leftwinger

Diamond Member

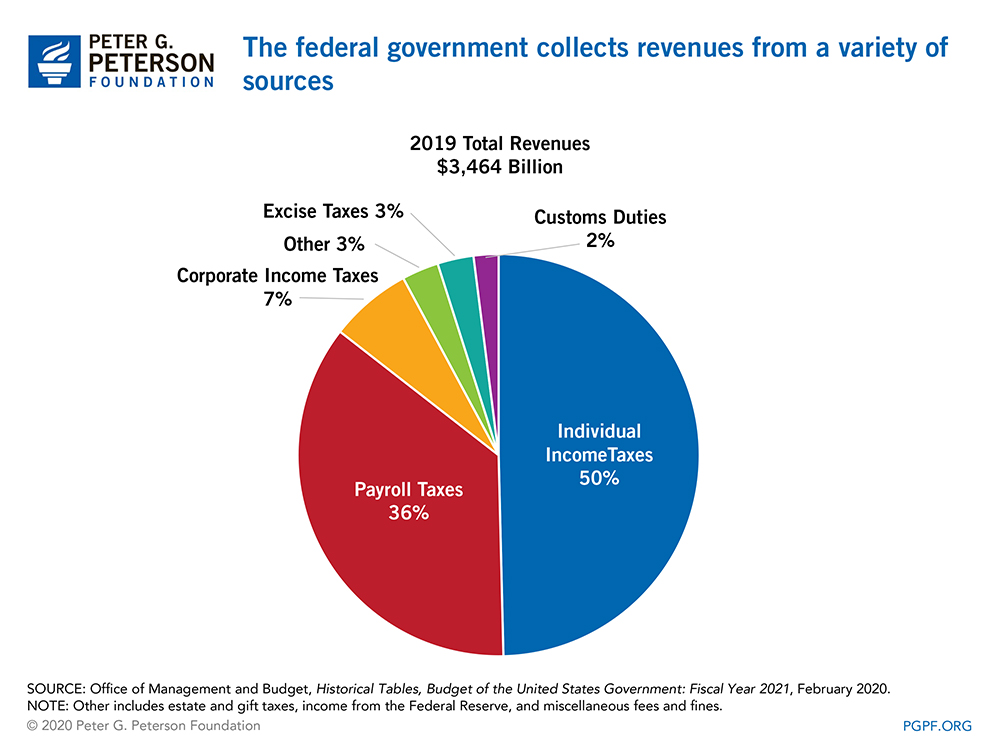

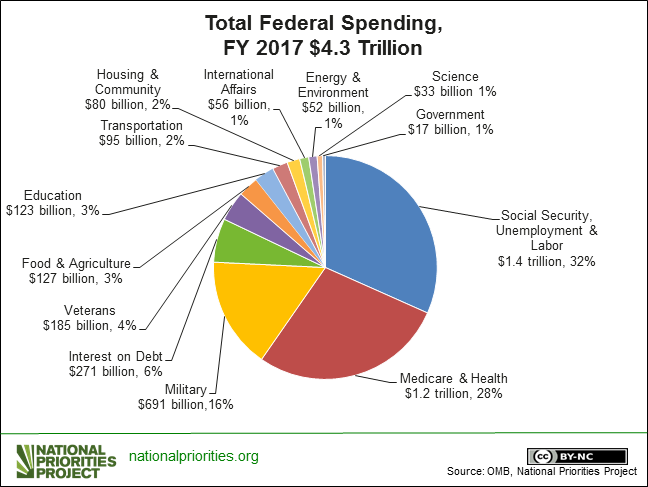

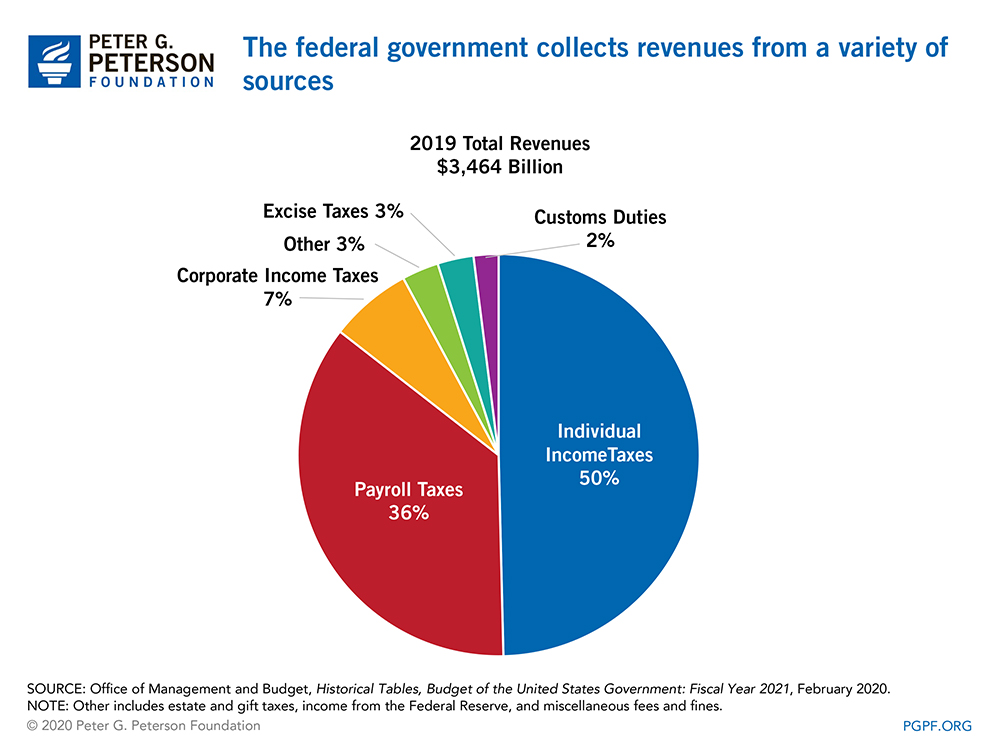

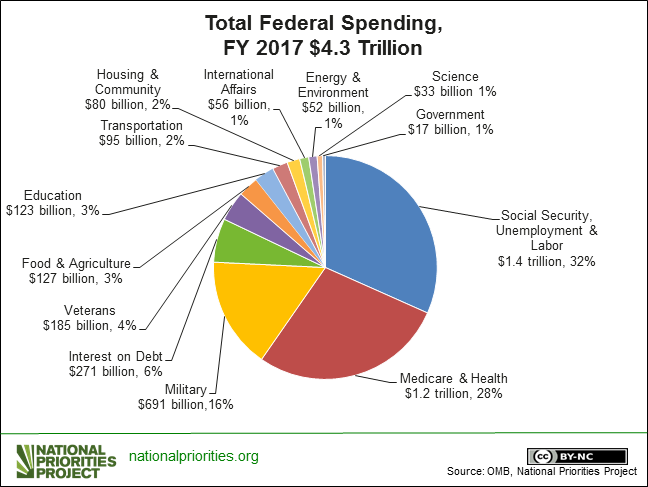

Question: How would the FEDERAL GOVT confiscate $1T - $2T more dollars to balance over-spending.

One Poster keeps saying "TAX the RICH" in a different thread. HOW? Income Tax rate on Rich does not move the revenue.

Poster screamed to put the top tax bracket back before Reagan dropped it down or other.

Chart below shows FED revenue collected as percentage of GDP. Notice revenue is pretty constant at ~20%*GDP no matter where the UPPER INCOME TAX rate is set (over 100 years).

Red is TAX rate (90% to 28% or so). Green is percentage of GDP collected. In fact when Upper Tax rate is lower GOVT gets higher percentage of GDP.

Blanket Theory: IF TAXES are too high GDP drops, GOVT revenue drops also as GDP drops.

Example: $20T GDP * 20% is $4T. If GOVT tried to take $5T they won't get it by raising the top income TAX RATE (over 100 years proves this fact).

This is not a new subject or issue. I have yet to hear an alternative workable solution over decades.

HELP ME: Where would they be able to confiscate another $1T? $2T without killing the economy.

1.) Capital Gains? make it 90%? would anyone buy stocks? 80%? 70% where would they buy stocks?

2.) 90% Upper income tax? History has proven this does not work. why not? Rich quit making income as too much is taken? they leave the country?

3.) A New special tax? 10% property tax on Property worth over $10million? Affects coastal elite........doubtful they would do that.

4.) Raise Business tax to 90%? Would any business stay open? Would they hire anyone.

5.) A National Sales Tax of 10%? Would sales drop? GDP drop and its' a wash?

6.) A Wealth TAX? They take 10% of everything you own each year? Tax was paid when wealth had been accumulated. Likely un-constitutional.

7.) A New special tax? 10% property tax on Property worth over $1million? Affects many. would everyone buy $500K houses only?

8.) Luxury Tax. Define Luxury? A Boat? Car over $100K.........very sticky. moving target.

Bottom line: I don't have any answer. note: Would they stop additional new spending when they "had enough"? would it be indexed to increase with what? GDP?

So I open it to the masses. Come one, come all. Where do they confiscate money to cover over-spending without killing the economy?

