall street bankers were able to buy up these mortgage backed securities and use them as collateral on the global market--in the mother of all casino's known as the derivatives market. All warnings of an imminent collapse were completely ignored by both congressional and senate banking boards. .

The Federal government basically built a house of cards that collapsed leaving the American taxpayer holding the bag.

And when did all this deregulation happen? Under Bill Clinton's watch. Now it appears that Obama may want to try it again.

Fannie Mae Eases Credit To Aid Mortgage Lending - NYTimes.com

Last edited: