Ray From Cleveland

Diamond Member

- Aug 16, 2015

- 97,215

- 37,438

- 2,290

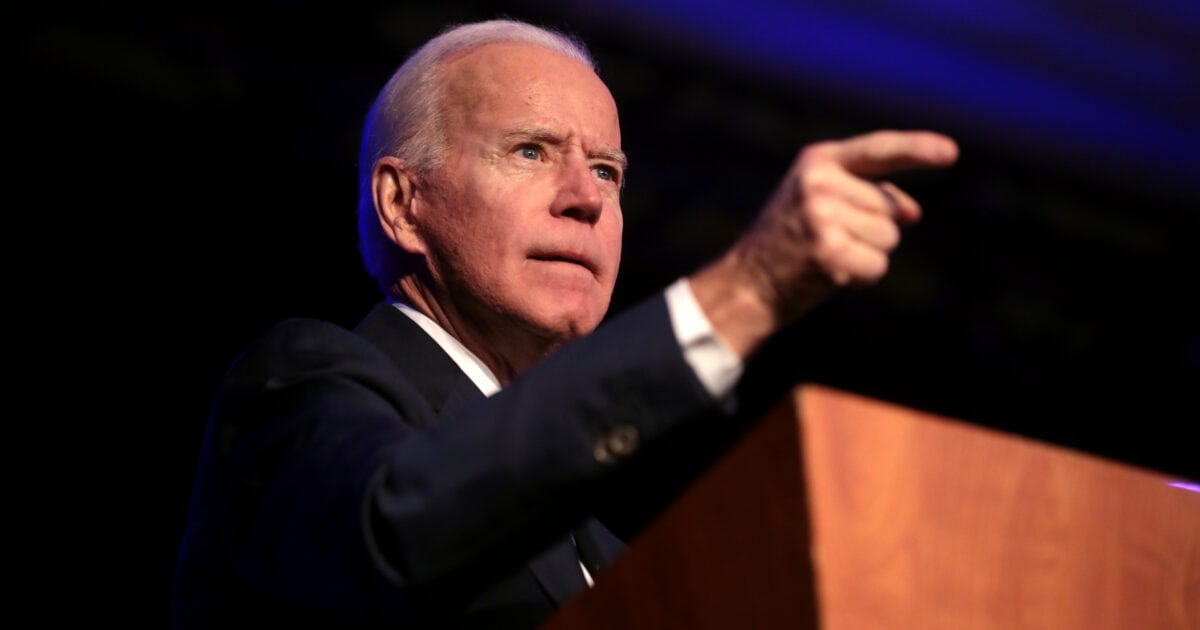

President Biden and congressional Democrats imposed a long list of tax increases as part of their “Inflation Reduction Act” passed in 2022.

On Jan. 1, 2023 the following Democrat tax hikes will take effect:

$6.5 Billion Natural Gas Tax Which Will Increase Household Energy Bills

Think your household energy bills are high now? Just wait until the three major energy taxes in the Inflation Reduction Act hit your wallet. The first is a regressive tax on American oil and gas development. The tax will drive up the cost of household energy bills. The Congressional Budget Office estimates the natural gas tax will increase taxes by $6.5 billion.

$12 Billion Crude Oil Tax Which Will Increase Household Costs

Democrats are imposing a 16.4 cents-per-barrel tax on crude oil and imported petroleum products that will be passed on to consumers in the form of higher gas prices.

$1.2 Billion Coal Tax Which Will Increase Household Energy Bills

The tax hike more than doubles the current excise taxes on coal production. Under the Democrat proposal, the tax rate on coal from subsurface mining would increase from $0.50 per ton to $1.10 per ton while the tax rate on coal from surface mining would increase from $0.25 per ton to $0.55 per ton.

JCT estimates that this will raise $1.2 billion in taxes that will be passed on to consumers in the form of higher electricity bills.

$74 Billion Stock Tax Which Will Hit Your Nest Egg — 401(k)s, IRAs and Pension Plans

When Americans choose to sell shares of stock back to a company, Democrats will impose a new federal excise tax which will reduce the value of household nest eggs. Raising taxes and restricting stock buybacks harms the retirement savings of any individual with a 401(k), IRA or pension plan.

www.atr.org

www.atr.org

Now aren't you glad you make less than 400K a year? I know I am.

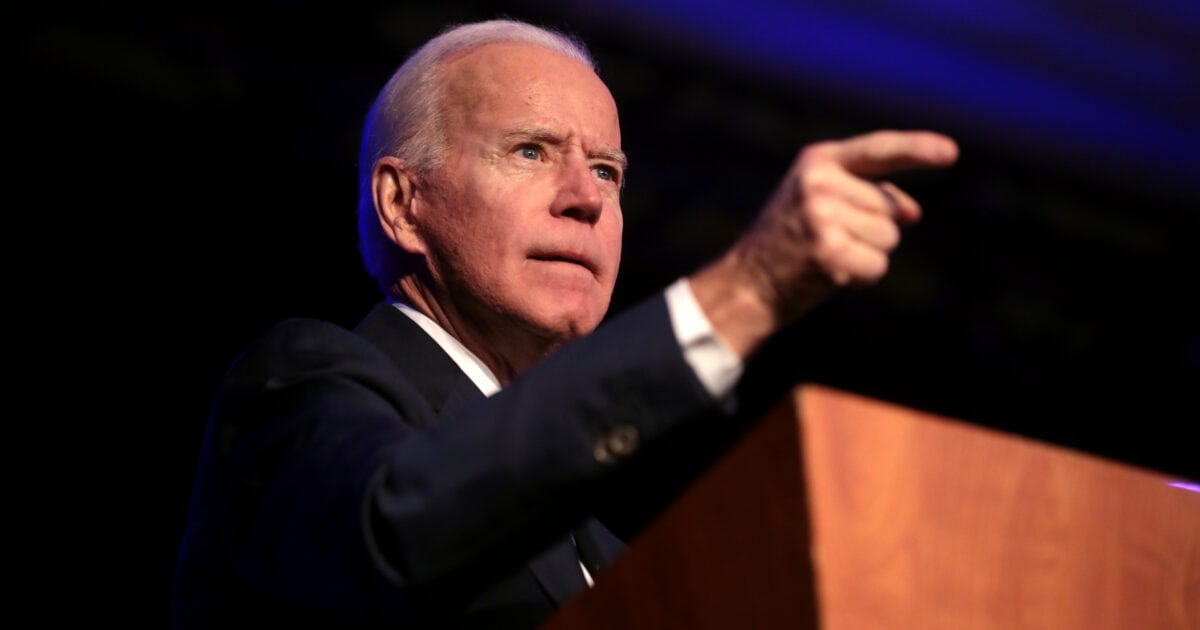

On Jan. 1, 2023 the following Democrat tax hikes will take effect:

$6.5 Billion Natural Gas Tax Which Will Increase Household Energy Bills

Think your household energy bills are high now? Just wait until the three major energy taxes in the Inflation Reduction Act hit your wallet. The first is a regressive tax on American oil and gas development. The tax will drive up the cost of household energy bills. The Congressional Budget Office estimates the natural gas tax will increase taxes by $6.5 billion.

$12 Billion Crude Oil Tax Which Will Increase Household Costs

Democrats are imposing a 16.4 cents-per-barrel tax on crude oil and imported petroleum products that will be passed on to consumers in the form of higher gas prices.

$1.2 Billion Coal Tax Which Will Increase Household Energy Bills

The tax hike more than doubles the current excise taxes on coal production. Under the Democrat proposal, the tax rate on coal from subsurface mining would increase from $0.50 per ton to $1.10 per ton while the tax rate on coal from surface mining would increase from $0.25 per ton to $0.55 per ton.

JCT estimates that this will raise $1.2 billion in taxes that will be passed on to consumers in the form of higher electricity bills.

$74 Billion Stock Tax Which Will Hit Your Nest Egg — 401(k)s, IRAs and Pension Plans

When Americans choose to sell shares of stock back to a company, Democrats will impose a new federal excise tax which will reduce the value of household nest eggs. Raising taxes and restricting stock buybacks harms the retirement savings of any individual with a 401(k), IRA or pension plan.

List of Biden Tax Hikes Hitting Americans on Jan. 1 - Americans for Tax Reform

President Biden imposed a long list of tax hikes as part of the "Inflation Reduction Act." These Biden tax hikes take effect on Jan. 1:

Now aren't you glad you make less than 400K a year? I know I am.