I do not know the answer? Maybe I am way way off base. If so, consider this an entry point. Make your case.

One Poster keeps saying "TAX the RICH" in a different thread. HOW? Income Tax rate on Rich does not move the revenue.

Poster screamed to put the top tax bracket back before Reagan dropped it down or other.

Chart below shows FED revenue collected as percentage of GDP. Notice revenue is pretty constant at ~20%*GDP no matter where the UPPER INCOME TAX rate is set (over 100 years).

Red is TAX rate (90% to 28% or so). Green is percentage of GDP collected. In fact when Upper Tax rate is lower GOVT gets higher percentage of GDP.

Blanket Theory: IF TAXES are too high GDP drops, GOVT revenue drops also as GDP drops.

Example: $20T GDP * 20% is $4T. If GOVT tried to take $5T they won't get it by raising the top income TAX RATE (over 100 years proves this fact).

This is not a new subject or issue. I have yet to hear an alternative workable solution over decades.

HELP ME: Where would they be able to confiscate another $1T? $2T without killing the economy.

1.) Capital Gains? make it 90%? would anyone buy stocks? 80%? 70% where would they buy stocks?

2.) 90% Upper income tax? History has proven this does not work. why not? Rich quit making income as too much is taken? they leave the country?

3.) A New special tax? 10% property tax on Property worth over $10million? Affects coastal elite........doubtful they would do that.

4.) Raise Business tax to 90%? Would any business stay open? Would they hire anyone.

5.) A National Sales Tax of 10%? Would sales drop? GDP drop and its' a wash?

6.) A Wealth TAX? They take 10% of everything you own each year? Tax was paid when wealth had been accumulated. Likely un-constitutional.

7.) A New special tax? 10% property tax on Property worth over $1million? Affects many. would everyone buy $500K houses only?

8.) Luxury Tax. Define Luxury? A Boat? Car over $100K.........very sticky. moving target.

Bottom line: I don't have any answer. note: Would they stop additional new spending when they "had enough"? would it be indexed to increase with what? GDP?

So I open it to the masses. Come one, come all. Where do they confiscate money to cover over-spending without killing the economy?

I do not know the answer? Maybe I am way way off base. If so, consider this an entry point. Make your case.

Last edited: